Although DeFi (decentralized finance) is only a decade old, it stands to dethrone a legacy banking system older than America itself.

Just like the inception of the internet, DeFi is only understood by a small minority of people but will soon become ubiquitous when its benefits become obvious.

With the bull run upon us let’s discuss three of DeFi’s best applications in 2025:

1. Better Exchanges Than The Mainstream

DEX stands for decentralized exchanges and allows users to exchange one crypto token for another.

Just like how you can use the Forex markets to exchange a peso for a dollar or the stock exchange to turn a dollar into a stock, Dexes allow for exchanging one cryptocurrency to another.

Additionally, Dexes offer thousands more cryptocurrency options than centralized crypto exchanges like Coinbase, Binance, and Gemini.

How else are you going to jump on the latest presale like $BEST Wallet or $SUBBD?

As of mid-May 2025, the total value locked (TVL) in decentralized finance (DeFi) is approximately $116.5 billion, according to DefiLlama.

2. Earning Interest On Your DeFi Crypto Gains

Lending platforms allow any user to lend their cryptocurrency assets and receive interest on them.

Like any lending system, collateral must be deposited by the borrower. The collateral can be tokens such as BTC, ETH, UNI, and the interest returned to investors is much, much higher than what many traditional investors are used to.

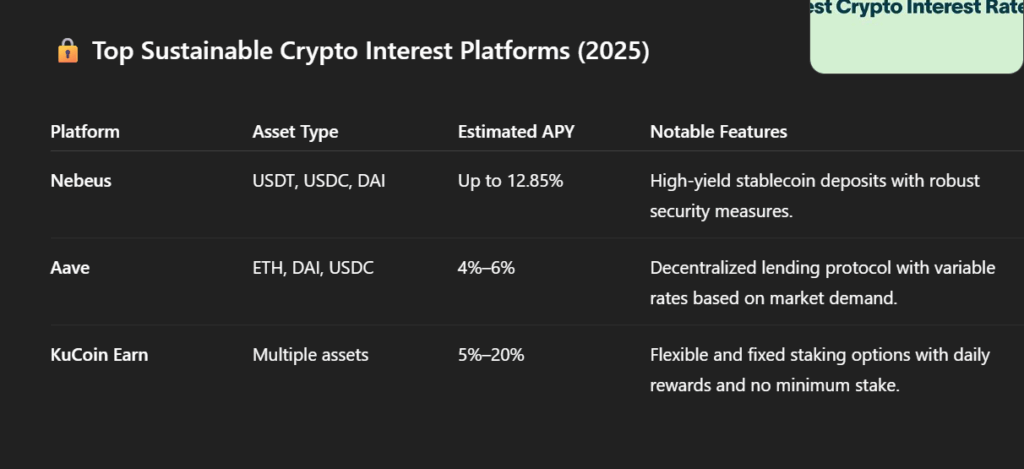

(X)

Interest returned to loaners starts around 6% and goes upwards of 100% ROI … but follow that chart we found on X if you want sustainable options.

The three most popular crypto lending and borrowing platforms are Aave, Compound, and MakerDAO (All Ethereum-based). More reason to be bullish on Ethereum.

3. Centralized Digital Currencies

Oh, wait. Strike that, reverse it, like Gene Wilder in Willy Wonka.

Central bank digital currencies (CBDCs) aim to control. DeFi aims to remove control. That’s the ideological fault line. Stablecoins are crypto assets pegged to fiat currencies like the U.S. dollar or euro, but built on decentralized rails.

USDC, DAI, Tether, and CEL are the top options right now offering digital dollars without the state’s leash. These tokens also offer great interest yields on decentralized exchanges andcontinue to pay more than high yield savings accounts from traditional banks.

Final Thoughts

Although DeFi is in its infancy the ability to grow your funds and invest in emerging tech startups makes it an incredible investing opportunity.

The only thing stopping the market from growing any further is the barrier for entry among new crypto investors. This is a hurdle DeFi will have to vault in the future. But the opportunity is there.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Although DeFi (decentralized finance) is only a decade old, it stands to dethrone a legacy banking system older than America itself.

- Although DeFi is in its infancy the ability to grow your funds and invest in emerging tech startups makes it an incredible investing opportunity.

The post 3 Reasons Why DeFi is Better Than Centralized Finance appeared first on 99Bitcoins.