Image source: Getty Images

Up until the start of 2014, no FTSE 100 company had delivered a superior return to JD Sports Fashion (LSE:JD.) shares on a 10-year basis. Rapid earnings growth meant the sports/athleisure giant had delivered a stunning overall return of 1,068%.

However, a sharp price slide since last autumn means long-term returns have tumbled closer to the UK blue-chip average.

Today, JD Sports’ share price sits at 77.5p per share, up from 23p a decade ago. That represents a 237% increase, meaning £10,000 of stock bought back then would now be worth £33,695.

The sportswear retailer has never been the most generous dividend payer. Yet with shareholder payouts added to those share price gains, someone who parked £10k in JD would have enjoyed a total return of £35,539, or 255.4%.

That’s far above the 85.1% total return the broader FTSE 100’s delivered in that time. Yet JD’s share price is far lower than the record peak of 235.7p struck in late 2021, and is in danger of further slippage.

What can investors expect going forward? And should they consider buying JD shares today?

Strong forecasts

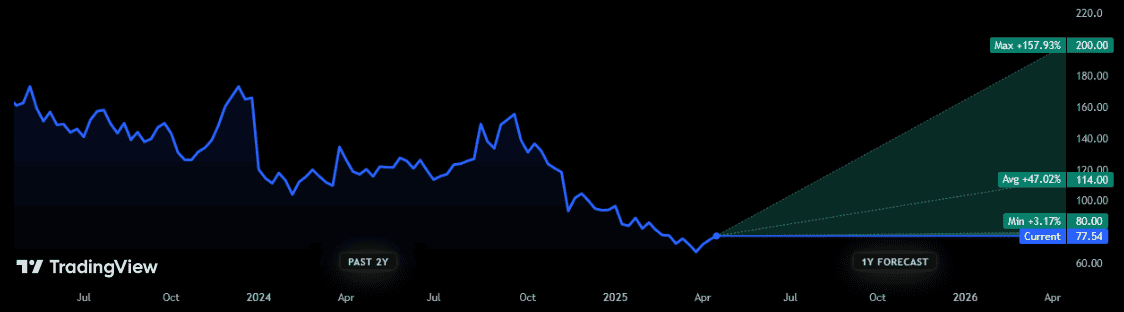

Unfortunately, price forecasts aren’t available beyond the next 12 months. But estimates for that period are positive across the board, despite the threat recent sales weakness could persist.

Right now, 17 analysts have ratings on the Footsie stock. And the average price forecast is 114p, suggesting a break through £1 for the first time since late 2024.

There are some significant risks to these bubbly forecasts however. One is that weak demand for bigger-ticket items like expensive trainers could continue as trade tariffs sap economic growth.

The possibility of a US recession is especially concerning for the retailer too. Following its acquisition of US retailer Hibbett last summer, JD sources 40% of revenues from the States, making it its single most important territory.

Fresh trade barriers also threaten severe supply chain disruptions and higher costs. Remember that a substantial quantity of its goods are manufactured in Asian countries like China.

Are the shares a potential buy?

Yet while the firm may face big challenges in the short term — it’s forecast a fall in like-for-like revenues this financial year (to January 2026) — I still feel JD’s an attractive stock to consider, and especially at current prices.

Recent share price weakness means it trades on a forward price-to-earnings (P/E) ratio of 6.4 times, which is well below the 10-year average of 16-17 times. While this fairly reflects the company’s near-term troubles, I believe it could also provide a springboard for JD’s shares to rebound.

The business is shrewdly scaling back capital expenditure in the near term. However, it plans to continue expanding aggressively, adding around 100 net new stores this year alone. This will leave the firm in a strong position to recover when market conditions improve.

Over the long term, the athleisure market’s still tipped for robust growth. Analysts at Fortune Business Insights reckon it will expand at a compound annual rate of 9.82% through to 2032. With strong relationships and exclusive agreements with industry giants such as Nike and Adidas, I feel JD’s well-placed to capitalise on this opportunity and is worth a closer look.