Image source: Getty Images

Achieving financial independence through passive income is a top priority for many UK investors. And with the average UK salary projected to hit £37,000 in 2025, I’m wondering how much someone needs to invest in an ISA to generate this amount.

The numbers behind the dream

To earn an annualised £37,000 annually, an investor would need around £740,000 in an ISA. That’s based on the assumption that an investor could achieve an average dividend yield of 5%. This would mean earning a passive income without drawing down the balance of the portfolio. While £740,000 might sound like a lot of money to reach, it’s achievable. The only thing is, it takes time.

Stocks and Shares ISAs have outperformed their cash counterparts, offering an average return of 11.9% in the year leading up to February 2025, compared to just 3.8% for Cash ISAs. This significant difference underscores the potential of equity-based investments for long-term wealth generation.

However, it’s important to note that investing in stocks carries risks, and past performance is no guarantee of future returns. Diversification and a long-term strategy are key to mitigating these risks and maximising returns.

The road to £740,000

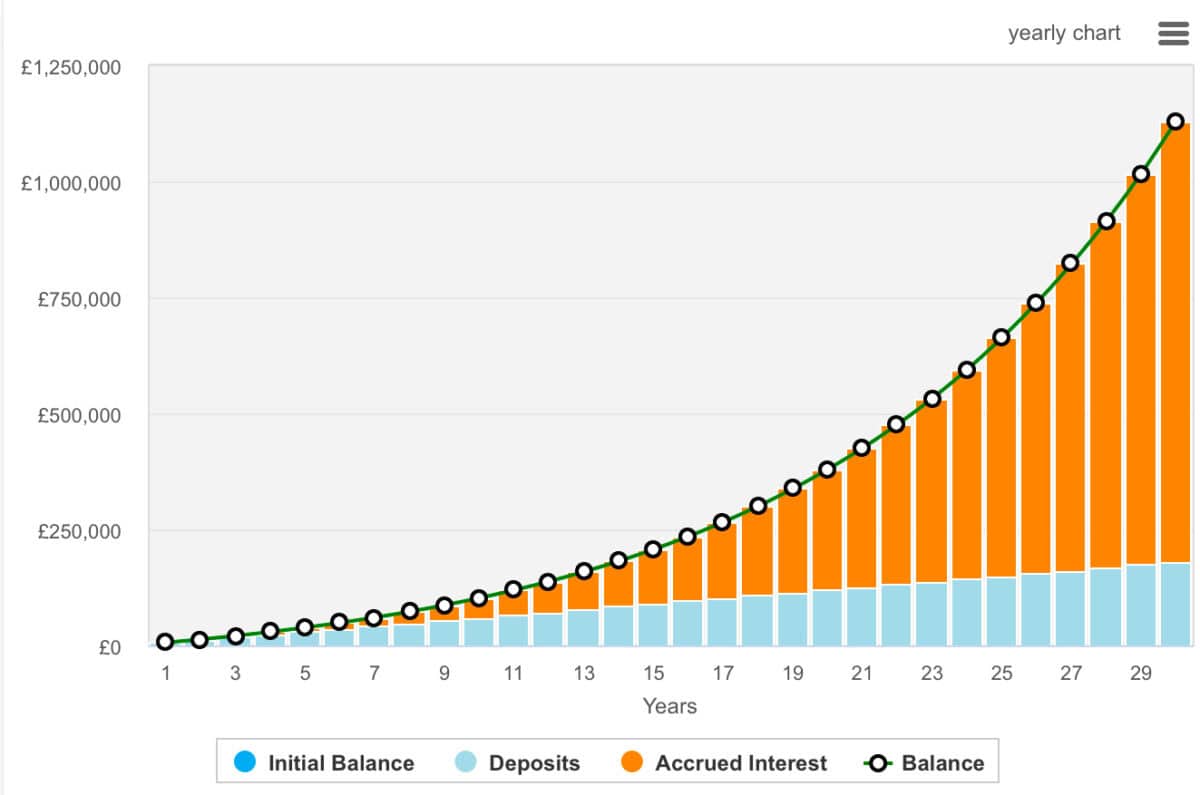

For most investors, accumulating £740,000 is no mean feat. It requires consistent saving, disciplined investing, and a clear financial plan. That’s just the start. It also requires investors to invest wisely, and as Warren Buffett states, to avoid losses. In the example below, I’ve assumed £500 of monthly contributions and a 10% annualised return. Under these circumstances it would take 26 years to compound to £740,000.

However, not everyone can achieve 10% annually. With 8% growth, it would take 30 years and lower percentage returns would take even longer.

A reality check

While the idea of earning the average UK wage passively is enticing, it’s crucial to approach this goal with realistic expectations. Market volatility, inflation, and unforeseen expenses can impact investment returns. It’s also the case that, assuming a constant inflation rate of 2.5% per year, £37,000 today will feel like approximately £19,558.47 in today’s money after 26 years.

An investment to consider

Here’s one from my daughter’s SIPP that investors may want to consider.

The Monks Investment Trust (LSE:MNKS) is a globally-focused investment trust managed by Baillie Gifford, aiming to deliver long-term capital growth through a diversified portfolio of growth-oriented equities. Its strategy emphasises adaptability, investing in companies positioned to thrive amid structural and cyclical changes.

The trust’s approach includes identifying businesses that innovate to reduce costs or improve service quality, ensuring resilience across market cycles. Over the long term, Monks has performed well, with a net asset value (NAV) total return of 173.2% over 10 years as of March 2025.

However, the trust employs gearing (borrowing to invest), which can amplify returns but also increases risk. If investments underperform, the cost of borrowing can lead to significant losses, particularly during market downturns.

Despite this, the trust’s disciplined risk management and focus on long-term fundamentals make it an attractive option. It’s something I may buy more of, for my daughter’s SIPP at least.