Algorand leads tokenized stocks in 2025, outpacing Ethereum. The $425M Exodus stock on NYSE highlights the ALGO edge in RWA tokenization. By 2030, the industry could rise to command a market cap of over $1 trillion.

Tokenization is the future, and with BlackRock, one of the world’s largest asset managers, at the forefront of this drive, the future looks bright for platforms that become industry leaders. At the moment, Algorand is dominating the world of tokenized stocks, considering the total value locked (TVL) of securities trading on this proof-of-stake and secure blockchain.

Stand Aside Ethereum: Algorand Dominates Tokenized Stocks

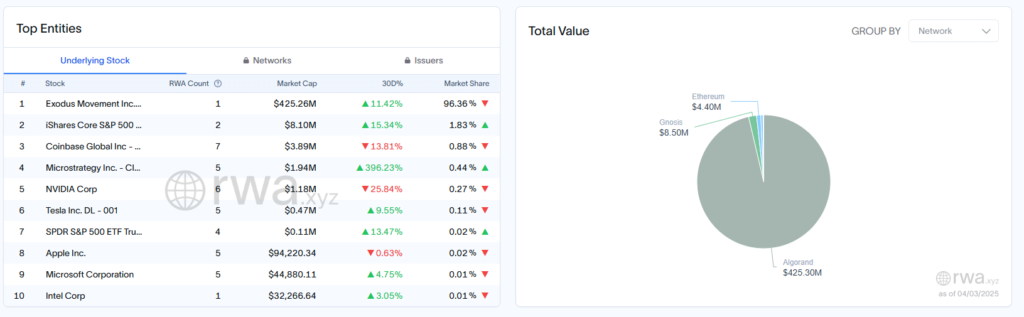

Data from RWA.xyz shows that Algorand has more tokenized stock value than Ethereum and its layer-2 scaling solutions, such as Arbitrum, Base, and Polygon, combined.

(Source)

In this realm, Exodus (EXOD), a tokenized stock on Algorand, is capturing the attention of traders–some of whom are also buying some of the hottest presales to invest in.

At press time, over $425 million worth of EXOD tokens are circulated and secured on the Algorand mainnet. However, EXOD is the only tokenized stock in Algorand.

Ethereum wins based on the number of tokenized equities and indexes deployed. For example, there are tokenized NVIDIA, Strategy, and Coinbase stocks on Ethereum and its layer-2s like Polygon and Base–which is also the host of some of the best meme coins to buy in 2025.

The tokenized Coinbase stock, COIN, has a market cap of $3.8 million, circulates on Ethereum, and is backed by Gnosis.

EXOD Tokenized Stock: Everything You Need to Know About Leading RWA

Exodus is the team behind a Bitcoin wallet, and EXOD is their stock, which is available for trading on the NYSE, one of the largest exchanges in the world.

EXOD is a Class A share, and holders can trade the tokenized stock freely on the NYSE.

Trading of EXOD began on December 18, 2024, marking a historic moment for the Bitcoin wallet and crypto in general. Most importantly, the move underscored the growing integration of new technology with traditional finance (TradFi).

With EXOD trading on-chain, not only is the stock more transparent, but its liquidity is higher, boosted by increased legitimacy and adoption after listing on the NYSE.

However, even with this listing, the journey wasn’t smooth.

In May 2024, the United States SEC rejected their application before eventually approving the listing seven months later, in December 2024, when Donald Trump took over as president of the United States.

Crypto laws in the United States will likely improve in the next few years.

AlgoKit 3.0: Tooling For RWA Tokenization

Accordingly, Algorand is preparing for this future and releasing new developer tools.

On March 26, they released AlgoKit 3.0, an upgrade that accelerates the development experience for businesses and developers focusing on real-world asset (RWA) tokenization.

AlgoKit 3.0 is live.

Now supporting native TypeScript alongside native Python, opening the doors for 18M+ developers to build on the Algorand blockchain; no need to learn niche languages.

Web3 just got way more accessible.

Build today: https://t.co/tOd2MKQliM pic.twitter.com/mbf3NYXpJ1

— Algorand Foundation (@AlgoFoundation) March 26, 2025

The Algorand Foundation said the release includes new TypeScript smart contract support that expands beyond Python. After this update, developers can now write smart contracts in TypeScript.

At the same time, they introduced advanced debugging tools to streamline smart contract verification, thereby reducing errors while improving security.

One of the biggest updates in this release was the enhancement of scalability and performance. Algorand now supports a throughput of over 10,000 TPS, following the release of the Dynamic Lambda update in January that slashed block times to under three seconds.

With these tools and multiple tokenization platforms on Algorand, like Lofty, Koibanx, and Trusty Digital, more users will likely choose to tokenize on Algorand, taking advantage of its superior scalability, security, and dominance.

This outlook only makes sense.

John Woods, the CTO of Algorand, said that tokenizing assets on scalable chains like Algorand will unlock new financial possibilities.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Algorand Outpaces Ethereum In Tokenized Stocks, Exodus On NYSE Dominates

- Algorand tokenized stock, EXOD, trading on NYSE dominates and surpasses those in Ethereum

- AlgoKit 3.0 kit released to boost RWA tokenization

- Will Tokenization unlock new financial opportunities?

The post Algorand Dominates Tokenized Stocks: Ethereum Dwarfed by $425M RWA Value on ALGO appeared first on 99Bitcoins.