Image source: Getty Images

Tough market conditions mean that Legal & General (LSE:LGEN) shares have delivered an underwhelming return since April 2015.

At 249.8p per share, the FTSE 100 company has dropped 5.7% in value over the past decade from 265.10p. It means that £10,000 worth of shares purchased a decade ago is now worth £9,430.

This isn’t the sort of performance long-term holders of Legal & General shares would have been hoping for. However, a steady flow of blue-chip-beating dividends means the overall return isn’t as poor as the stock price alone suggests.

Since late April 2015, the financial services giant has paid dividends totalling 167.17p a share. As a consequence, someone who invested £10k back then would have made a total return of £12,860, or 28.6%.

That’s far below the FTSE 100 average of around 84.2%. However, could Legal & General shares provide index-beating returns going forward? And should investors consider buying the company today?

Prices to rise?

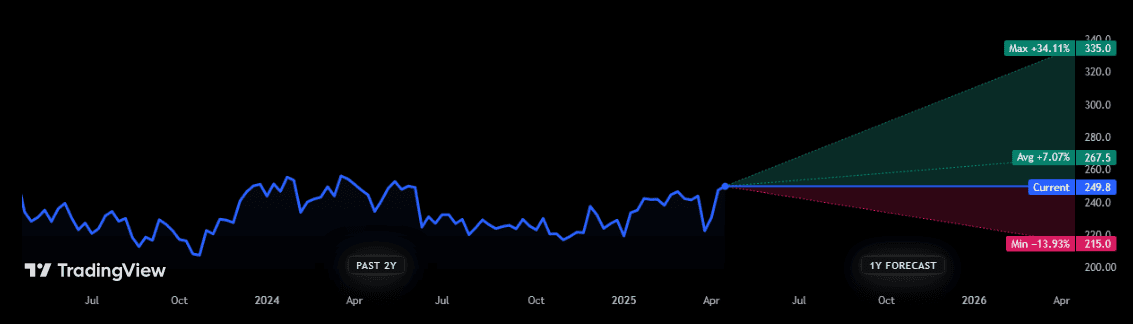

Unfortunately, City analysts don’t provide price forecasts for the next 10 years. However, estimates are available for the next 12 months, and they provide room for optimism.

The 15 analysts with ratings on Legal & General shares believe they’ll appreciate by mid-single-digit percentages over the next year. However, analysts aren’t united in their assessment, as the chart above shows.

Yet with brokers also tipping more market-beating dividends, I think there’s a good chance of a solid return in the short-to-medium term. Dividend yields sit above 9% for each of the next three years.

Between 2025 and 2027, Legal & General plans to return around 40% of its market capitalisation (£5bn) to shareholders through a mix of dividends and share buybacks. With a strong balance sheet — its Solvency II capital ratio finished 2024 at 232% — the company looks in great shape to hit this target too.

Should investors buy Legal & General shares?

That said, I’m more confident in Legal & General’s dividend prospects than its share price. By specialising in discretionary financial products (think asset management, life insurance, and retirement products), it’s in danger of stagnating or even falling as the global economic struggles for traction.

The introduction of ‘Trump Tariffs’ and reciprocal action from the US’ trading partners threatens to choke off growth. It also means inflationary pressures could rise, putting further pressure on consumer spending.

But as a long-term investor, I believe Legal & General is a great share to consider (I hold it in my own portfolio). I believe earnings will rise strongly over the next decade and beyond, driven by rapid population ageing across its markets and the growing importance of financial planning. This could turbocharge demand for the services it specialises in.

In the meantime, investors can console themselves with those 9%-yielding dividends, even if Legal & General’s share price underperforms. On balance, I think the company could prove one of the FTSE 100’s standout buys over the long term.