Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is taking the lead in the crypto market as Bitcoin continues to consolidate near its all-time highs. After months of lagging behind BTC, ETH is now making a strong move, with bulls pushing price action toward the critical $2,800 resistance. This level, which has consistently capped upside momentum since early February, now stands as the key battleground for Ethereum’s next major leg.

Related Reading

Market sentiment has shifted as Ethereum shows signs of reclaiming dominance, driven by renewed spot demand and strengthening technicals. Top analyst Ted Pillows has weighed in on the rally, emphasizing the importance of the $2,850 mark. According to Pillows, this is the most significant resistance Ethereum has faced in this cycle, and breaking through it could unlock a powerful move toward $3,000 and beyond.

Momentum has been building steadily over the past few weeks, and ETH’s recent resilience against macroeconomic pressure is adding to the conviction. If bulls manage to flip this resistance into support, it could mark the beginning of a broader altcoin surge. For now, all eyes are on Ethereum as it flirts with a breakout that could reshape market dynamics heading into June.

Ethereum Eyes Expansion Phase Amid Shifting Global Dynamics

Ethereum is positioning itself for a potentially expansive move as both technical indicators and market sentiment continue to align in its favor. After weeks of consolidation and steady gains, ETH is now testing the $2,850 resistance—a level that has held price down since February. The setup suggests that Ethereum is not only regaining momentum but could also lead the next phase of the crypto rally.

While the crypto market gains traction, broader macroeconomic forces are reshaping investor behavior. A recent decision by the U.S. Federal court to strike down former President Trump’s tariffs on various countries has created fresh uncertainty across global markets. This policy reversal could introduce volatility in traditional finance, as trade dynamics shift and new fiscal responses take shape.

Despite this uncertainty, Ethereum appears to be thriving. There’s a view that crypto assets like ETH could perform well under tight economic conditions, and current price action supports that view. ETH is showing resilience, supported by growing spot demand, a bullish structure, and rising investor confidence.

Pillows highlighted in his latest analysis that if Ethereum reclaims the $2,850 level in the coming sessions, the path to $4,000 will open quickly. This would represent a major breakout and likely trigger a wave of capital rotation from Bitcoin and stablecoins into altcoins.

For now, ETH remains just below a breakout point. If bulls can push decisively above resistance, it would confirm the start of an expansionary move that could reshape the broader market, positioning Ethereum as a leading force in the next phase of the cycle.

Related Reading

ETH Reclaims Weekly Key Levels

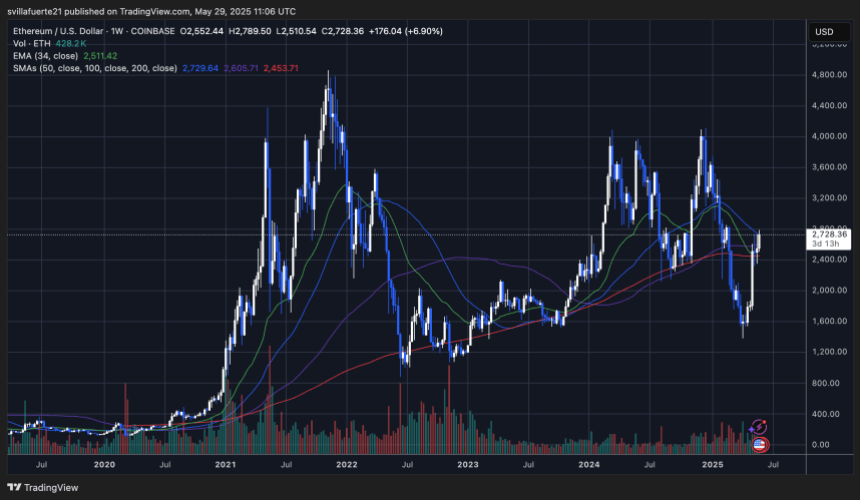

Ethereum is showing renewed strength on the weekly chart, currently trading at $2,728.36 after reaching a high of $2,789.50. This move marks a significant recovery from recent lows near $1,600 and confirms the formation of a strong uptrend. ETH has now reclaimed the 34-week EMA at $2,511.42 and is pushing above the 100-week SMA at $2,605.71. These moving averages now act as dynamic support levels, reinforcing bullish sentiment.

The next critical level to watch is the 50-week SMA, currently sitting at $2,729.64, just slightly above the current price. A confirmed weekly close above this level would mark the first time ETH has sustained strength above it since late 2023. That could open the door for a push toward the $3,200–$3,600 zone, with $4,000 in sight if momentum accelerates.

Volume has also picked up on this recent move, signaling healthy participation from buyers. Historically, similar recoveries from major moving average clusters have preceded expansive legs in Ethereum’s price.

Related Reading

As long as ETH maintains this structure and closes the week above $2,700, bulls are likely to retain control. The breakout above $2,850—last defended in early 2024—remains the final hurdle before Ethereum can challenge prior cycle highs.

Featured image from Dall-E, chart from TradingView