Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price action in recent weeks has been mostly highlighted by a trading range between $80,000 and $85,000, with a struggle to reclaim buying pressure. Despite the current lack of a strong bullish momentum, many crypto analysts are banking on a bullish continuation and a new Bitcoin price all-time high before the end of 2025.

According to crypto analyst TradingShot, Bitcoin could be approaching the final leg of this bull cycle, predicting a peak above $125,000. However, this analysis comes with a caveat that an extended bear market might roll in by October 2025.

Long-Term Bitcoin Cycles Hint At Imminent Peak

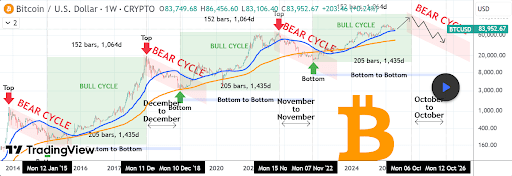

TradingShot’s analysis, which was posted on the TradingView platform, is based on over a decade of symmetrical Bitcoin market behavior that shows both bull and bear cycles unfolding in consistent timeframes. According to TradingShot, the bull cycles dating back to 2015 have all lasted approximately 1,064 days, or 152 weeks, with each cycle topping out almost exactly three years after the previous bottom. On the other hand, bear cycles have consistently lasted for around one year, either from December to December or November to November.

Related Reading

This historical symmetry is reflected in the chart below, which highlights three bull cycles followed by three bear periods, all forming a repeating pattern. The most recent bottom, recorded on November 7, 2022, marked the start of the current bull cycle. If this pattern holds, Bitcoin could reach its next peak in the week of October 6, 2025.

The bull cycle has led to Bitcoin breaking above $100,000 and now with an all-time high of $108,786, but like many others, the analyst predicted this peak will still be broken this year. This peak will likely mirror the explosive rallies that ended the 2017 and 2021 cycles and eventually surpass $125,000.

Sell Everything In October 2025, Buy Back In October 2026

TradingShot’s primary advice is blunt but strategic: sell everything by October 2025. According to the analyst, this window could be the final opportunity to exit near the top before the next bear cycle takes hold. Counting 1064 days from the most recent bottom of $15,600 in November 07 2022, gives a time estimate for the next cycle top on October 6 2025. If history repeats itself, the subsequent bearish phase will likely last for 12 months and bottom out around October 12, 2026, before the next bull phase.

This timing is not speculative; it’s based on a consistent one-year bearish phase across three full market cycles. Therefore, it would be better to sell before October 2025 and start accumulating by October 2026.

At the time of writing, Bitcoin is trading at $84,500, up by 0.9% in the past 24 hours and 48% away from the predicted peak of $125,000.

Featured image from Adobe Stock, chart from Tradingview.com