Image source: Getty Images

On paper, a £100,000 investment in Tesla (NASDAQ: TSLA) made a decade ago would now be worth approximately £2.4m, reflecting share price growth of 2,340%.

This growth trajectory masks significant turbulence, notably earlier this year as shares plunged 30% from their December peak of $488.54. Nonetheless, this growth’s huge.

However, it gets better. That’s because the pound has depreciated around 20% over the last decade. Essentially, £100,000 back then would have bought be $150,000 of Tesla stock. Today, that $150,000 of stock would be worth $3.5m, or £2.7m.

Should investors cash in?

Tesla’s decade-long ascent transformed early investors into millionaires, fuelled by its electric vehicle (EV) market dominance and cult-like shareholder loyalty. However, the company and its stock is at something of a crossroads.

So after such a bull run, why would investors consider selling? Well, Tesla’s financial metrics defy automotive sector norms, trading at 147 times trailing earnings – an 860% premium to the industrials sector median.

This premium is also present in forward metrics — those based on analysts’ forecasts — with the forward price-to-earnings-to-growth (PEG) ratio of 8.5 representing a 450% premium to the industrials sector average.

On paper, this looks like an opportunity to sell. The stock’s surged and the valuation metrics certainly aren’t attractive. In fact, the stock’s value appears entirely disconnected with its fundamentals.

Of course, the value proposition lies in Elon Musk’s plans for Tesla. The boss sees the company dominating in self-driving and robotics. In short, it has a lot of cash, and grand plans, but so far it appears to be falling some way behind its peers.

Overreach and unpopularity

What’s more, Musk’s simultaneous roles as Tesla CEO, head of SpaceX, and Trump administration’s Department of Government Efficiency (DOGE) chief have diluted focus, and this appears to be impacting shareholder conviction.

After all, he can’t realistically run all these companies at once. And that’s an issue given Musk has been so central to Tesla’s rise.

Concerningly, this role in the Trump administration doesn’t appear to be bearing any fruit for Tesla shareholders either. In fact, the administration’s cancellation of a $5bn EV charging initiative and new 25% steel/aluminium tariffs have disrupted Tesla’s China-dependent supply chain.

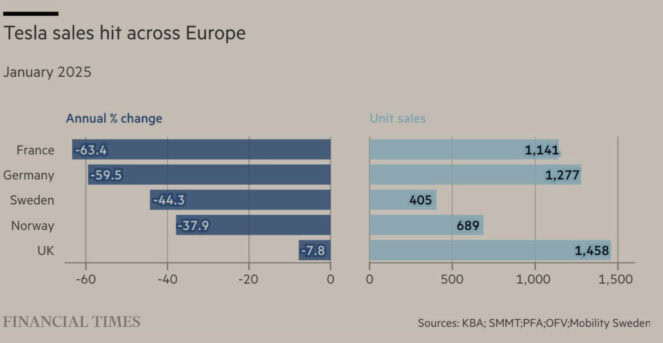

In addition, Morning Consult data shows Musk’s consumer favourability plummeting to 3% in early 2025 from 33% in 2018, eroding the brand’s cultural capital. This is particularly apparent when we look at recent sales data in Europe.

As the Financial Times data below highlights, Tesla sales fell 63.4% in France in January. Musk’s own image may have something to do with this. Sales in Germany also plummeted where he’s shown support for the more radical AFD party.

Of course, none of this will really matter if Tesla delivers a dominant product in self-driving and humanoid robots. However, that’s a big ‘if’ given the lack of publicised progress.

I’d love to be bullish on this Western technology leader, but I simply can’t get behind the valuation and the speculative nature of investing in unproven technology. I won’t consider buying.