The Monetary Authority of Singapore (MAS) is engaging with Chocolate Finance to ensure customer withdrawals are processed in an orderly manner.

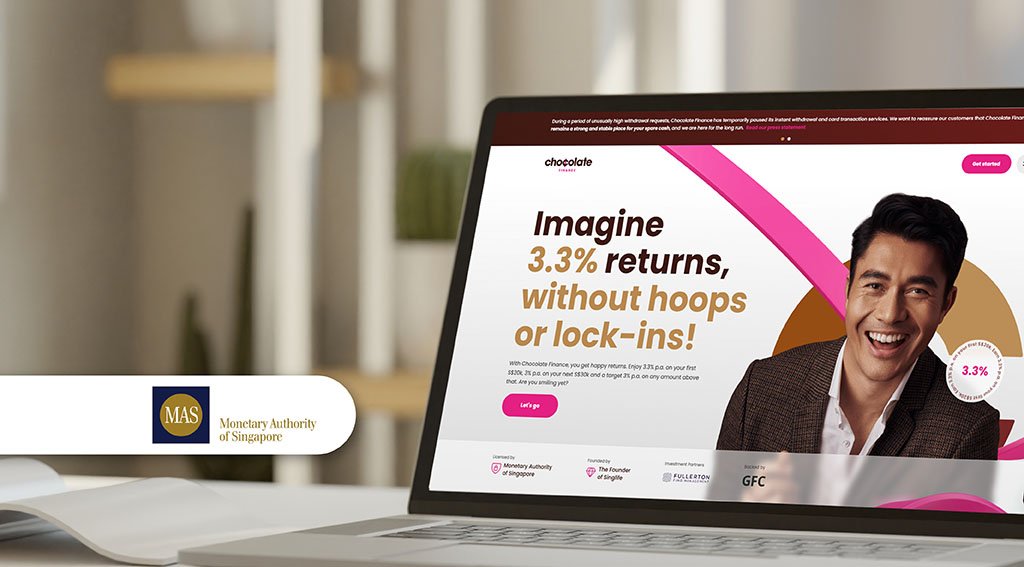

Chocolate Finance, a Singapore-based financial services platform operated by Chocfin, temporarily suspended instant withdrawals on 10 March 2025 due to a surge in customer requests.

The spike was attributed to a major surge in AXS bill payments, as users sought to maximise benefits from the platform’s miles reward programme.

Chocolate Finance CEO Walter de Oude shared that this surge made the programme unsustainable, leading to the removal of AXS payments via its Visa debit card on 5 March.

The firm acknowledged that its communication regarding the change was inadequate, leading to confusion among customers.

Many feared liquidity issues, triggering a wave of withdrawal requests which led to the suspension of instant withdrawals.

Chocolate Finance issued a joint statement with Allfunds, an independent fund custodian, affirming that customer assets remained secure and that measures were being implemented to restore normal operations.

MAS emphasised that digital advisors are required to segregate customer assets from their own, with funds held by independent custodians licensed and regulated by the authority.

The regulator said,

“Customer monies must remain intact and cannot be used to meet the liabilities of the digital advisor at all times.”

MAS noted that Chocolate Finance and Allfunds have confirmed compliance with these requirements.

The regulator will continue to monitor the situation to ensure adherence to regulatory obligations and the protection of customer interests.

Featured image credit: Edited from Freepik