According to joint research cited in news reports, about $110 billion — roughly ₩160 trillion — left South Korean crypto platforms during 2025. Trading activity did not stop. Instead, much of the money moved to foreign exchanges where more products and tools are available to ordinary investors.

Market Limits Fuel Outflows

Reports have disclosed that domestic rules largely confine local exchanges to spot trading. Many complex products remain off limits for retail traders in Korea, so traders turned to overseas platforms such as Binance and Bybit. The joint study by CoinGecko and Tiger Research is cited as the primary basis for the $110 billion figure.

Banking And Rules Shape Choices

According to a joint report by CoinGecko and Tiger Research, South Korean investors moved over KRW 160 trillion (~$110 billion) in crypto assets from domestic exchanges to overseas platforms in 2025 due to local regulatory limits that restrict CEXs largely to spot trading. Korean… pic.twitter.com/KrYgFurdsm

— Wu Blockchain (@WuBlockchain) January 2, 2026

South Korea tightened compliance and user protections in recent years. Laws designed to protect customers were passed, such as the Virtual Asset User Protection Act in 2024, but firms and users say the laws did not create a full framework for wider market services.

Lawmakers debated the Digital Asset Basic Act, but delays left gaps that some traders found limiting. As a result, a growing share of Korean-held crypto migrated to wallets and platforms abroad.

Fee Impact And User Behavior

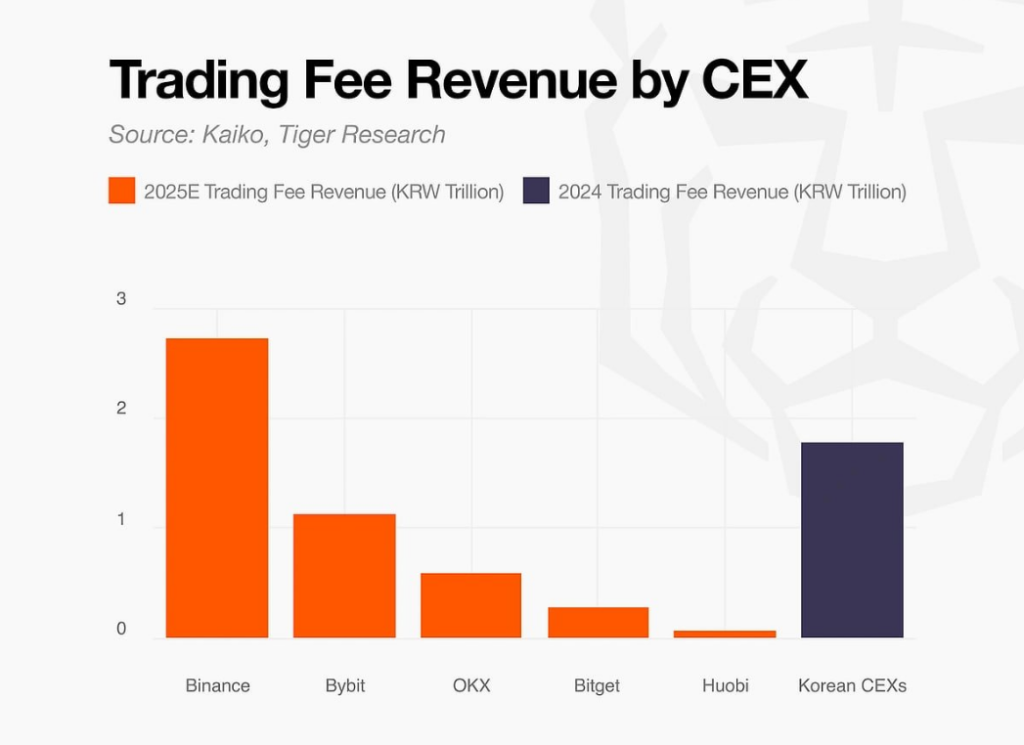

Based on platform analyses, fee revenue from Korean users on overseas exchanges became significant. Estimates in the sector put user-based fees at about ₩2.73 trillion for Binance and roughly ₩1.12 trillion for Bybit in 2025.

Reports also indicated the number of Korean accounts with large overseas balances grew by more than double year-on-year. Some capital was shifted into self-custody wallets too, showing that users split bets between exchanges and private wallets.

Authorities point to risks when money crosses borders. Regulators have focused on anti-money-laundering checks and bank partnerships for crypto firms. Traders, on the other hand, emphasize access. They want margin trading, derivatives, and other services that they cannot get at home. This tension between access and oversight is central to the movement of funds.

Trading Demand Remains High

Volume trends suggest Korean interest hasn’t waned, but shifted location. Domestic platforms handled substantial spot trading, but overall demand appears to have flowed into overseas venues instead of disappearing. The $110 billion figure tracks transfers and placements, not asset losses. In other words, value was relocated rather than erased.

Lawmakers in Seoul are said to be working on broader rules, including stablecoin provisions that many industry players have pushed for. If new statutes arrive and markets reopen to a wider set of services, some funds may return. But for now, many users keep trading outside Korea to access a wider menu of choices and tools.