Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The dollar is weakening this year. As reported, the US dollar index declined 7% year-to-date, one of its worst openings in recent history.

The dollar index measures the value of the dollar against six other major foreign currencies. As tensions between the US and several countries have increased on the trade front, worries regarding the long-term strength of the dollar are beginning to emerge.

Related Reading

Bitcoin Receives More Attention From Investors

As the dollar weakens, more investors are turning to Bitcoin as a potential hedge. Venture capitalist Tim Draper indicated that Bitcoin may serve as an insurance policy against the failure of fiat currencies.

He thinks the digital currency will keep appreciating in value relative to the US dollar, particularly as international confidence in fiat currencies falters.

In a comment he made on the X platform, he said Bitcoin “might be worth an infinite amount of USD.”

Bitcoin might be worth an infinite amount of USD.

During the Civil War, the south’s Confederate Dollar went through hyperinflation.

After starting 1:1 with USD, it ended the war at over 10 million to 1.

People lost faith and scrambled to trade their cash in for USD.

But now… pic.twitter.com/qRTEKl4VkU

— Tim Draper (@TimDraper) May 1, 2025

Draper likened Bitcoin’s present surge to a change in monetary behavior. He pointed out that during uncertain times, individuals will shift their funds towards the assets that make them feel more secure.

While gold has played that function previously, Draper stated that Bitcoin is starting to fill the position because of its digital format and convenience.

A Civil War-Era Analogy Raises Eyebrows

To illustrate his argument, Draper referred to American history. He cited the Confederate States of America, which had printed its own paper money during the Civil War in 1861.

Initially, it was pegged at a 1:1 ratio with the US dollar. But towards the end of the war, the Confederate dollar had disintegrated, exchanging at over 10 million to 1 compared to the US dollar.

Draper explained this illustrates how quickly a currency can disintegrate when trust is lost. He cautioned that something like that can happen again if individuals, businesses, and even governments lose faith in the stability of the current system. In his opinion, Bitcoin stands to gain from that change.

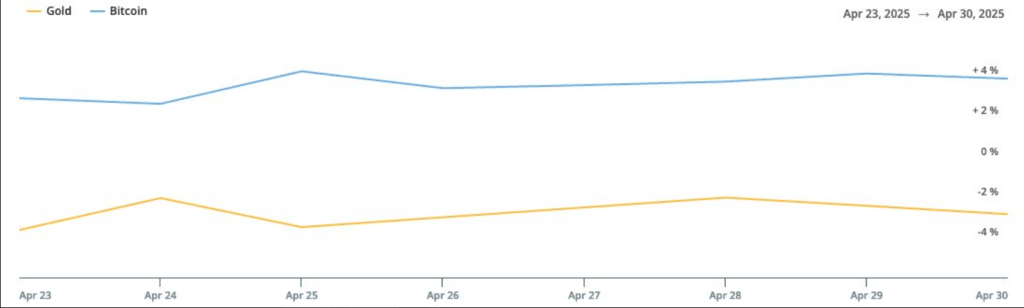

Bitcoin Versus Gold In A Changing Market

Gold will usually be the first safe haven when there are financial pressures, but Draper believes that it is no longer number one. He noted that gold has issues such as huge storage fees and physical movement. Bitcoin, however, is a purely online existence and can easily transfer quickly across borders.

Related Reading

He also stated that Bitcoin possesses special strengths—like limited supply and autonomy from central banks—that make it more attractive than conventional assets.

These characteristics, Draper explained, are becoming increasingly difficult to overlook as the global financial system comes under greater stress.

Governments Start To Take Notice

Draper claims that even some governments are seeking to find out if they should keep Bitcoin reserves. That marks a shifting sentiment towards how cryptocurrencies are perceived, not only among private investors but also public institutions.

Featured image from Unsplash, chart from TradingView