Image source: Getty Images

After the April we’ve just had, saying with confidence what May will bring in the stock market is a bold move. But I don’t think there’s ever a bad time to be looking at quality growth stocks.

Whether it’s the UK or the US, there are opportunities worth considering. For investors looking to build wealth, these are names that should be on the radar.

3i – a FTSE 100 compounder

At first sight, it’s difficult to see right now as a good time to consider buying shares in 3i (LSE:III). The stock is at an all-time high and up 722% over the last 10 years.

Apart from a couple of recent additions, the stock has left the rest of the FTSE 100 in the dust. And investors shouldn’t be too quick to conclude the opportunity has passed.

What has set the private equity firm above its peers is the fact it has focused on investing its own capital, rather than money from external investors. And this is still the case.

One of Warren Buffett’s most important principles is that investing well is about being greedy when others are fearful. And 3i’s structure has given it a unique ability to do this.

Its investment portfolio is heavily concentrated in one asset – a European discount retailer. And while the company has performed exceptionally well, a lack of diversification can be risky.

This is something investors should bear in mind in the context of their own portfolios. But I think 3i is a quality company that could continue to do well for shareholders for a long time.

Amazon – growth in all the right places

The Amazon (NASDAQ:AMZN) share price has fallen almost 15% since the start of the year. And the firm is still growing strongly and I think the stock is unusually good value right now.

On both a price-to-earnings (P/E) and a price-to-book (P/B) basis, Amazon shares are at some of their lowest levels in the last five years. And the reason for that is fairly clear.

The company’s online platform does business all around the world. So increased costs of international trade are a clear and genuine risk for the firm.

That’s why the share price has been falling. But the company’s most recent earnings report is a good illustration of why I think this is a good time to consider buying the stock.

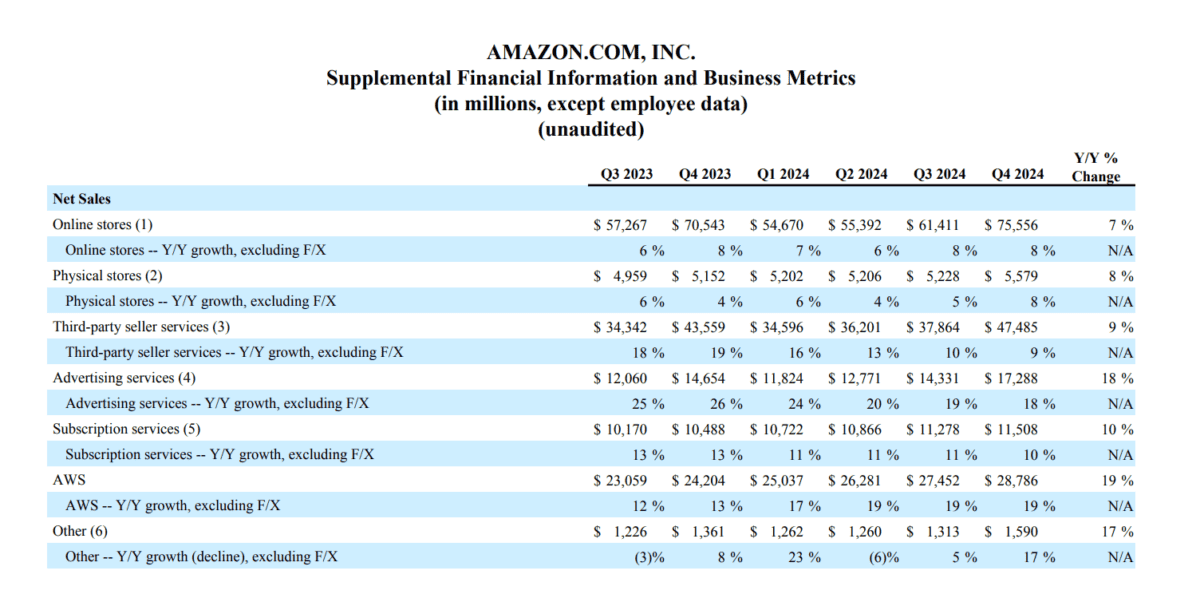

Source: Amazon Q4 Results 2024

Overall revenues are up 10%, but the really interesting thing in my view is where this growth has come from. It’s been driven by the cloud computing division and the advertising unit.

Both of these are high-margin businesses, meaning profits have been growing rapidly as sales in these divisions increase. And this looks like a powerful combination going forward.

Quality businesses

In terms of share prices, 3i and Amazon have had contrasting fortunes since the start of the year. But both look to me like quality businesses with outstanding long-term prospects.

From an investment perspective, this is what matters the most. While there are no guarantees, this is what gives investors the best chance of getting a strong return over the long term.