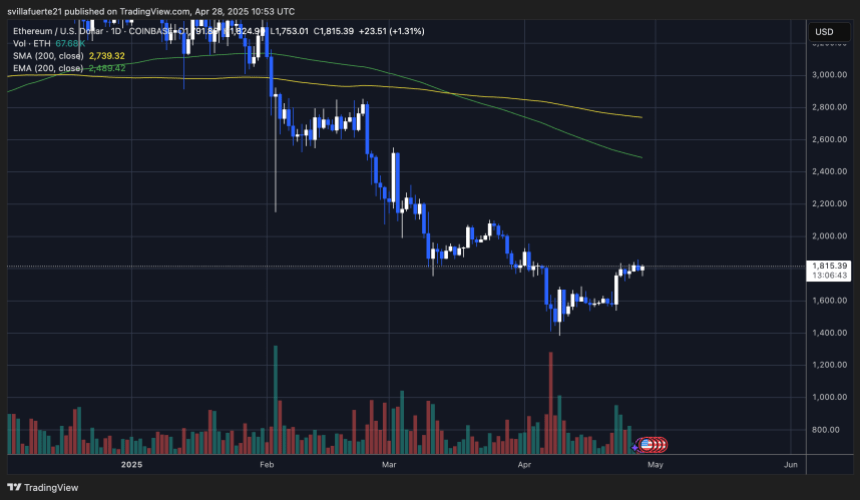

Ethereum is now facing a critical test as it trades within a tight range, sitting below the $1,850 resistance and above the $1,750 support. After a strong recovery from the $1,400 level earlier this month, bulls have managed to stabilize price action, but the real challenge is now unfolding. To confirm a sustainable bullish structure, Ethereum must decisively reclaim the $2,000 level in the coming days.

Market sentiment remains cautious as Ethereum consolidates below resistance while macroeconomic uncertainty continues to weigh on risk assets. Top crypto analyst Big Cheds shared insights on X, highlighting a technical concern: Ethereum is displaying a 4-hour bear divergence on the On-Balance Volume (OBV) indicator, along with an upper shadow structure.

With volatility expected to rise and traders closely watching for a breakout or breakdown, the coming sessions could define Ethereum’s trend for the next several weeks. Bulls need to act quickly to maintain momentum and prevent bears from regaining control.

Ethereum Battles Resistance As Bulls Try To Keep Control

Ethereum is starting to show early signs of a bullish structure on low time frames, giving bulls hope for a broader recovery. After pushing from the $1,400 local low, ETH has managed to hold above key moving averages and consolidate within a tight range. However, the market remains highly cautious, and selling pressure could increase quickly if bulls fail to reclaim higher levels.

Momentum has shifted in Ethereum’s favor over the past few days, and several analysts are calling for a potential massive breakout if key resistance levels are breached. A confirmed breakout above $1,850 could open the door for a swift move back to the $2,000 psychological level. Nevertheless, risks remain elevated, and an opposing bearish view suggests that Ethereum could revisit the $1,300 zone if bulls lose control.

Ched’s critical insights point out that Ethereum is forming a 4-hour bearish divergence on the On-Balance Volume (OBV) indicator. This, combined with the appearance of an upper shadow on local structure, signals weakening buying pressure. According to Cheds, a short position could be triggered if Ethereum loses the $1,750 support zone, which would confirm a breakdown from the current consolidation pattern.

Technical Details: Key Levels To Change Structure

Ethereum is trading at $1,815 after days of tight consolidation and modest upward movement. Bulls have managed to defend the $1,750-$1,800 support range, but the real test remains ahead. To shift the broader bearish structure into a confirmed bullish trend, Ethereum must reclaim the $2,100 level. Without this breakout, any rallies are likely to be seen as temporary relief within a broader downtrend.

Holding above the $1,800 level is critical in the coming days. A firm base above this zone would help build strong demand and create the conditions needed for a sustained recovery rally. Bulls are gaining some short-term momentum, but they still face a market clouded by macroeconomic uncertainty and cautious sentiment.

If Ethereum fails to maintain support at $1,750, downside risks will grow rapidly. Breaking below this zone could trigger a sharp sell-off, likely sending ETH toward the $1,500 mark. As the market shows signs of strength, Ethereum’s next move will be decisive. It will determine whether it can join a larger recovery trend or continue struggling within a volatile and uncertain environment.

Featured image from Dall-E, chart from TradingView