BlackRock’s iShares Bitcoin Trust (IBIT) is closing out May with a bang. The BlackRock Bitcoin ETF brought in over $6.2 billion this month alone, setting a new personal best. That’s not just a strong month, it’s the strongest since IBIT launched, and it didn’t launch that long ago.

Day After Day, Money Keeps Pouring In

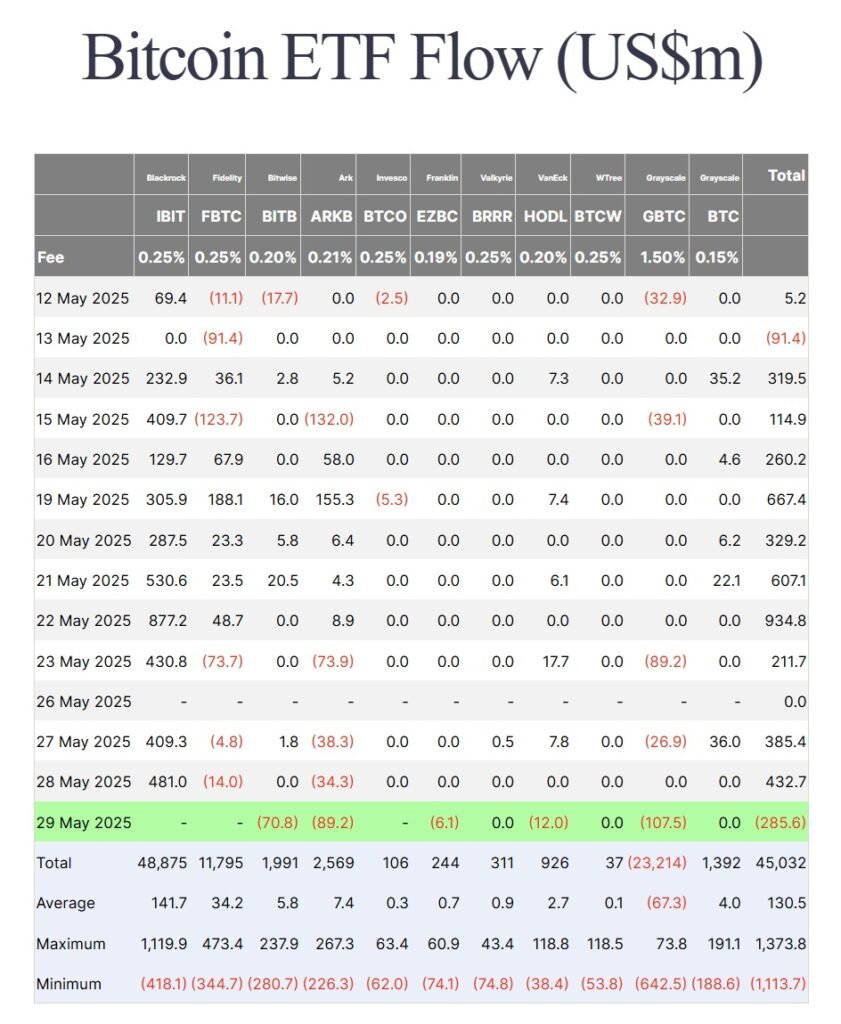

If you looked at IBIT’s inflows recently, you’d think someone left the faucet running. The fund saw net inflows on 30 out of 31 trading days in May. Just on May 28, it pulled in $481 million. That kind of consistency is rare in any investment space, especially one known for its volatility like crypto.

Since its debut in January 2024, IBIT has moved fast. It now holds more than $72 billion in assets, placing it among the top 25 largest ETFs in the world. To put that in perspective, the next youngest fund in that top group has been around for more than a decade. IBIT just passed its first birthday.

Why Is Everyone Jumping In?

Several things are working in IBIT’s favor right now. For one, institutional investors have finally warmed up to crypto in a big way. Funds, banks, and even traditional asset managers are starting to treat Bitcoin as a serious part of the financial ecosystem. It’s not just a curiosity anymore.

Another nearly *$500mil* into iShares Bitcoin ETF…

Starting to get ridiculous.

Inflows 30 of past 31 days.

Nearly $9.5bil in new $$$.

IBIT comfortably in top 5 ETFs by inflows this year (out of 4,200+ ETFs).

— Nate Geraci (@NateGeraci) May 29, 2025

Another factor is the current U.S. political climate. With clearer rules and a friendlier tone from regulators, the crypto space feels less like the Wild West. Investors are still cautious, but they’re not frozen with uncertainty like they were a couple of years ago.

And then there’s Bitcoin itself. The price recently hit an all-time high of over $112,000. That kind of momentum tends to attract attention, especially when more people can access it through vehicles like ETFs instead of going through crypto exchanges directly.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

IBIT Is Leading the Pack

There are multiple Bitcoin ETFs in the U.S. now, but BlackRock’s IBIT is running ahead of the crowd. During a recent 10-day streak, IBIT pulled in 96 percent of all new money flowing into spot Bitcoin ETFs. Altogether, the U.S. Bitcoin ETF market brought in more than $9 billion over the past five weeks. At the same time, gold funds saw over $2.8 billion in outflows.

It’s clear that some investors are trading in their gold for digital gold. That doesn’t mean everyone’s on board, but the trend is hard to miss.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Where Things Go From Here

IBIT’s massive growth is part of a bigger story. Crypto is becoming more integrated into mainstream finance, not just for tech-savvy traders but for everyday retirement accounts and institutions too.

Still, this is crypto we’re talking about. Things can change quickly. Prices swing. Regulations shift. Investors looking to jump in now should still do their homework and be ready for a bumpy ride.

For now, though, IBIT’s performance shows that Bitcoin is no longer standing outside the gates of traditional finance. With billions flowing into the BlackRock Bitcoin ETF, it’s clear that Bitcoin is being taken seriously on Wall Street. It’s pulling up a seat at the table, and apparently, it brought friends.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- BlackRock’s iShares Bitcoin Trust (IBIT) pulled in $6.2 billion in May, its highest monthly inflow since launch.

- The fund recorded inflows on 30 out of 31 trading days in May, signaling sustained investor confidence in Bitcoin exposure.

- IBIT now holds over $72 billion in assets, making it one of the 25 largest ETFs globally despite launching just last year.

- Institutional investors and favorable U.S. regulatory signals are contributing to IBIT’s rapid growth and appeal.

- During a recent 10-day stretch, IBIT accounted for 96 percent of all inflows into U.S. spot Bitcoin ETFs.

The post BlackRock’s Bitcoin ETF Breaks Records with $6.2B May Inflows appeared first on 99Bitcoins.