Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is gaining momentum again after tagging the $2,739 level and setting a new local high, reaching prices not seen since late February. The rally marks a strong comeback for ETH, which has been under significant pressure earlier this year. Now, bulls appear firmly in control as the broader crypto market wakes up and capital flows return to altcoins.

Related Reading

Analysts are calling for a potential altseason, fueled by Ethereum’s relative strength against Bitcoin and growing investor confidence. As Bitcoin consolidates near all-time highs, Ethereum has taken the opportunity to outperform, pushing up through key resistance levels with conviction.

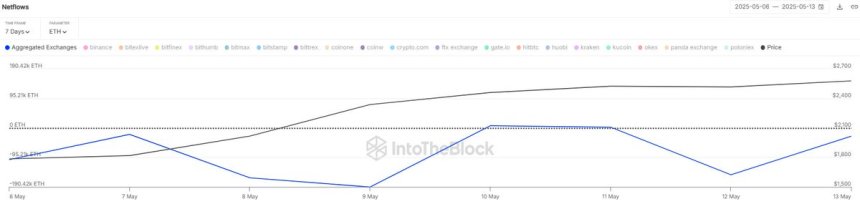

Supporting this narrative, data from Sentora (formerly IntoTheBlock) reveals that $1.2 billion worth of ETH has been withdrawn from centralized exchanges over the past seven days. This sustained trend of net outflows suggests continued accumulation and reduced sell-side pressure, both strong signals for long-term bullish momentum.

With price action heating up and investor sentiment shifting, Ethereum could be preparing for a major breakout. If bulls maintain control, the $3,000–$3,100 region may be tested in the coming days as the next major resistance zone. All eyes are now on ETH as the altcoin market shows signs of life.

Ethereum Builds Momentum As Exchange Outflows Signal Accumulation

Ethereum is trading above critical levels as speculation of a sustained rally continues to grow. After weeks of sluggish movement, ETH has roared back to life, gaining over 50% in value since last week. This sharp move to the upside has reignited hopes for an altseason, with many analysts viewing Ethereum’s breakout as the potential trigger for broader altcoin market strength.

Ethereum is now holding firmly above the $2,600 mark, a level that had acted as strong resistance for months. This breakout, coupled with increasing momentum against Bitcoin, suggests bulls are regaining control. Traders are closely watching the next major resistance zone between $2,900 and $3,100, which could serve as a key test for Ethereum’s uptrend.

Adding to the bullish case, data from Sentora reveals that $1.2 billion worth of ETH has been withdrawn from centralized exchanges over the past 7 days. This trend has intensified since early May, pointing to increased investor accumulation and reduced sell-side pressure. Large exchange outflows are often seen as a sign that holders intend to store ETH off-exchange, decreasing immediate supply and supporting upward price movement.

With market sentiment turning bullish and Ethereum leading the charge, all eyes are now on whether ETH can maintain its momentum and drive the altcoin market into a new growth phase. If accumulation trends persist and bulls hold key levels, Ethereum’s path toward $3,100 could open the door to a broader market rally.

Related Reading

Price Action Details: ETH Testing Key Levels

Ethereum’s weekly chart shows a powerful breakout after weeks of bearish pressure, with ETH now trading around $2,599.14. The recent surge pushed the price above both the 200-week EMA ($2,259.65) and the 200-week SMA ($2,451.55), two critical long-term trend indicators. Reclaiming these levels signals renewed bullish momentum and a strong shift in sentiment.

The breakout candle itself is one of the largest weekly green candles in over a year, reflecting a sharp influx of buyer interest and potentially marking a key reversal point after months of downside. Notably, this move brings ETH to levels not seen since February, with the local high for the week reaching $2,739.05.

Volume has increased significantly during this move, confirming the strength behind the rally. However, Ethereum now faces overhead resistance near $2,800–$2,900, a zone that previously acted as support during early 2024 before the breakdown. If bulls maintain momentum and close this week above $2,600, it could open the door for a test of the $3,100 resistance zone.

Related Reading

On the downside, the key support to watch is around $2,450, aligned with the 200-week SMA. A failure to hold that level could invite a retest of $2,250. For now, the trend is bullish, but follow-through next week will be crucial.

Featured image from Dall-E, chart from TradingView