Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is facing a crucial test as it struggles to break above key resistance levels while holding just above critical support. The market remains stuck in a tight range, reflecting growing indecisiveness among traders and investors. Uncertainty has become the new normal, with macro conditions and political developments continuing to cloud sentiment.

Related Reading

US President Donald Trump has added further volatility to the mix, unsettling financial markets with unpredictable policies and newly imposed tariffs. His erratic behavior has only intensified the fragile mood, pushing risk assets like Bitcoin into deeper consolidation.

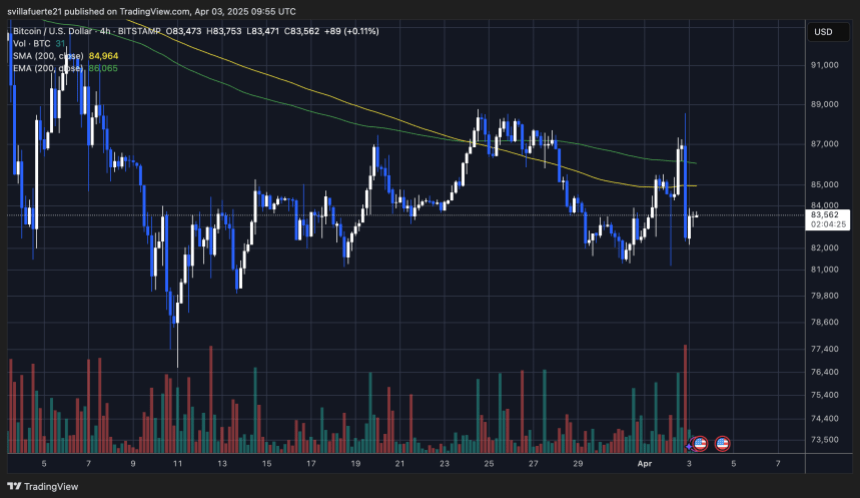

Despite brief rallies, Bitcoin has once again failed to break above descending resistance, according to crypto analyst Carl Runefelt. This rejection, paired with declining trading volume, is a sign that buyers may be losing strength. Runefelt warns that if volume continues to dry up and BTC remains stuck below key levels, the bearish target of $78,600 remains a strong possibility.

While bulls are defending support zones for now, the lack of momentum is raising red flags. Unless Bitcoin can reclaim higher ground soon, the odds of a deeper correction will continue to grow — making the coming days crucial for determining the market’s next direction.

Bitcoin Down 25% from January ATH As Bears Tighten Grip

Bitcoin is now down 25% from its January all-time high, and bulls are struggling to regain control. After repeated attempts to reverse the trend, BTC continues to hold above the $81,000 level — a key support zone — but has failed to reclaim the $86,000 mark, which is necessary to confirm any serious recovery. The inability to push higher has weakened market confidence, and bulls now find themselves in a difficult position.

Macroeconomic uncertainty and fears surrounding escalating trade wars, especially under U.S. President Donald Trump’s unpredictable policies, have added to market volatility. These factors continue to favor the bears, and the pressure on high-risk assets like Bitcoin remains intense. With broader financial markets under stress, bullish sentiment in the crypto space is fading quickly.

Panic is beginning to set in for some investors as selling pressure shows no sign of slowing. However, there’s still a sliver of optimism among market watchers who believe that a bounce could follow once key resistance levels are reclaimed.

Runefelt recently shared insights pointing to BTC’s failure to break above descending resistance — a bearish sign. He also noted that trading volume continues to decline, a sign that market participation is thinning out. This lack of volume often precedes large moves, and in this case, the bearish target of $78,600 remains firmly on the table if bulls fail to reclaim momentum.

For now, the market remains on edge. Bitcoin’s ability to hold above $81K and attempt a move past $86K will be critical in determining whether a recovery is possible — or if the next leg down is about to begin.

Related Reading

Technical Details: Key Levels To Hold

Bitcoin is currently trading at $83,500 after several days of choppy, volatile price action that has left traders uncertain about the market’s next direction. The recent swings between key levels have highlighted the indecision among both bulls and bears, with neither side able to take full control. For bulls, the immediate challenge is to reclaim the $85,000 level, which aligns with the 4-hour 200-day moving average (MA). A successful move above this mark would be an encouraging signal of short-term strength.

Beyond that, the next key level is $86,000, which is where the 4-hour exponential moving average (EMA) sits. Reclaiming this zone would help shift momentum back in favor of the bulls and potentially set the stage for a recovery attempt toward $90,000.

Related Reading

However, the most critical level in the short term is support at $81,000. This price zone has acted as a strong floor in recent weeks, and losing it would likely trigger further downside pressure. As macro uncertainty and market-wide volatility continue, bulls must defend this support while working to reclaim the MAs above. The coming sessions will be crucial in defining whether Bitcoin can recover—or slide deeper into correction territory.

Featured image from Dall-E, chart from TradingView