Image source: Getty Images

The FTSE 250 index of mid-cap stocks has risen 5% in value in 2025. That’s not bad, but it’s below the performance of other major global indexes. The FTSE 100 for instance is up 12% over the period.

This underperformance reflects a bleak outlook for the UK economy, along with increasing pessimism over interest rate cuts as inflation rises. Roughly 40%-45% of the FTSE 250‘s earnings come from Britain, far higher than the internationally flavoured Footsie.

Some of the index’s top quality constituents have actually fallen sharply since 1 January, which I believe represents a potential dip-buying opportunity. Here are two such stocks I think demand serious consideration today.

Bloomsbury Publishing

Bloomsbury Publishing‘s (LSE:BMY) shares have dived 29% in the year to date. While its Harry Potter franchise remains as popular as ever, weakness in other parts of the business has pulled the book producer sharply lower.

More specifically, poor sales at its academic publishing division have taken the shine off the firm’s other operations. Organic sales here dropped 10% in the last financial year, it announced in May, due in part to budgetary pressures in the UK and US. The company’s failed to recover ground since then.

While these troubles may persist, I think there’s a lot to like at Bloomsbury that makes it worth a close look. The long-term outlook for its academic publishing unit remians robust, helped by its gamechanging acquisition of high-margin operator Rowan & Littlefield.

But what really draws me in is the quality of its consumer division, and more specifically its pedigree in the fast-growing fantasy and sci-fi fiction markets. Harry Potter isn’t the only star series in its portfolio — Sarah J Maas’s A Court of Thorns and Roses is another one of its bestselling series, with 75m sales and more books contracted to come down the pipeline.

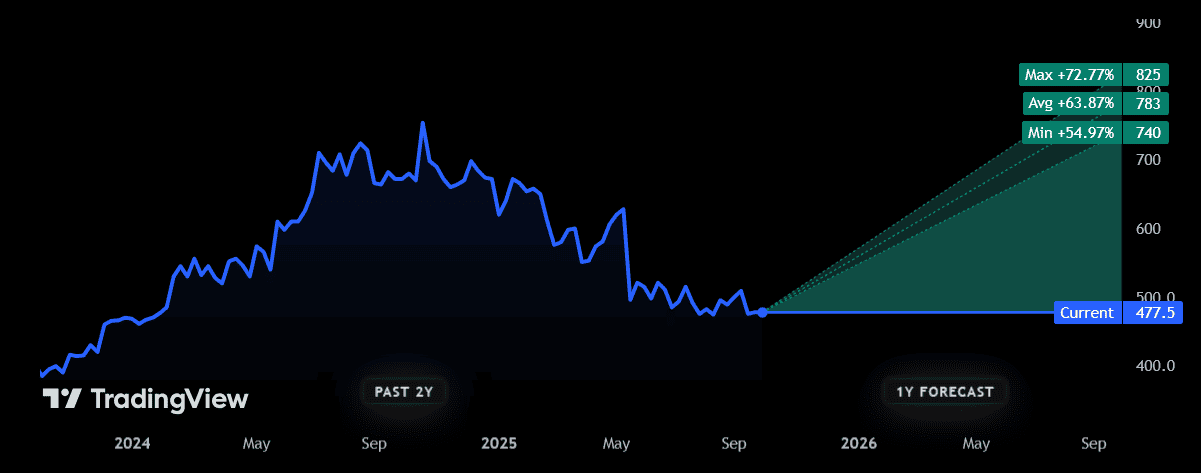

City analysts are united in their view that Bloomsbury shares will rebound over the next 12 months. The consensus view is for a 64% rise from current levels, to 783p per share.

Ibstock

Ibstock‘s (LSE:IBST) share price has dropped 21% since 1 January. It’s fallen on fears that the recent housing market recovery could be flagging as the UK economy struggles and inflation rises.

For long-term investors, however, I think the brick manufacturer’s investment case remains a robust one. It’s why I hold the company in my own Stocks and Shares ISA.

Despite high competition, the demands of a growing population could supercharge product sales over the next decade. The government plans to build 3m new homes to 2029 alone. Wisely, Ibstock’s invested heavily in capacity to meet future demand.

But that’s not all that’s attracted me, as I think the company can also expect robust off-take from the repair, maintenance and improvement (RMI) sector. The UK housing stock is one of the oldest in the world, so there should be steady demand here for years to come.

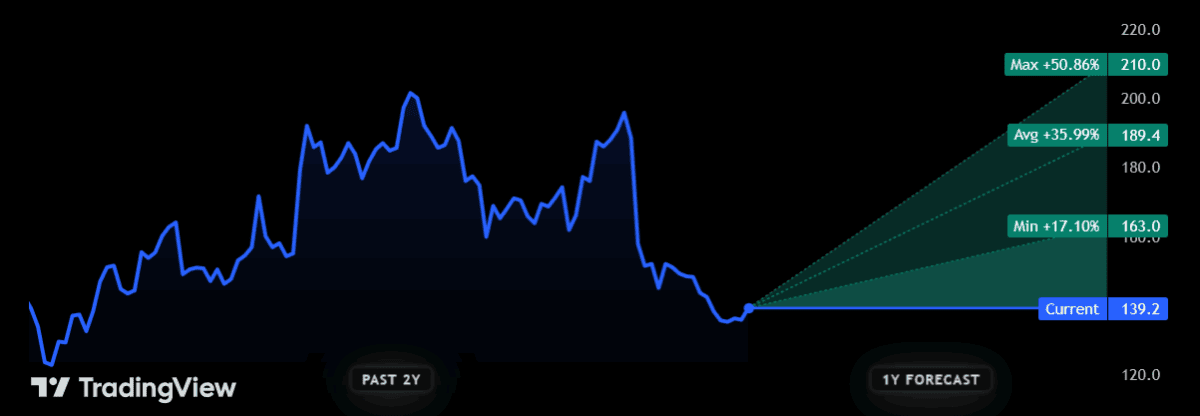

As with Bloomsbury, City brokers are united in their belief Ibstock shares will rebound over the next year. The average share price target among them is 189.4p, representing a 36% premium from today’s levels.