On-chain data shows the cryptocurrency market as a whole has witnessed capital inflows of nearly $19 billion while Bitcoin and others have gone through their recovery.

Crypto Market Has Enjoyed Net Capital Inflows Over The Past Month

In a new post on X, analyst Ali Martinez has talked about the latest trend in the capital inflows for cryptocurrencies. In the digital asset sector, capital mainly flows in and out through three asset classes: Bitcoin, Ethereum, and the stablecoins. The altcoins usually only see a secondary rotation of capital from these coins.

As such, the netflows related to the three of BTC, ETH and the stables can provide a sufficient-enough estimation for the situation of the entire cryptocurrency market.

For calculating the capital inflows/outflows related to Bitcoin and Ethereum, the “Realized Cap” indicator can be used. The Realized Cap is an on-chain capitalization model that finds the total value of any asset’s supply by assuming the value of each individual token as the same as its last transaction price. This is different from the usual Market Cap, which just sums up the supply at the current spot price.

In short, what the Realized Cap reflects is the amount of capital that the investors of the cryptocurrency as a whole have put into it. Changes related to the metric, therefore, reflect the inflow or outflow of capital.

In the case of the stablecoins, the change in the Market Cap is enough to gauge the capital netflow. This is down to the fact that the Realized Cap is no different from the Market Cap for them, as a result of their price never varying from the fiat currency that they are pegged to.

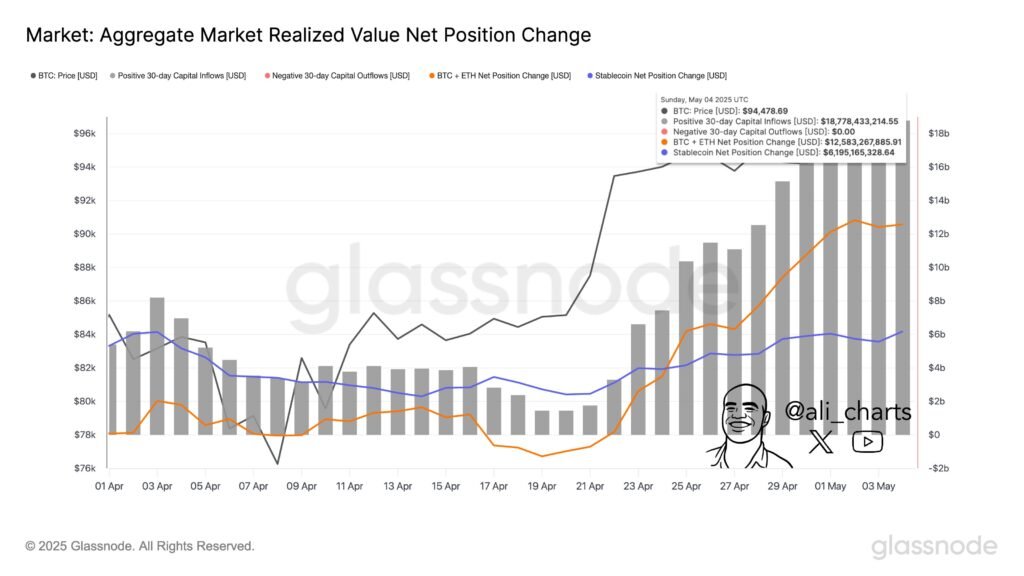

Now, here is the chart shared by the analyst that shows the trend in the 30-day aggregate cryptocurrency market netflow based on these indicators over the past month:

As displayed in the above graph, the combined 30-day Bitcoin and Ethereum Realized Cap change is currently at a positive $12.58 billion. This means that these two cryptocurrencies have enjoyed a notable net capital inflow during the past month.

Similarly, the stablecoins have seen a net inflow of $6.19 billion in the same period. Thus, it seems the digital asset sector as a whole has witnessed the incoming of $18.77 billion in capital.

While this trend has occurred, Bitcoin and the other assets have gone through their price recovery runs, so it’s possible that as long as these inflows keep up, the rallies could be sustainable.

It only remains to be seen how the investors will behave in the coming days, however, as it often doesn’t take much for sentiment to shift in the cryptocurrency sector.

Bitcoin Price

At the time of writing, Bitcoin is trading around $94,200, down 1% in the last seven days.