Image source: Getty Images

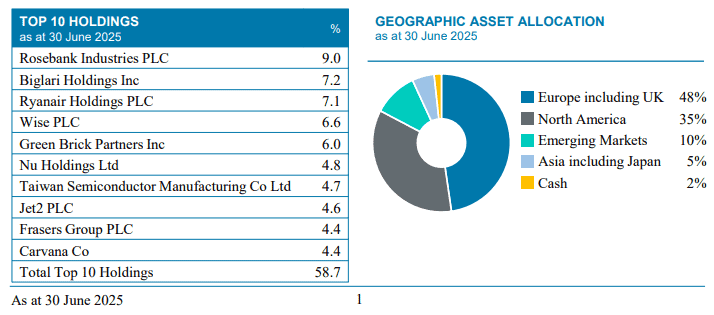

It’s probably fair to say that VT Holland Advisors Equity Fund isn’t immediately familiar to a lot of British investors. Given that the fund is very much on the small side (only £39.3m), perhaps that’s unsurprising. But VT Holland Advisors holds a handful of exciting growth stocks, and has delivered excellent outperformance.

Run by Andrew Hollingworth, it has returned 77.8% for the three-year period to 30 June. That destroys its Investment Association Global Sector benchmark (25.7%), and also beats both the FTSE 100 and S&P 500.

Helping drive some of the recent portfolio outperformance has been a pair of top growth stocks (which I also own). Let’s take a closer look at them.

A snowball at the top of a hill

The first stock is Nu Holdings (NYSE:NU), which is the firm behind Brazilian digital lender Nubank. It’s up 35% year to date.

Nubank was built from the ground up as a digital-only bank, with no physical branches. It offers customers far superior and cheaper services than the legacy banks across Latin America.

Our enthusiasm for Nubank is that we can see a potential revolution in its customer offering vs sleepy, fat banking incumbents.

Andrew Hollingworth

In Q1, Nu grew its customer base to an incredible 118.6m, adding over 4m in the quarter. Yet it only operates in three countries (Brazil, Mexico, and Colombia). And while around 60% of adults in Brazil are customers, the other two nations offer significant growth potential (never mind elsewhere).

That said, the lender could come unstuck as its credit portfolio grows. If the loss ratio worsens, that could quickly eat into margins and dent investors’ confidence.

Nevertheless, the firm’s fundamentals are impressive. Average monthly revenue per customer has increased from $7 in 2022 to $11.20 in Q1 2025. But among longer-term customers who use more of services, that figure jumps to nearly $26.

This is why Hollingworth has described the company as “a snowball at the top of a hill“. I agree, making this share worth considering for the long term, in my opinion.

Classic disruptor

The second stock I want to highlight from VT Holland Advisors’ portfolio is one I finally bought earlier this month: Wise (LSE: WISE). This fintech stock is up around 31% over the past year.

Wise helps people and businesses send money across borders quickly, cheaply, and transparently. Around two-thirds of the company’s new customers come by word of mouth.

The firm takes a cut of the transfers, but what Hollingworth likes is how Wise keeps lowering fees as it scales (similar to Nubank). Wise’s cross-border take rate in Q1 was 0.52% globally, down from 0.58% the year before.

The fund manager says this is “classic disruptor behaviour“, with the firm “building a powerful…[and] hard-to-copy scalable network“.

Looking ahead, Wise could face rising competition, with rivals all looking to take share in the massive £32trn cross-border money market. A global economic downturn would also likely slow payment volumes.

Yet, I think Wise is still worth considering right now, along with VT Holland Advisors Fund. The latter’s portfolio of just 30 stocks does present some concentration risk, but I reckon the manager’s strategy to “find great companies run by great managers available at great prices” will continue to bear fruit.