In the early days of FinTech, speed to market was everything. Platform-as-a-Service (PaaS) models promised rapid deployment, simplified compliance, and

pre-integrated features. For many startups, this was a lifeline. But as these companies grow, especially in regulated or high-volume environments, they’re finding that the very infrastructure that helped them launch is now holding them back.

A quiet shift is happening: FinTechs are re-evaluating their dependency on third-party platforms and asking a foundational question: should we own the

core?

Why ‘Fast and Easy’ Isn’t Always Built to Last

PaaS solutions are attractive for good reasons. They reduce upfront costs, abstract away complex compliance burdens, and provide ready-made modules like

KYC, transaction processing, or card issuing. But there’s a price to pay for this convenience:

These aren’t just technical issues. They’re strategic bottlenecks. When your roadmap depends on someone else’s platform, agility and innovation suffer.

Licensing Over Subscription: A Shift in Mature Markets

At

SDK.finance, we’re seeing a clear trend among scaling FinTechs, EMIs, and even banks: a move away from SaaS and toward infrastructure ownership. Licensing the source code gives these companies the control they need to adapt, expand, and differentiate.

This trend is especially common among startups that have already launched but find themselves constrained by scalability limits or commercial terms. As

one such company told us:

“We launched quickly using a third-party platform, but now we’re hitting technical and commercial limits. We need to take back control and are actively looking for a source code-based solution that

we can evolve on our own terms.”

Over the years, we’ve seen this same scenario play out repeatedly. It’s no longer rare. It’s the norm for startups moving into their growth phase.

That’s Why SDK.finance Offers Both Options

To support businesses at different stages of their journey, SDK.finance provides two delivery models:

-

PaaS (Platform-as-a-Service): A subscription-based model designed for early-stage FinTechs and SMBs that prioritise time-to-market

and low upfront costs. Hosted in the cloud, it offers a fast start with 470+ API endpoints, a built-in back office, and essential integrations. -

Source Code License: A one-time purchase for full backend control. Ideal for enterprises or scaling FinTechs that need deep customisation,

data ownership, and architectural flexibility. This model gives clients complete access to the platform’s modular codebase, ledger engine, and API layer, without vendor lock-in.

Both models are powered by the same core: a robust, real-time ledger foundation, modular service architecture, and production-grade scalability of over

2,700 TPS. The difference lies in the degree of autonomy clients want to maintain.

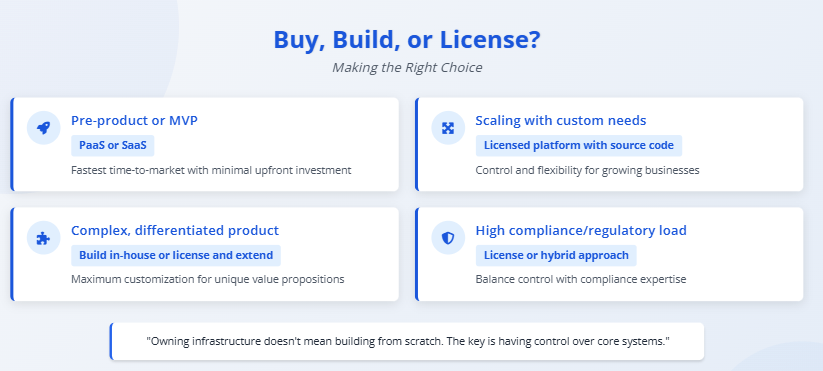

Buy, Build, or License? Making the Right Choice

Here’s a simplified framework we use when advising FinTech clients:

Owning infrastructure doesn’t mean building from scratch. The key is having control over core systems while integrating best-in-class external services

where it makes sense.

From Platform Tenants to Platform Owners

The FinTech boom of the last decade was built on abstraction and speed. But as the industry matures, priorities are shifting toward resilience, ownership,

and long-term scalability.

Infrastructure control isn’t a luxury. It’s a competitive advantage. For ambitious FinTechs, the critical question is no longer

how fast can we launch? It’s

how far can we grow with what we’ve built?

At SDK.finance, we’re here to support both answers.