Image source: Getty Images

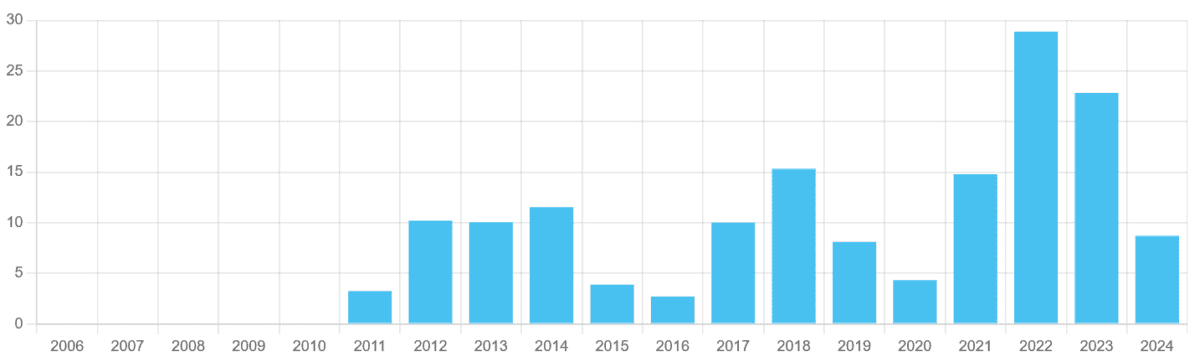

Mining stocks are among the most cyclical out there. Annual profits can swing wildly depending on economic conditions, as can shareholder dividends. This has been the case with Glencore (LSE:GLEN) shares for more than a decade.

Since listing on the London Stock Exchange in 2011, shareholder payouts have been up and down like a see-saw. More recently, they’ve sank as China’s spluttering economy and higher global interest rates hit commodities demand. In the years before that, they rose strongly as a post-pandemic recovery drove metals and energy values.

Encouragingly, however, City analysts are tipping Glencore shares to rebound strongly over the next few years.

9.6% dividend yield

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 14 US cents | 40% | 3.8% |

| 2026 | 22 US cents | 57% | 6.2% |

| 2027 | 34 US cents | 55% | 9.6% |

You’ll perhaps be unsurprised that this stunning expected dividend growth coincides with expectations that profits will bounce back signficantly.

Currently, the number crunchers expect Glencore:

- To swing from losses per share of 13 US cents last year to earnings of 20 cents in 2025.

- To record earnings of 33 US cents in 2026, up 65% year on year.

- To print earnings of 44 US cents the following year, a 33% increase.

Such growth far outstrips expected dividend growth of 1.5%-2% for the broader FTSE 100 over the near term. It also means dividend yields on Glencore shares shoot past the FTSE’s long-term average of between 3% and 4%.

Shaky cover

But dividends are never guaranteed, of course. So I need to consider how realistic these forecasts are.

On the plus side, Glencore’s robust balance sheet may leave it in better shape to pay dividends during a fresh downturn than many other miners. As of December 2024, its net-debt-to-EBITDA (earnings before interest, tax, depreciation, and amortisation) ratio was a modest 0.78.

But as we’ve seen time and again, this probably won’t be enough to stop cash rewards collapsing if profits sink. Glencore already looks exposed on this front, with predicted dividends covered between 1.3 times and 1.5 times by expected earnings through to 2027.

These figures sit far below the security benchmark of two times.

Should investors buy Glencore shares?

On balance, then, predicting the size of Glencore’s dividends to 2027 remains a tough ask given current macroeconomic uncertainty.

Encouragingly, the US-China trade deal announced today (12 May) bodes well for the company’s profits, as does a steady fall in worldwide inflation. However, substantial risks remain to the global economy (and by extension) to commodity prices, including the potential for fresh dust-ups between the US and other major trading partners.

It’s helpful, therefore, to consider the returns Glencore shares may deliver over the longer term rather than just the next few years. And from this perspective, I’m far more upbeat when it comes to assessing the company’s dividend and share price potential.

As both commodities producer and trader, the FTSE firm has significant opportunities to exploit the next ‘commodities supercycle’. I think earnings and dividends could soar as themes like the growing digital economy, rapid urbanisation, and decarbonisation initiatives drive metals demand.

I buy shares based on their investment potential over at least a decade. And on this timescale, I think Glencore’s are worth serious consideration.