Most inexperienced investors make the mistake of believing they’re late to the game with Bitcoin. Nope. Wrong!

Although Bitcoin is the top dog, there’s still plenty of room for it to grow and dethrone gold’s market cap (that’s a 10x gain when that happens by the way).

Let’s discuss two reasons why you’re still an early investor in Bitcoin.

Reason #1 Bitcoin is Gold 2.0

Bitcoin is gold 2.0 — its currency redefined — and everyone’s trying to get a piece of the pie.

Satoshi Nakamoto, the person or group of developers who created Bitcoin envisioned the asset one day dethroning precious metals and other conventional fiat currencies:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”. — Satoshi Nakamoto

While it has grown considerably, Bitcoin remains relatively cheap, with analysts predicting it will reach over $200,000 in 2025.

Reason #2: A generational shift in wealth is happening now

Within the next few decades, millenials will become the wealthiest generation in history. Baby Boomers are set to pass on a massive $68 trillion to their children, the largest generational wealth transfer ever.

Everyone’s excited — except the banks.

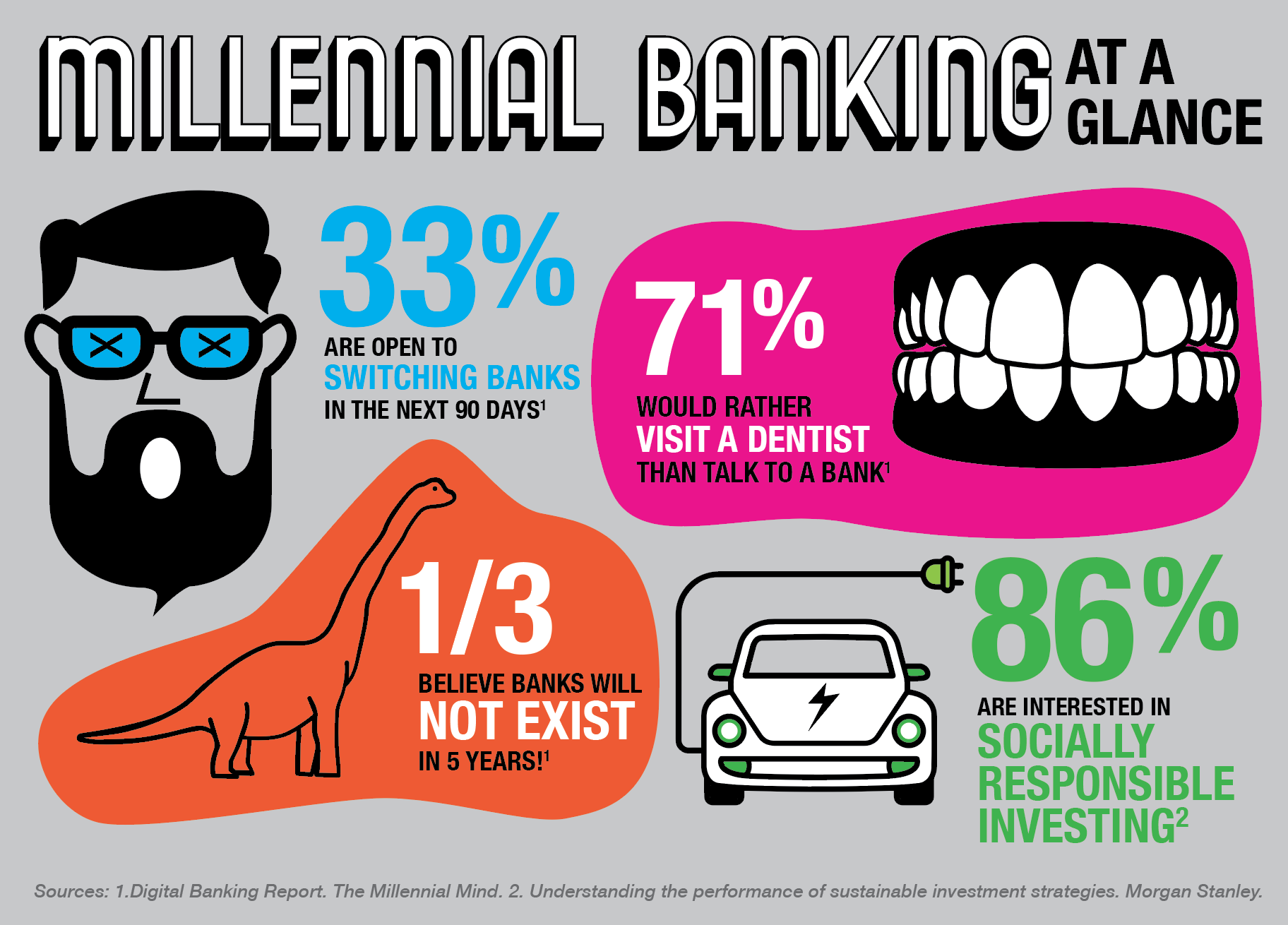

Bitcoin was created after the 2008 financial crisis due to a serious mistrust in banks. Meanwhile, millennials, the generation arguably hurt most by the banks, are following suit in their mistrust. According to the Millennial Disruption Index — a 3-year study of 10,000 Millennials, the majority (71%) of Millennials reported that they would rather go to the dentist than listen to anything banks have to say.

As quoted from that study: “The 2008 financial crisis was the worst financial disaster since the Great Depression, inflicting widespread, devastating costs on millions of American families. All told, more than $13 trillion of household wealth vanished, 11 million individuals were displaced from their homes, and nine million Americans lost their jobs.”

Sorry, isn’t cutting it for millennials or Gen Z. This is why a quarter of American Millennials earning $100,000 in individual or owning $50,000 in investable assets are holding or using cryptocurrencies.

When the generational shift in wealth occurs, banks will slowly incorporate cryptocurrency to appease younger generations or else evaporate. This may seem preposterous right now, but the data indicates otherwise.

Here are a few key questions to ponder over the future of Bitcoin:

- Will more cryptocurrencies get a verified exchange-traded fund, making it easier for people to invest?

- Can BTC overtake even a quarter of the gold market?

- What if BTC replaces the currency of nations plagued by hyperinflation?

Final Thoughts on Bitcoin Adoption

Early Bitcoin investors Tyler and Cameron Winklevoss recently said this about the crypto: “We think it will be the best-performing asset of the current decade,” Tyler Winklevoss said in an interview with CNBC.

“Our thesis is that Bitcoin is gold 2.0 and will disrupt gold. If it does that, it must have a market cap of $9 trillion. So we think bitcoin could price one day at $500,000 a bitcoin.”

The market for Bitcoin to grow is massive. We’re still in the Wild West days of crypto and blockchain.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Most inexperienced investors make the mistake of believing they’re late to the game with Bitcoin. Nope. Wrong!

- A US Bitcoin Reserve is on its way. Michael Saylor, MicroStrategy’s fierce Bitcoin advocate, wants the U.S. to own the crypto game.

- For now, the debate about cryptocurrency’s place in America’s financial future is just beginning.

The post 2 More Reasons Why You’re an Early Bitcoin Investor appeared first on 99Bitcoins.