Is Bitcoin poised to hit $110,000? With $16B in leveraged shorts at risk of liquidation and strong institutional buying, BTCUSDT could surge to new all-time highs.

Earlier this week, Changpeng Zhao, the founder of Binance, urged retail investors to buy Bitcoin now, stating they’ve had 15 years to invest.

In an interview, Zhao predicted the coin could soar to $500,000 by year-end. Who knows? If momentum remains, by the end of next year, BTCUSDT might double from $500,000 to $1 million.

DISCOVER: Top 20 Crypto to Buy in May 2025

Short Squeeze to $110,000?

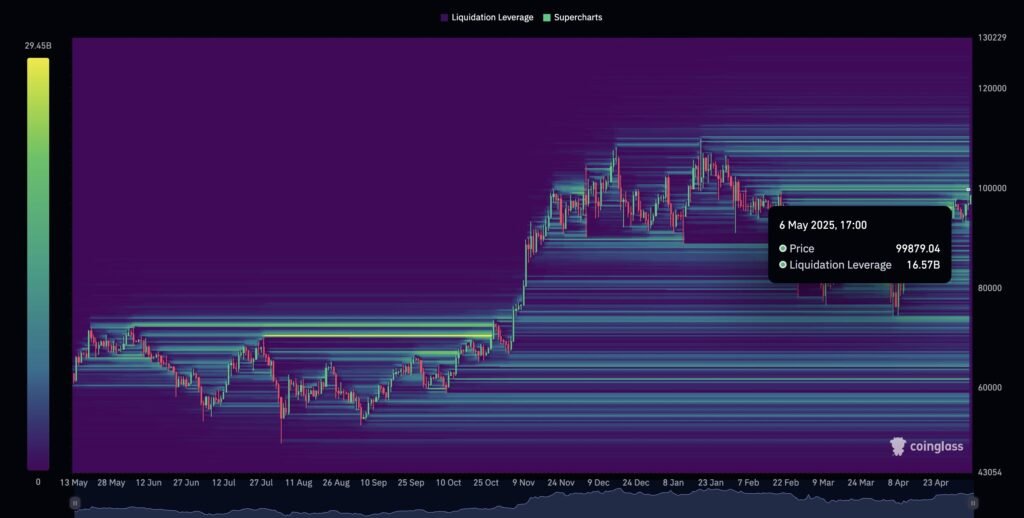

Exchange data suggests bulls are gearing up for this cycle. An analyst on X noted that $16 billion in leveraged shorts will be forcibly liquidated if Bitcoin closes above $99,900.

(Source)

That’s no small sum.

With bulls in control and Bitcoin surging, the anticipated short squeeze could push prices past $100,000 and, later, $110,000 in a continued bullish trend. In turn, some of the best meme coin ICOs in May 2025 could benefit.

This upward move may just be the start. In Q1 2025, prices crashed after hitting $110,000, dropping to $74,500 and retesting 2021 highs. If BTCUSDT retests $110,000, bulls could drive the coin to new all-time highs, a step toward $500,000.

