Bitcoin is slowly pushing higher, aiming to reclaim the 200-day moving average, but the price remains stuck below it. Considering the futures market sentiment, the next breakout or rejection could spark major volatility.

Technical Analysis

The Daily Chart

As the daily chart suggests, BTC has managed to recover from the March sell-off and is now trading just below the 200 DMA, located around the $88K mark, which is acting as a strong dynamic resistance. The recent structure shows short-term higher highs and lows, but the price is still capped below the $88K level.

The buyers need a clean daily close above this zone and the 200-day moving average to open the door toward $92K and eventually, the $100K level. If the price gets rejected again, the $80K region will be key for maintaining a recovery structure.

The 4-Hour Chart

On the 4-hour timeframe, Bitcoin has broken above the long-term descending trendline and is consolidating just below the $86K–$88K supply zone. The structure shows higher highs and higher lows, indicating bullish momentum.

However, the price action has been choppy recently, with multiple rejections from the $86K area. The RSI is also gradually rising but hasn’t reached overbought yet, meaning bulls still have fuel, but they need to show conviction. A confirmed breakout above $88K could trigger a fast rally in the coming weeks.

Sentiment Analysis

Open Interest

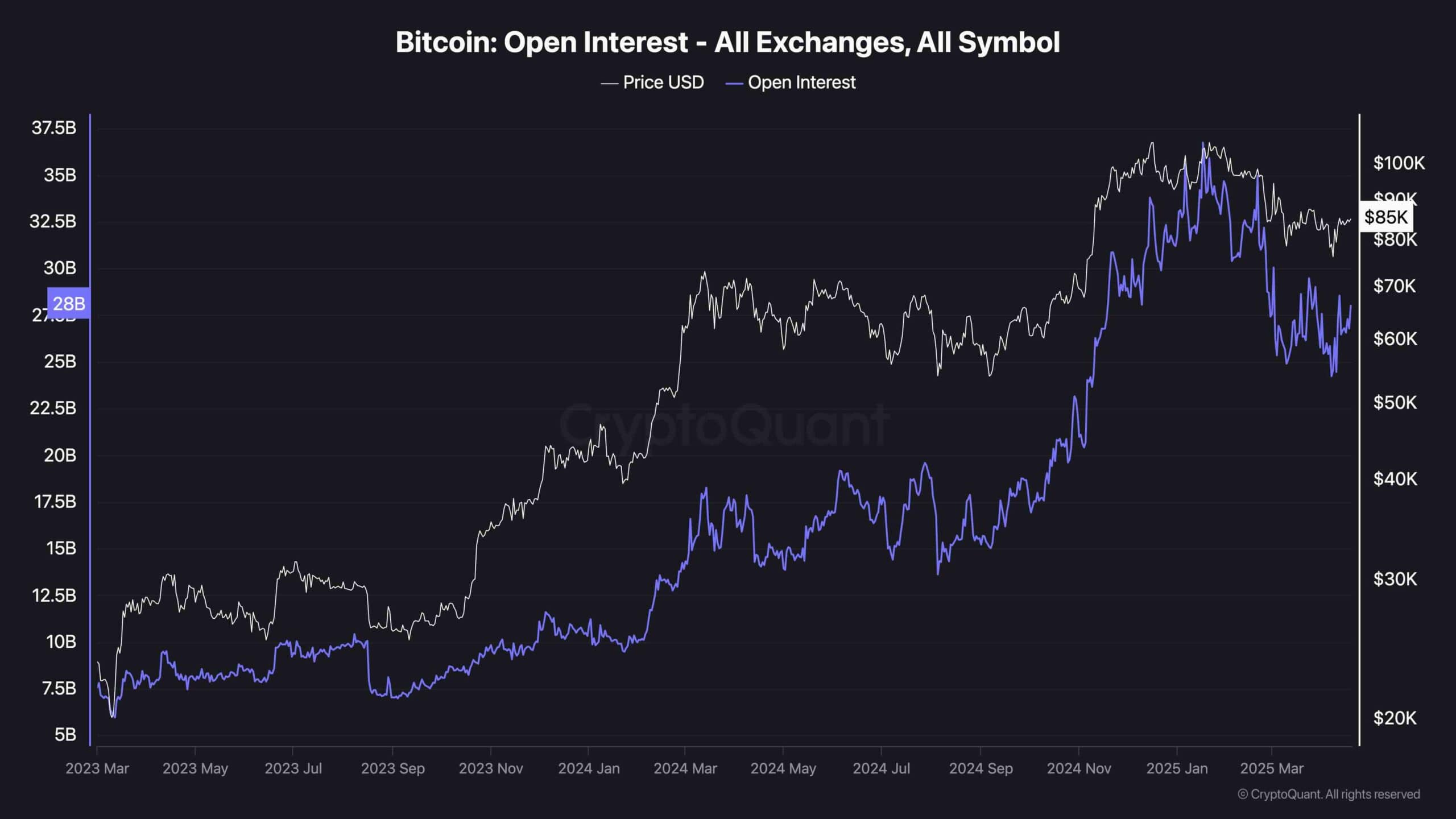

Looking at the futures market sentiment metrics, the open interest is climbing again, now sitting around $28B as the price hovers around the $85K mark. This rising OI trend suggests growing speculative activity in the derivatives market.

Historically, sharp increases in OI during sideways or slightly bullish price action often precede major volatility. If the market breaks higher, the stacked long positions could fuel a squeeze to the upside. But if resistance holds and price reverses, a long liquidation cascade is likely. Either way, the next major move will likely be amplified by this buildup in leverage.

The post Bitcoin Price Analysis: How BTC Can Escape the Current Consolidation Range appeared first on CryptoPotato.