Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Despite the recent crypto crash that sent most digital assets tumbling, Ethereum (ETH), Solana (SOL) and Cardano (ADA) have managed to hold their ground. According to latest reports, these three cryptocurrencies are now leading the charts as the most trending coins in the market after the crash.

Related Reading

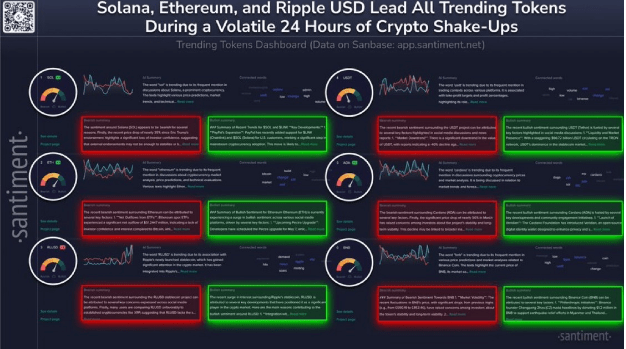

Santiment Unveils Top Trending Cryptos

The crypto market took a significant hit after fears of new tariffs implemented by United States President Donald Trump rattled investors and sent digital assets plunging across the board. However, while US stock markets closed, signs of recovery began to emerge across specific cryptocurrencies, with Ethereum, Solana, and Cardano leading the post-crash chatter.

According to an X (formerly Twitter) post by Santiment, a market intelligence platform, Solana is now back in the headlines as market analysts closely watch its price action following its crash.

The popular meme coin is seeing an increased level of speculative predictions, market trends, and technical chart breakdowns. As a result, SOL is recapturing the attention of retail and institutional investors. There’s also been notable activity within the Solana network as anticipation for a price rebound or breakout keeps spreading.

Ethereum is also trending in the crypto market, not just for its prolonged price slump and reaction to the crypto crash, but its ongoing transition to Ethereum 2.0 — a key upgrade focused on scalability and energy efficiency.

Santiment notes that analysts are highlighting Ethereum’s network performance during the market stress, showcasing an increase in discussions about the cryptocurrency’s market analysis. There have also been increased price predictions, technical evaluations, and talks about the cryptocurrency’s scalability and adoption.

Just like Solana and Ethereum, Cardano is seeing renewed attention as traders assess the cryptocurrency’s position in the broader market. There has been an influx of mentions surrounding Cardano’s market trends, with users speculating on its future price action and potential investments. Forecasts for the ADA price also range widely, with social media buzz and speculative posts fueling the cryptocurrency’s presence on trending charts.

While not as widely discussed as ETH, SOL, and ADA, Binance Coin (BNB) has also been showing up in technical forecasts. Santiment reveals that analysts are tracking BNB’s trading ranges and potential price movements, making it a focal point for investors and traders.

Related Reading

Stablecoins Join List Of Trending Assets

In addition to the altcoins above, Santiment has disclosed that stablecoins have also joined the list of top trending assets. While Ethereum, Solana, and Cardano experienced major declines after the crypto crash, stablecoins, as their names imply, remained stable against the dollar.

Ripple’s newly launched stablecoin RLUSD is trending due to its association with the crypto payments company, which gained significant attention following the completion of its legal battle with the US Securities and Exchange Commission. The stablecoin has been integrated into Ripple’s payment system, improving cross-border transactions and attracting institutional interest.

There has also been a significant increase in adoption and trading volume, with crypto exchange Kraken reporting an 87% surge in the latter and a $10 billion growth in the former.

Featured image from Gemini Imagen, chart from TradingView