Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

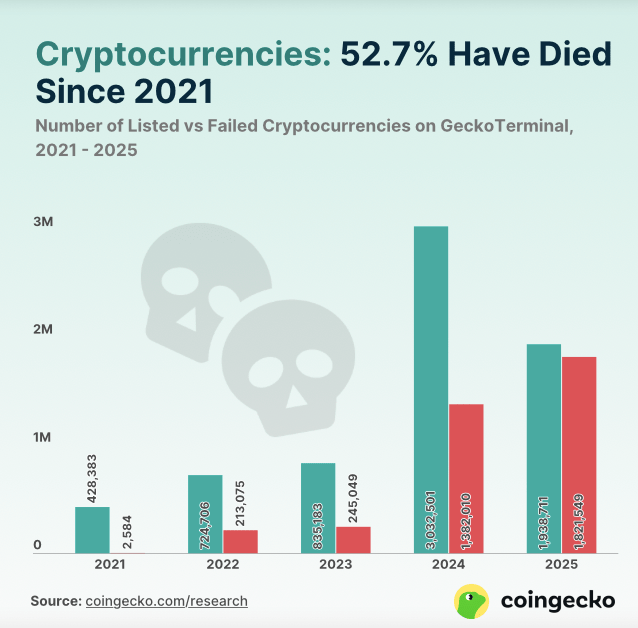

A recent report revealed that over 50% of all crypto tokens have failed in the past five years, with a significant decrease in token survivability over the past year.

Related Reading

50% Of Crypto Tokens Have Collapsed

On Wednesday, CoinGecko published a report claiming that over half of the tokens registered in its Decentralized Exchange (DEX) tracker, GeckoTerminal, have died in the past five years.

The study examined the total number of crypto tokens once listed in the DEX tracker with one trade or more before going defunct.

Since 2021, nearly 7 million tokens have been listed in the real-time tracker, with 3.7 million cryptocurrencies no longer actively traded and considered to have failed. As a result, 52.7% of all examined crypto died, 86.5% failing between 2024 and early 2025.

According to the report, 49.7% of all recorded project failures between July 2021 and March 2025 occurred in the first quarter of this year. By March 31, 1.8 million tokens had collapsed, representing the highest number of failures recorded in a single year.

In 2024, nearly 1.4 million crypto projects failed, accounting for 37.7% of all collapses during the analyzed period. The number of failing projects has significantly increased from 0.5% in 2021 to 25% in 2025’s first three months.

Nonetheless, CoinGecko noted that 2024 has the highest number of launches, seeing over 3 million new projects deployed in the crypto market. Since 2021, the total number of projects has skyrocketed by around 1,550%, going from 428,383 listed projects on GeckoTerminal to nearly 7 million crypto projects.

Memecoin Frenzy Responsible For Most Failures?

The massive increase in token launches was fueled by the launch of the Solana-based memecoin launchpad Pump.fun, which facilitated the deployment of tokens. The platform’s creation led to a “flood of meme coins and low-effort projects entering the market.”

Notably, the start of this cycle’s memecoin frenzy saw the launch of hundreds of PolitiFi tokens, celebrity tokens, and scam tokens, with many reaching market capitalizations of hundreds of millions in record time.

The report highlighted that crypto failures were in the low six digits before Pump.fun’s launch, with only 12.6% of all dead tokens between 2021 and 2023. By July 2024, reports revealed most celebrity memecoins had crashed over 90% since launch, with the majority essentially “dead.”

Related Reading

Amid the Q1 market retraces, most cryptocurrencies have seen a sharp price decline, with some of the strongest tokens retesting monthly and yearly lows.

The recent nosedive in token survivability could be related to the market exhaustion and market turbulence, which coincided with the launch of the official TRUMP and MELANIA memecoins and the LIBRA token scandal.

“This sharp decline in token survivability may be linked to broader market turbulence, particularly following Donald Trump’s inauguration in January 2025, which coincided with a downturn in the crypto market,” the report concluded.

Featured Image from Unsplash.com, Chart from TradingView.com