Is Bitcoin being at the “least bullish phase” since November 2022 a golden opportunity to buy the BTCUSDT dip? With the Bitcoin price consolidating between $83,000 and $88,000, BTC whale selling slowing, and bulls eyeing a breakout above $90,000, are bulls ready to press on?

On April 21, Bitcoin is still consolidating, moving within a $5,000 range between $83,000 and $88,000. This sideways movement follows a period of lower lows, with the world’s most valuable coin sliding from $109,000 in January 2025 to $74,500 in April 2025.

DISCOVER: Top 20 Crypto to Buy in April 2025

Bitcoin at Its “Least Bullish Phase” in Over Two Years

Although sellers are dominant, the uptrend from Q4 2024 is valid. Most bulls expect the Bitcoin price to recover in the coming trading sessions, funneling capital into some of the hottest presales in 2025. This forecast holds as long as Bitcoin remains above its 2021 highs, rejecting attempts to decline further.

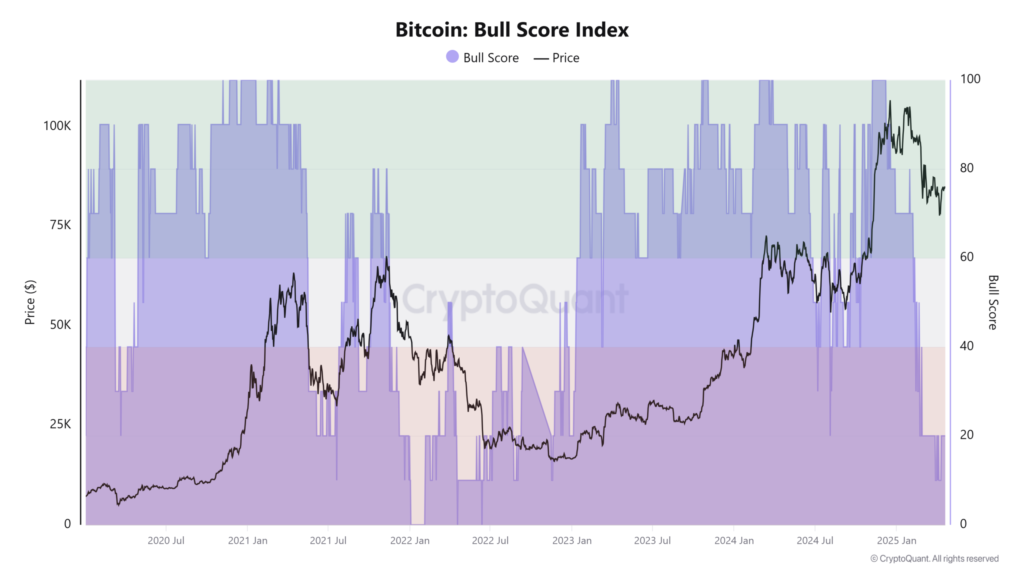

CryptoQuant analysts note that, despite the Bitcoin price being at historical levels, well above the 2017 and 2021 cycle highs, the BTCUSDT price action is in its “least bullish phase” since November 2022.

Referencing the CryptoQuant Bull Score Index, a tool for gauging sentiment, analysts highlight that the reading has dropped to 20. In their analysis, this level is often associated with bearish investor behavior and a low probability of a sustained rally in the near term. Additionally, the index has remained below 50 for 99.5% of the past two months, the longest such stretch since the 2022 bear market.

(Source)

In November 2022, Bitcoin and crypto prices crashed following the collapse of FTX and several crypto hedge funds earlier that year. Bitcoin fell to as low as $15,800, which led to the launch of some of the best Solana meme coins like BONK. However, this decline marked a price bottom.

Though sentiment plummeted and investors turned away from crypto, it was an inflection point. Within months, Bitcoin was posting higher highs, reaching $50,000 in the second half of 2024 before extending gains after Donald Trump’s presidential victory in November 2024.

Time to Buy the BTCUSDT Dip?

If history is a guide and Bitcoin is at cycle lows, could this consolidation be the perfect time to buy the BTCUSDT dip?, or does more pain await Bitcoin holders?

From the BTCUSDT price action, bulls have struggled to break $90,000, and sellers remain in control despite general optimism. The last time bulls surpassed $90,000 was in early March. Since then, the Bitcoin price has dropped below $80,000 and retested 2021 highs. For bulls to regain control, a close above $90,000 is critical to catalyze demand and push prices above $100,000.

(BTCUSDT)

There is hope. CryptoQuant analysts observe that Bitcoin whales have slowed their selling. Daily BTC sales from large holders have declined from 800,000 BTC in late February to around 300,000 BTC last week. This suggests that capitulation may be subsiding, a positive sign for bulls.

However, for bulls to strengthen their position, accumulation must gain momentum. Although whale selling has decreased, whale holdings have also dropped by over 30,000 BTC in the past week. Moreover, their monthly accumulation rate fell from 2.7% in March to just 0.5%, the lowest since February 20. This drop indicates that confidence remains shaky, with no firm conviction among large investors.

DISCOVER: 7 High-Risk High-Reward Cryptos for 2025

Bitcoin Price: Buy Now or Wait? BTCUSDT Below $90,000

- Bitcoin price consolidating between $83,000 and $88,000

- CryptoQuant analysts: Bitcoin at the “least bullish phase” since FTX collapse in November 2022

- Whale selling activity slowing down, a relief for BTC

- Time to buy the dip? After November 2022, BTCUSDT rose to over $70,000 by the end of October 2024

The post Bitcoin In Its “Least Bullish Phase” Since November 2022: Buy the BTCUSDT Dip? appeared first on 99Bitcoins.