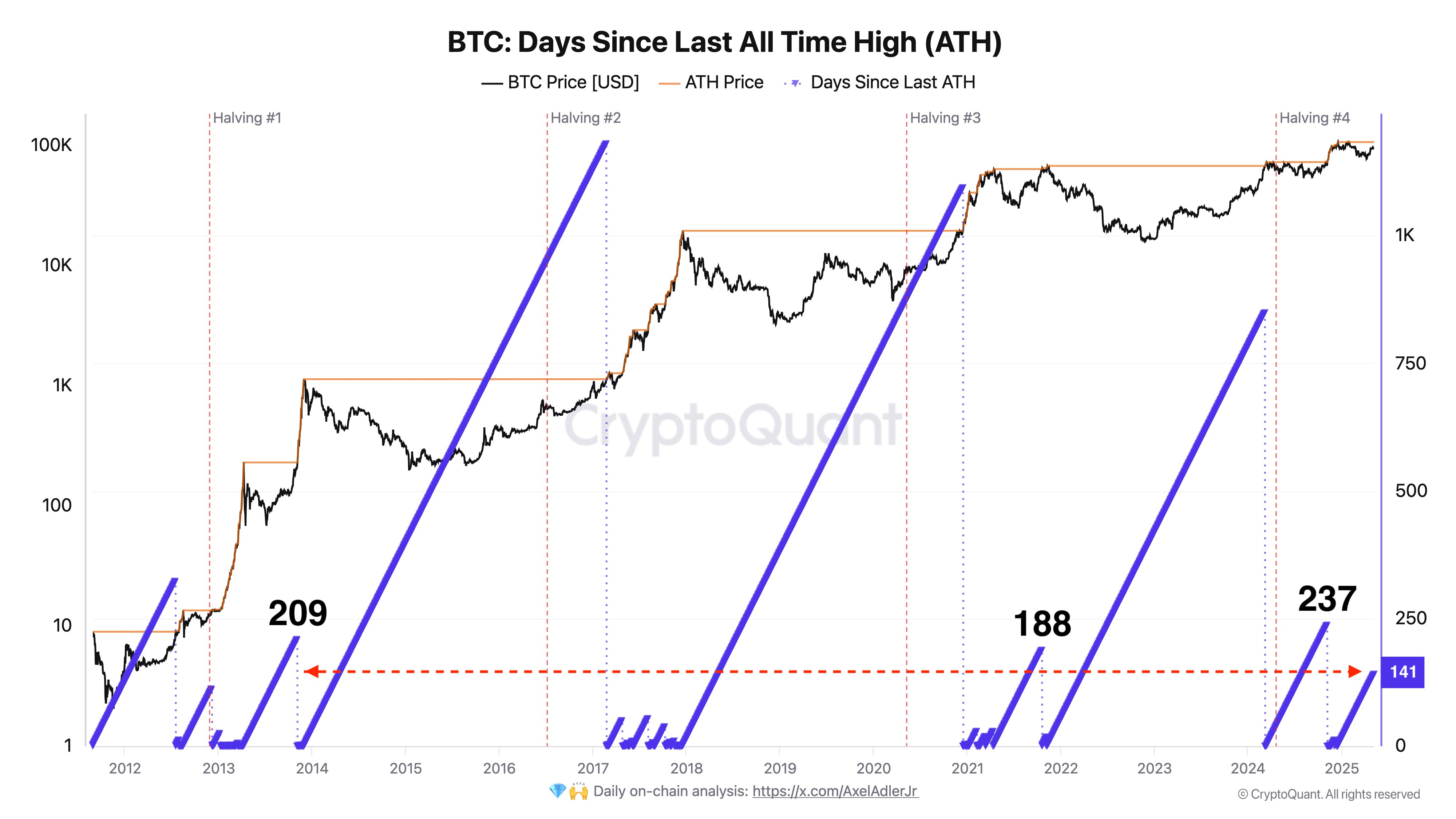

Historical data support this forecast. Bitcoin typically takes 211 days to reclaim a new all-time high after a previous peak.

(Source)

It’s been roughly 145 days since the last high in January, meaning Bitcoin could hit new highs within the next two months.

Bullish Case for Bitcoin

Some analysts expect BTCUSDT to break out sooner, pumping the best high-risk, high-reward cryptos.

