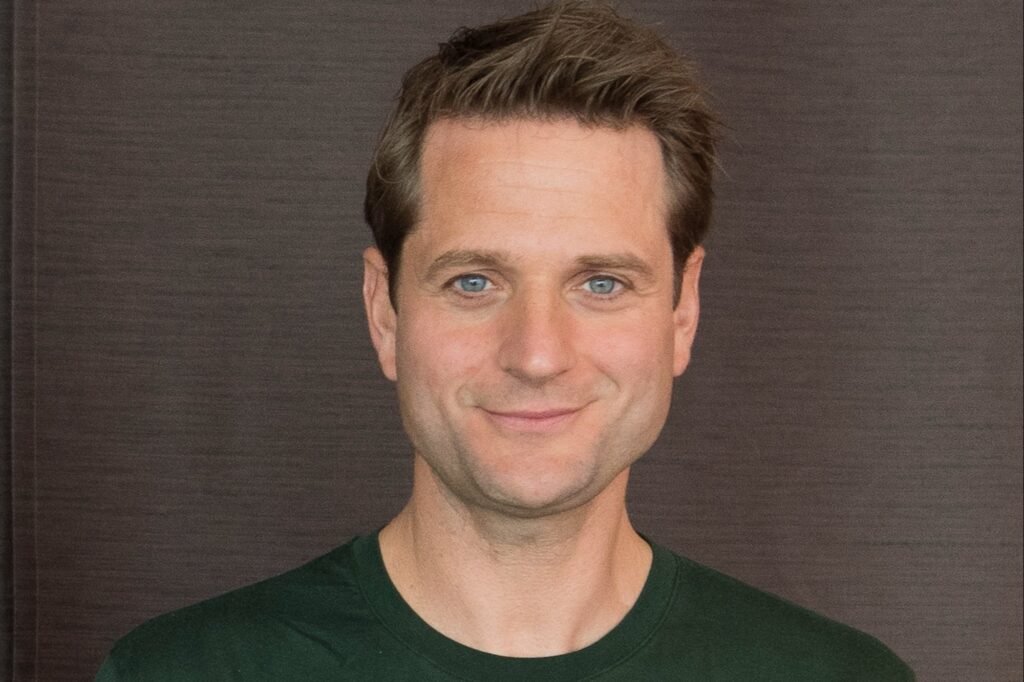

Was that Klarna CEO Sebastian Siemiatkowski on the screen or an AI clone?

When “buy now, pay later” fintech company Klarna reported its first-quarter financial results this week via video, it placed a realistic AI clone of Siemiatkowski, 43, front and center. The clone started the one-minute, 23-second presentation by admitting it was an “AI avatar, here to share Klarna’s Q1 2025 highlights.”

According to Klarna’s first quarter 2025 results, the company hit 100 million active consumers in the first quarter of 2025, a new record and the fastest growth in two years. Klarna also delivered its fourth profitable quarter in a row, achieving an adjusted operating profit of $3 million. Revenue rose 15% year-over-year to $701 million for Q1, with the U.S. driving 33% of that growth.

On the call, Siemiatkowski’s likeness voiced that AI was the reason behind the company’s growth. Klarna said that 96% of its roughly 3,000 employees use AI daily, resulting in a 152% increase in revenue per employee since the first quarter of 2023. The company is aiming to eventually reach $1 million in revenue per employee with the help of AI, up from $575,000 per worker last year.

“AI is helping us work smarter, scale faster, and deliver more value,” the AI clone stated.

Despite being upfront with the admission that it was an AI clone giving the results, Entrepreneur had a hard time telling the AI apart from Siemiatkowski.

Related: Duolingo Put Its Sarcastic Teen Chatbot to Work on Its Earnings Call

TechCrunch noted that the clone didn’t blink as much as a human would, and its voice didn’t sync up perfectly with its lip movements.

Siemiatkowski’s AI avatar said in the presentation that Klarna is using AI for marketing, product development, customer support, and insights.

“100 million consumers, profit, growth, and AI is the engine driving it all,” the avatar stated.

Klarna leads the U.S. market as the biggest “Pay in 4” loan company and was named Walmart’s exclusive installment loan provider in the U.S. in March. However, its net loss for the first three months of 2025 was $99 million, more than double the $47 million it reported at the same time last year.

The company first showcased an AI avatar of Siemiatkowski in December to talk about earnings for the third quarter of 2024. The voice of the AI avatar had a different accent, was more robotic, and the voice sync lagged more than the more recent version, but it was able to deliver the results in one minute and 22 seconds.

Klarna has worked for years to position itself as an AI-first company, cutting its workforce by 40% since 2022, and asking employees to use AI to fill in the gaps. In February 2024, the company announced a customer service AI that it claimed could do the work of 700 human customer service agents and handle questions in more than 35 languages.

Related: There Are New Rules for ‘Buy Now, Pay Later’ Programs — Here’s What to Know

According to Klarna’s first-quarter results, AI has had the most profound impact on Klarna’s customer service department. AI slashed costs by 40% while maintaining customer satisfaction rates, the company said.

However, AI alone is not enough to handle customer requests. Earlier this month, Siemiatkowski reversed an AI-induced hiring freeze to hire human workers again for customer service. He told Bloomberg that it was “so critical” to provide human support for customers if they needed it.

Klarna filed for a U.S. initial public offering in March but paused its plans a month later due to market volatility. The company is now planning to go public later this year.