Amidst the broader crypto market crash, XRP has broken below an important support zone that several traders have identified as pivotal. In a chart shared by crypto analyst Josh Olszewicz during his latest YouTube update, the token shows a pronounced break beneath the Ichimoku Cloud on the daily timeframe, with the price now positioned under the $2.00 handle. This move also places XRP below the neckline of a head and shoulders pattern.

How Low Can XRP Price Go?

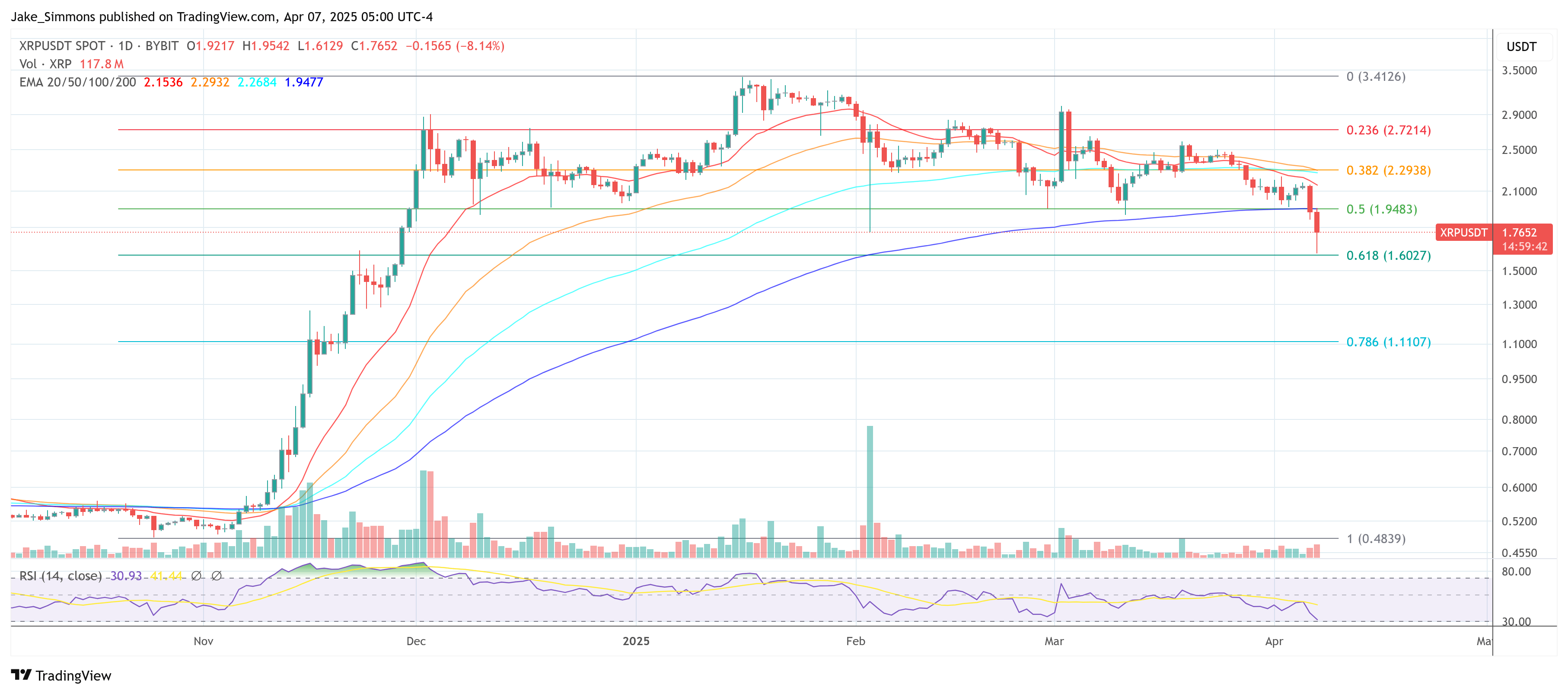

Olszewicz describes the chart pattern as a “head and shoulders variant mess—Frankenstein’s monster,” indicating that although the formation might not be a textbook head and shoulders, its overall structure strongly resembles a classic bearish reversal. The left “shoulder” formed around the $2.90 zone in early December 2024, the “head” near the $3.41 peak, and the right “shoulder” at roughly $3.00.

As price continues to drift lower, the complete violation of the neckline region below $2.00 underscores the potential for a meaningful downside extension. According to Olszewicz, XRP is now “below $2, below VPVR support, below the range,” with a possibility of dropping under $1.50 this week should bearish momentum intensify and sellers follow the pattern seen in numerous other altcoins in recent weeks.

“It would not shock me at all if we see everything puking and XRP is sub $1.50 this week. Would not shock me at all. It’s held up better than most alts but it’s some point sellers will take over here just like they’ve taken over most alt charts,” Olszewicz said.

The presence of key Fibonacci levels on Olszewicz’s chart offers further perspective on possible support and resistance points. The 0.5 retracement, indicated around $2.60, is currently above the market and may act as a significant barrier if XRP attempts to reclaim ground.

Meanwhile, the 1.618 extension hovers around $1.42, and the 2.0 extension near $1.16 could come into focus if momentum continues to favor the bears and the head and shoulder pattern fully plays out.

Jesse Colombo, another crypto analyst, has weighed in on X with an even more bearish perspective. Colombo suggests that the head and shoulders structure, if it plays out in full, might “sink [XRP] all the way back to $0.60 cents in a complete unwinding of its fall rally.”

Contrasting sharply with that outlook is the stance offered by CrediBULL Crypto, who also shared his views via X. Although he acknowledges the recent slip beneath support, he characterizes it as more likely to be a “deviation” or “false breakdown” below $1.80 than a true collapse in market structure.

He contends that XRP might wick under $1.80 briefly, only to recover its footing soon afterward and resume a broader upward trend. In his assessment, a dip to sub-$1.80 would not necessarily be a sign of inherent weakness, as long as XRP can reclaim that level relatively quickly and push beyond the immediate resistance clusters.

“I’m not expecting a breakdown below $1.80, I’m expecting a deviation below it- aka a false breakdown or fake out below it before the next leg up. It would not be a sign of weakness if we visit sub $1.80 basically,” he writes.

At press time, XRP traded at $1.76.