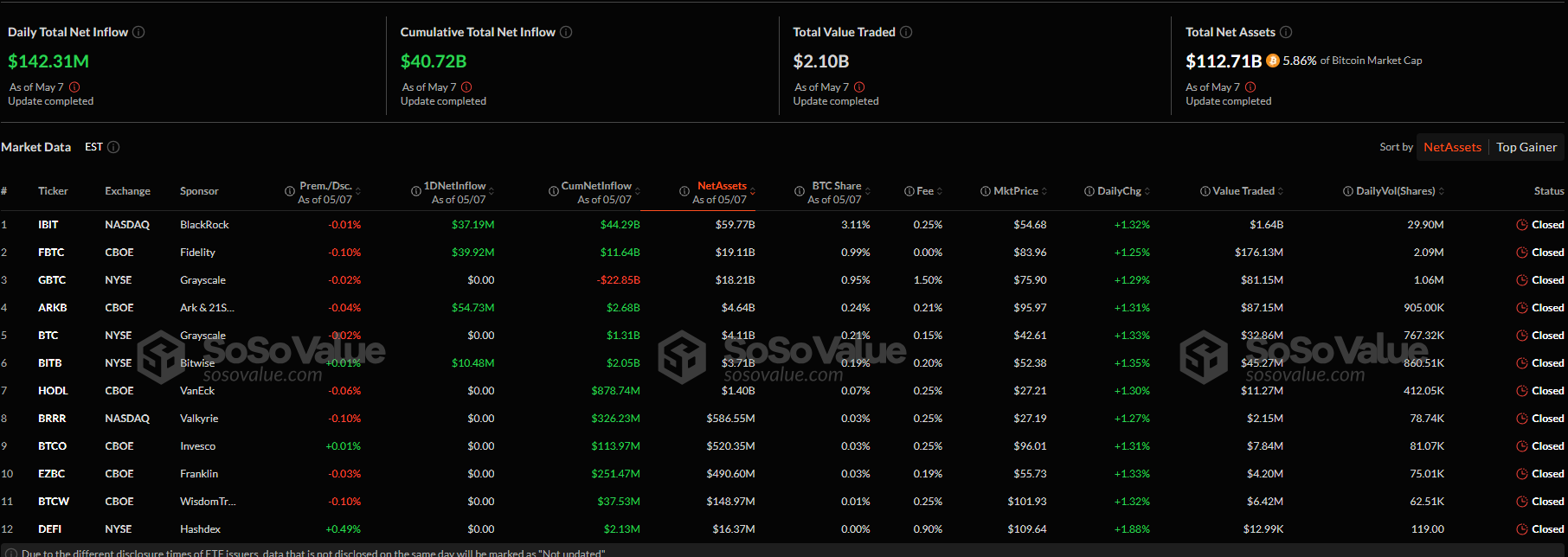

SosoValue data shows U.S. institutions purchased $142 million in spot Bitcoin ETFs, which are directly backed by BTC. Despite choppy price action, there were no outflows. Most institutions favored Fidelity’s FBTC spot Bitcoin ETFs.

(Source)

As reported by 99Bitcoins, BlackRock, a global asset management giant, increased its Bitcoin exposure. Meanwhile, more U.S. states and public firms are allocating billions to accumulate Bitcoin.

Although the Federal Reserve didn’t cut rates yesterday, economists expect a rate drop at the June 2025 meeting. President Donald Trump has urged Jerome Powell and the FOMC to lower rates, citing cooling inflation and reduced need for high borrowing costs.

