Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to a recent CryptoQuant Quicktake post, Bitcoin (BTC) could be preparing for its next major move. Contributor Crypto Dan highlighted that BTC is currently forming an accumulation pattern similar to those observed in 2024 – patterns that were followed by significant rallies.

Bitcoin Showing Signs Of Big Rally

Bitcoin has surged over 13% in the past week, signaling renewed optimism in the digital assets market. This momentum comes amid easing global tariff-related tensions, which had previously created headwinds for risk-on assets.

Alongside Bitcoin’s rise, the total cryptocurrency market capitalization has increased substantially – from approximately $2.5 trillion on April 8 to over $3.1 trillion at the time of writing.

Related Reading

Adding to the positive sentiment is BTC’s evolving technical structure. In a recent analysis, CryptoQuant contributor outlined how BTC is forming an accumulation pattern that preceded major price rallies in 2024.

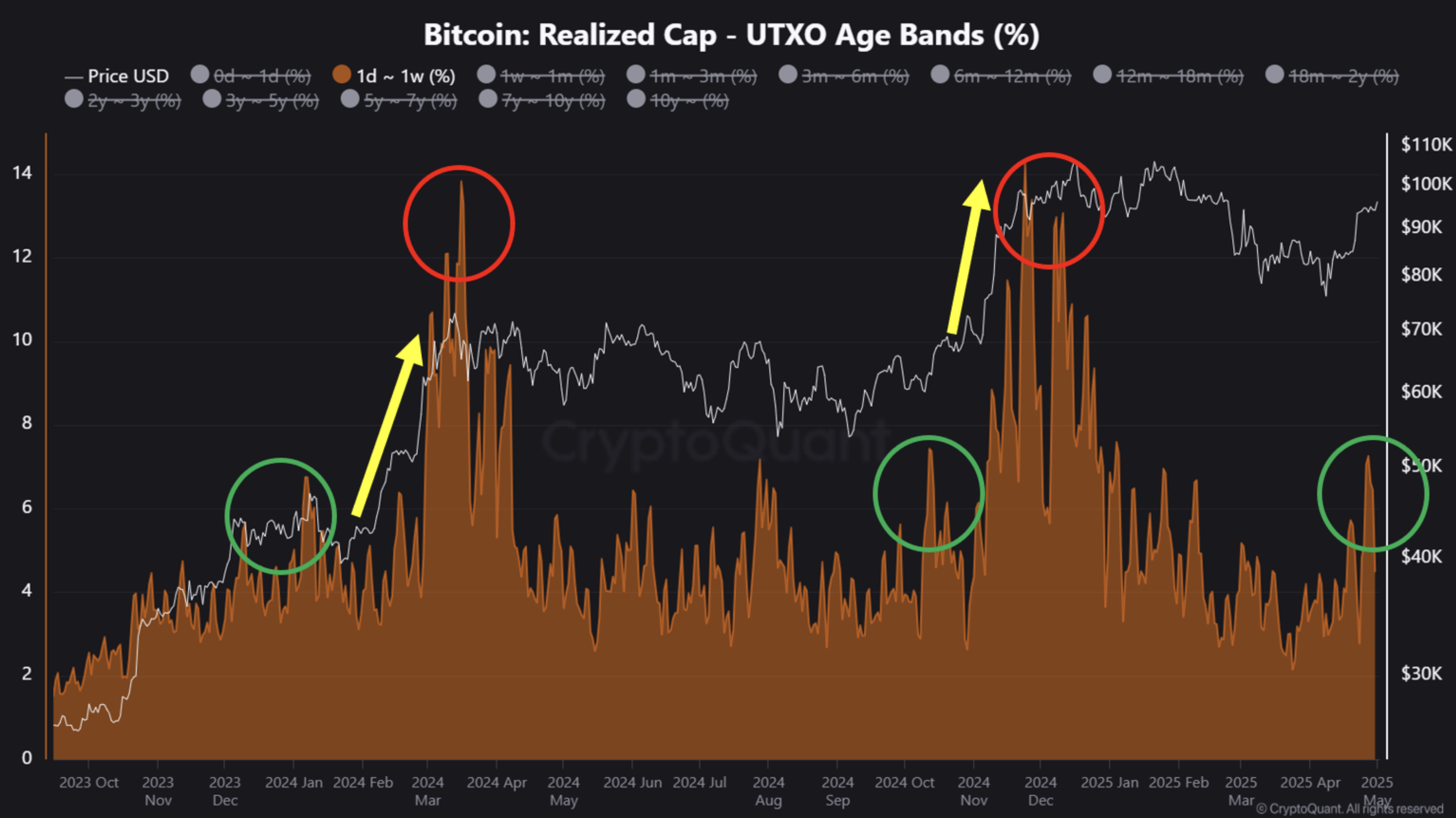

The contributor shared the following chart, stating that BTC’s current movement appears to be mirroring that from January and October 2024. On both the instances, BTC entered a significant uptrend that was powered by a sharp increase in the activity of short-term holders.

