Image source: Getty Images

The FTSE 100 is the main arena for investors who are seeking to make an above-average passive income. The likes of Lloyds, Shell, Legal & General, and Taylor Wimpey are among the London stock market’s best-loved dividend shares.

Many Footsie companies have qualities that make ideal dividend candidates. These include market-leading positions in mature industries, wide geographic footprints, and rock-solid balance sheets.

This is all great, but today I’m not interested in talking about FTSE 100 dividend heroes.

I think there may be better UK shares to buy for dividends right now.

Small talk

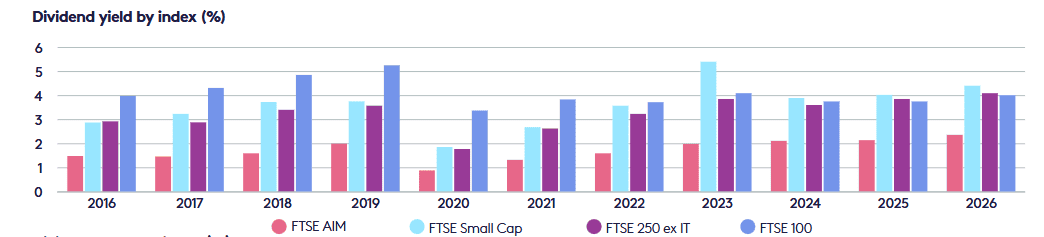

A fresh report from Octopus Investments has caught my eye this week. It shows that the prospective dividend yields on the FTSE 250 (when excluding IT stocks) and the FTSE Small Cap index beat that on offer from the FTSE 100:

Yet, this yield superiority is nothing new. As you can see, the dividend yield on small-cap shares has beaten that of the broader Footsie for the past two years.

And dividends among FTSE Small Cap companies are tipped to grow strongly between 2025 and 2026, resulting in yields of 4.03% and 4.41% respectively.

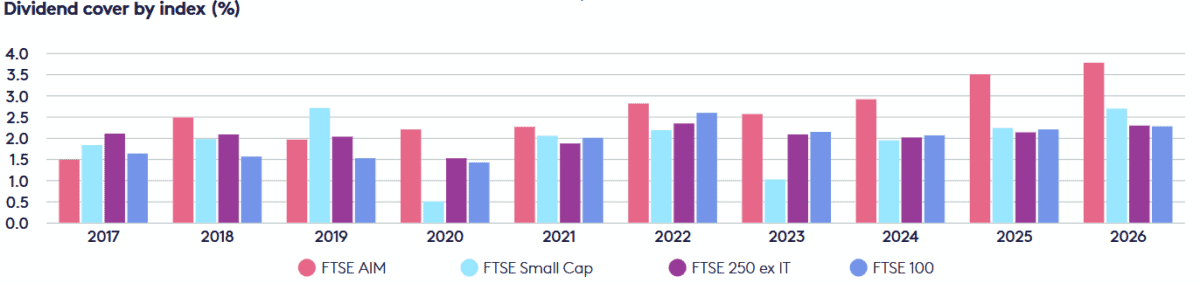

Of course yields are based on broker projections that aren’t set in stone. However, high dividend cover for the next two years provides payout estimates with plenty of steel.

In fact, as you can see, dividend coverage for the FTSE Small Cap, FTSE 250 (ex IT), and FTSE Alternative Investment Market (AIM) indexes also surpass that of the FTSE 100:

These superior yields and dividend coverage reflect expectations that profits outside the FTSE 100 are about to take off. According to Octopus Investments: “both the FTSE AIM index and the Deutsche Numis Smaller Companies Index are expected to deliver 22% compounded annual earnings growth for the two years to December 2026.”

Three top dividend stocks

I own several Footsie shares in my own portfolio for passive income. But Octopus’ research shows it can also pay to consider dividend stocks from outside the FTSE.

Radiator manufacturer Stelrad — with its forward yield of 5.9% and strong dividend cover of two times — is one small cap I’m looking at. I’m also considering pawnbroker Ramsdens — the dividend yield and dividend cover here are 5.1% and 2.3 times, respectively.

But Social Housing REIT (LSE:SOHO) is at the top of my shopping list today. The dividend yield here for 2025 is 9.2%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Dividend cover is far less impressive, at 1.3 times. In theory, this could see the company undershoot dividend forecasts if earnings disappoint.

However, Social Housing’s focus on the stable residential property market greatly reduces (if not totally eliminating) this threat. What’s more, tenants often receive financial help from central and local governments, providing rent collection with added robustness.

Under real estate investment trust rules (REIT), at least 90% of the firm’s annual rental earnings must be paid out in dividends. With its strong growth potential, I’m confident eye-catching dividends at Social Housing will continue to climb.