The crypto market is paying attention to a massive Dogecoin (DOGE) transaction. A whale transferred 100 million DOGE, or about $25.42 million, to Binance. The move has raised questions about whether a sell-off is about to happen or if this is just another typical shift in holdings.

Whale Activity Sparks Concerns

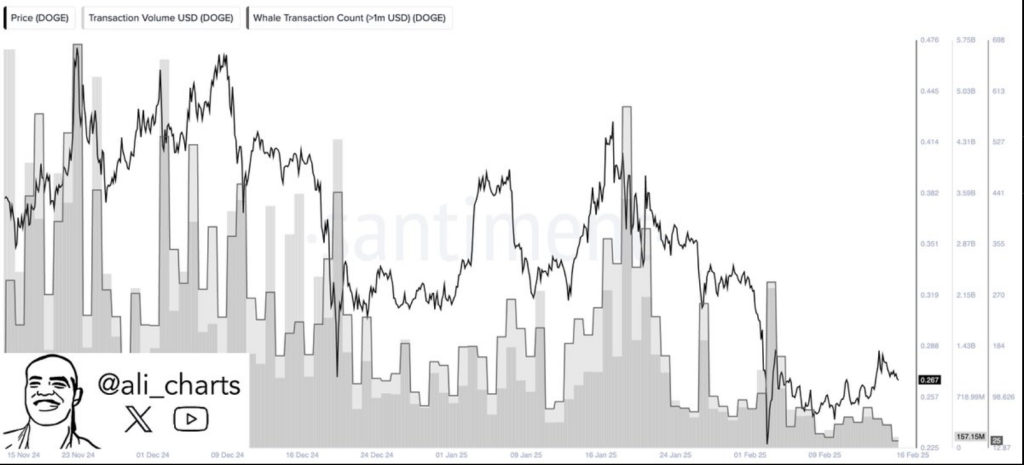

When a major cryptocurrency holder moves a sizable amount of their holdings to an exchange, it usually means they want to sell. The price of DOGE may drop as a result, which would cause smaller investors to react. However, cryptocurrency expert Ali Martinez noted a decline in whale activity overall, suggesting that major investors are not acting aggressively for the time being.

Whale activity on the #Dogecoin $DOGE network has declined by nearly 88% since mid-November! pic.twitter.com/6X4CIH3mf8

— Ali (@ali_charts) February 17, 2025

DOGE’s present market performance points to vagueness. As of the time of writing, the price is $0.255622; an intraday high is $0.257605 and a low is $0.250725. These swings imply a rather limited trading range; but, if more significant holders decide to sell their shares, volatility might increase.

Market Sentiment Remains Divided

According to certain traders, the whale transfer is a bearish signal, while others believe that its influence may be negligible unless an influx of additional coins occurs. Dogecoin has a history of reacting sharply to whale movements; however, the aggregate selling pressure appears to be subdued this time.

The ongoing discussion regarding a potential DOGE exchange-traded fund (ETF) is another significant factor that affects sentiment. If an ETF acquires momentum, it may attract institutional investors, potentially counteracting any selling pressure from whales. Nevertheless, the market is currently in a state of supposition, as no official approvals or timelines have been announced.

The Road Ahead For Dogecoin

Despite the whale move, the price of DOGE continues to remain steady, but if market sentiment shifts, there could be a further drop. Further dumping may occur if the price of DOGE drops below $0.25, which might further lower the price. On the other hand, strong purchasing activity may act as a barrier to further decrease.

Investors’ Options

The whale movement reminds us of the speed with which retail trade’s market dynamics could shift. Some people might decide to keep their positions since they hope that possible catalysts like the ETF will raise prices, while others take a more cautious approach, looking for signs of increased whale activity before deciding on what to do next.

Featured image from Medium, chart from TradingView