By “short-term holders,” the analyst refers to investors who typically hold BTC for one day to one week. In previous cycles, a sudden increase in activity from this group was followed by strong rallies – not only in BTC, but also across major altcoins. The analyst explained:

Notably, this indicator has historically moved ahead of major price surges, making it a reliable signal of accumulation. If this trend continues in the short term, Bitcoin may be on track to break above $100K and enter a strong upward phase.

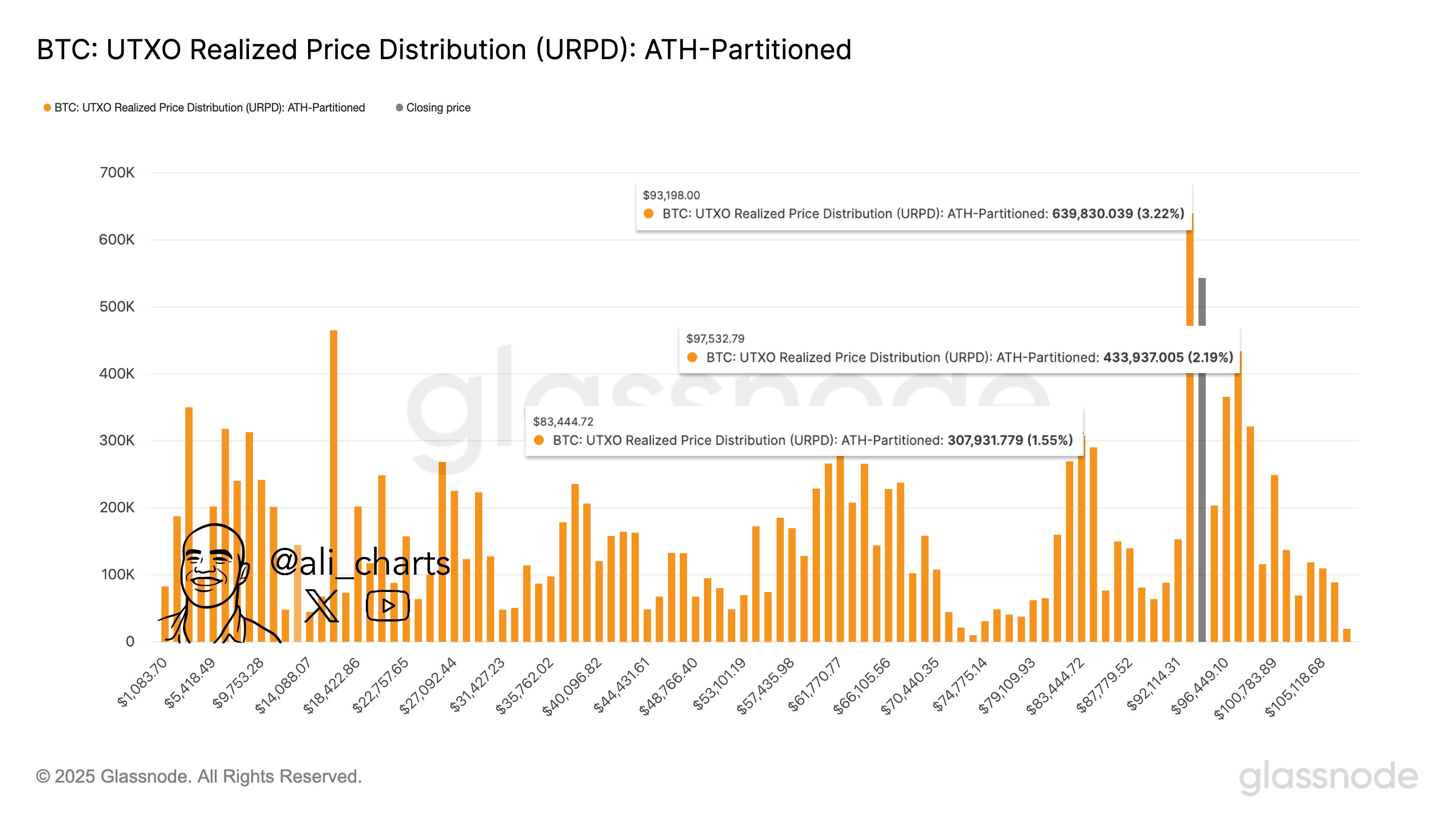

Meanwhile, prominent crypto analyst Ali Martinez identified $97,530 as the next major resistance level. Martinez emphasized that surpassing this price point could clear the path for Bitcoin to reach new all-time highs (ATH).

Despite The Momentum, Concerns Persist

Despite growing optimism, not all indicators support an immediate breakout. Some analysts caution that Bitcoin still faces obstacles. Notably, the 30-day Demand Momentum remains in negative territory – suggesting that recent bullish sentiment may not be fully sustainable yet.

Related Reading

Additionally, on-chain metrics reveal that a truly parabolic move could take more time. CryptoQuant contributor Carmelo Aleman observed that while BTC reserves on exchanges continue to decline, indicating long-term holder confidence, there may not yet be enough pressure to trigger a full-blown supply shock.

That said, one positive signal is a recent sharp rebound in Bitcoin’s Apparent Demand, which could indicate the early stages of a trend reversal. As of press time, Bitcoin is trading at $96,370, up 1.9% over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and Tradingview.com