Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has finally found stability above crucial demand levels after enduring weeks of heavy selling pressure and market uncertainty. Despite the broader crypto market’s volatility, XRP remains within a long-term range, trading between its $1.90 low and the $3.40 all-time high.

Related Reading

After gaining over 30% since last Tuesday, analysts are speculating about a potential breakout above critical supply zones. If XRP continues building momentum, it could soon challenge key resistance levels, setting the stage for a larger move to the upside.

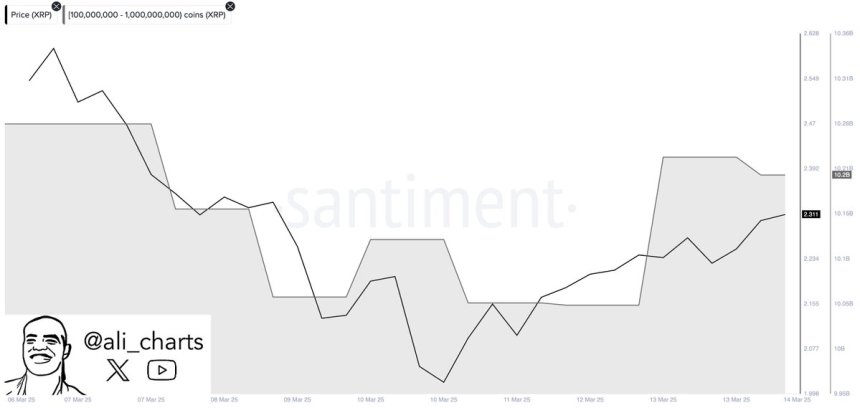

Adding to the bullish outlook, on-chain data from Santiment reveals that whales have accumulated over 150 million XRP in the last 48 hours. Historically, large-scale whale accumulation has often preceded major price rallies, as it signals growing confidence from institutional investors and high-net-worth holders.

With XRP holding above key support and whale activity increasing, investors are now watching for a decisive move above supply zones to confirm a long-term bullish reversal. The next few trading sessions will be crucial in determining whether XRP can maintain its strength or if further consolidation is needed before another major move.

XRP Outperforms As Whale Accumulation Signals A Potential Breakout

Compared to other major crypto assets, XRP has been overperforming since late 2024, showing strong resilience despite market-wide corrections. While many altcoins have struggled to reclaim key levels, XRP has held its range and built a foundation for a potential recovery. Once the market shifts into an uptrend, analysts believe that XRP could be one of the first assets to break into price discovery, potentially leading a massive rally.

Related Reading

Price action remains relatively stable, even as broader macroeconomic conditions create uncertainty. Speculation is growing not only about a crypto market recovery but also about a potential rebound in the U.S. stock market, which has faced its own volatility in recent months. If global financial markets regain strength, it could further support XRP’s bullish outlook.

Top analyst Ali Martinez recently shared on-chain data from Santiment, revealing that whales have accumulated over 150 million XRP in the last 48 hours. This large-scale accumulation is part of a broader trend, where whales and institutional players have been buying XRP during periods of market weakness. Historically, such accumulation phases have preceded strong price recoveries, as long-term investors position themselves for future gains.

For now, XRP bulls must hold current levels and reclaim key resistance zones to confirm the start of a new rally. If XRP breaks through crucial supply levels, it could signal the beginning of a major price surge, potentially pushing it into new all-time highs. The next few trading sessions will be critical in determining whether XRP can maintain its momentum or if further consolidation is needed before the next move upward.

Price Holds Above Key Demand

XRP is currently trading at $2.37, maintaining strength after defending the $1.89 support level last week. Bulls have successfully held key demand, preventing further downside, but the main challenge now is breaking above crucial supply zones to trigger a rally.

If XRP pushes above the $2.60 mark with strong momentum, it could open the door for a rally into price discovery. A break and reclaim of the $3 level would likely signal the start of a major uptrend, potentially leading to new all-time highs.

However, the market remains volatile, and a retest of range lows is still possible before XRP makes a decisive move. Bulls must continue defending key support levels while building momentum for a breakout above resistance.

Related Reading

The next few days will be critical in determining XRP’s short-term direction, as a failure to reclaim $2.60 could lead to a deeper consolidation phase before another attempt at higher prices.

Featured image from Dall-E, chart from TradingView