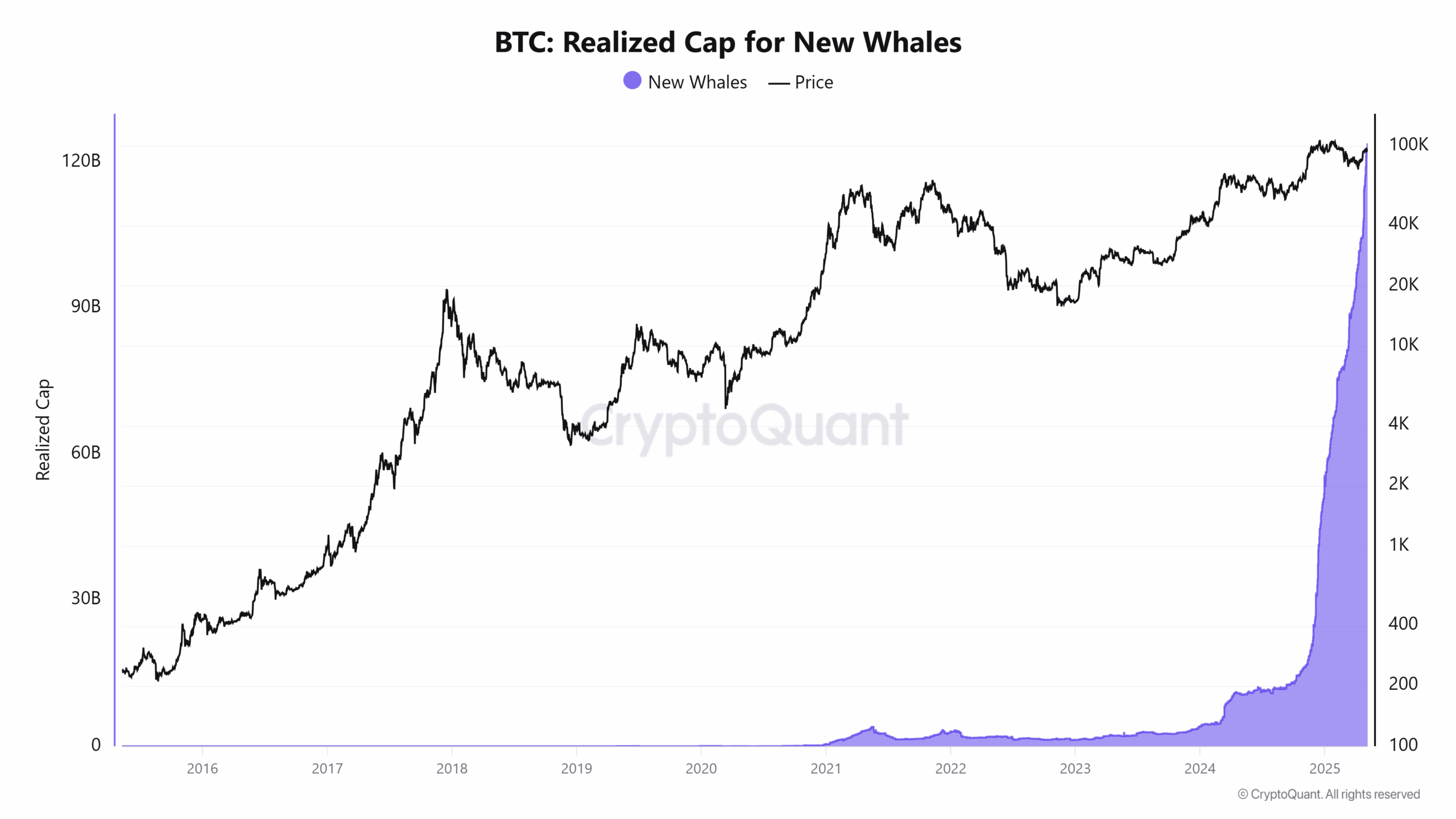

Onchain data further bolsters the bullish case. New whales are rapidly accumulating, holding more BTC than long-term holders for the first time.

According to CryptoQuant, the realized cap of new whales accounts for 52.4% of all whale-held coins. Their average entry price is $91,922, roughly three times that of older whales, who bought at $31,765.

(Source)

The growing dominance of new whales signals a massive capital inflow into Bitcoin.

DISCOVER: Next 1000x Crypto – 12 Coins That Could 1000x in 2025

Will Bitcoin Hit $110,000, $16B Shorts Face Liquidation

- Over $16 billion in leveraged shorts could be liquidated if BTC breaks $99,900

- U.S. institutions poured $142M into spot Bitcoin ETFs in 24 hours. BlackRock also buying

- New Bitcoin whales are dominant as new capital pours

- Will BTCUSDT print new all-time highs above $110,000?

The post Bitcoin to $110,000 Inevitable? Over $16B in Leveraged Shorts Set to Be Liquidated at $99,900 appeared first on 99Bitcoins.