Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price slipped to $105,235 today, dropping 1.5% over the past 24 hours and falling 4.2% in the last week. Some market watchers see this dip as a pause before a major move. According to their charts, Bitcoin could be gearing up for another steep gain.

Related Reading

Historical Patterns Point To Rebound

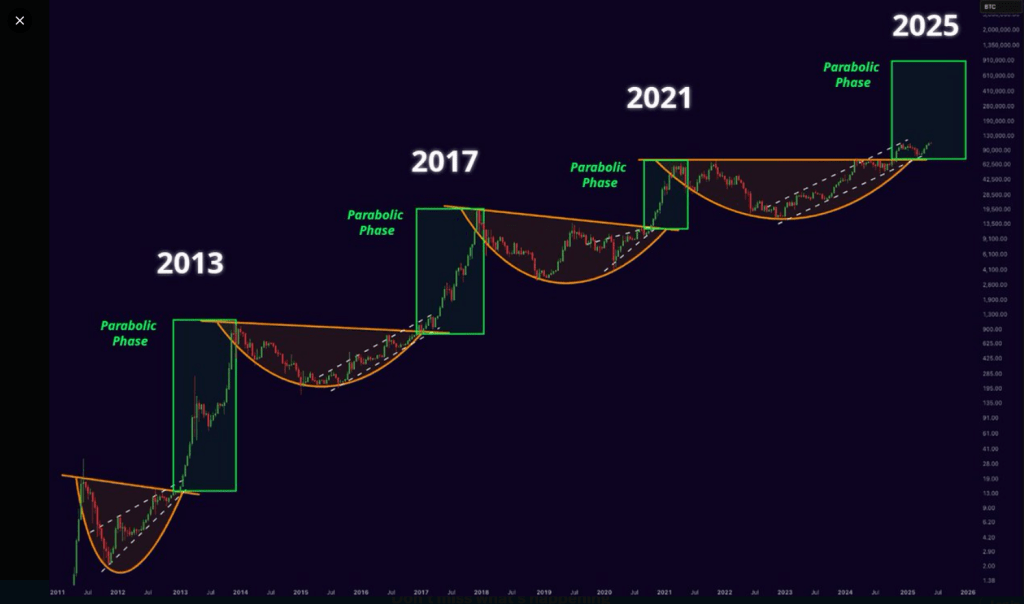

Based on reports from the analyst known as “Mister Crypto,” rounded-bottom formations and ascending triangles have marked every big Bitcoin rally. In 2013, when Bitcoin was trading under $10, it spent months in a smooth, curved base before breaking out and climbing past $1,000.

A similar pattern showed up in 2017. After nearly three years of sideways action, the price finally exploded toward $20,000. The last cycle in 2021 also followed the same playbook, with almost four years of building a wide base before shooting up to nearly $70,000.

Bitcoin will go parabolic.

This time won’t be different! pic.twitter.com/0fEMMMclbD

— Mister Crypto (@misterrcrypto) May 29, 2025

Mister Crypto’s chart suggests that the period after 2021 has formed another base. If history plays out the same way, his forecast points to a breakout in 2025 that could send Bitcoin as high as $900,000—a 760% rise from today’s level.

Analyst Charts Re-Accumulation

According to charts shared by another analyst, Bitcoin often moves in stages. First, there’s an initial “leg up” that signals the shift from deep accumulation into a growing bull trend. Then, the price settles into a sideways “re-accumulation” phase before the final run.

From 2019 through 2021, Bitcoin followed this path closely. Analysts note that from late 2023 into mid-2025, Bitcoin looks to be in that same re-accumulation phase. If this unfolds as in past cycles, the next big upswing could push Bitcoin into the $270,000–$350,000 range before any parabolic spike comes into view.

Long-Term Holders Keep Adding Coins

On-chain data shows long-term holders (addresses that haven’t moved their coins in over 155 days) are still piling on. Between March 3 and May 25, 2025, these holders increased their overall supply by nearly 1.40 million BTC.

That pushed long-term holdings from 14,354,000 BTC to 15,739,400 BTC. In previous bull markets—like those in 2013, 2017, and 2021—long-term holders often sold during the rallies to lock in profit.

Related Reading

Today, though, they seem content to hold. If large pockets of Bitcoin remain off exchanges, fewer coins are available for new buyers. That could tighten supply and make sharp moves more likely once demand picks up.

Looking Ahead In Uncertain Market

Bitcoin has lost momentum recently, but many analysts feel these dips won’t last. At $105K region, the price sits below last week’s levels.

Based on reports, some see that as healthy consolidation before a bigger run. Others warn that global interest rates, regulation, and macro factors could slow things down.

Featured image from Pexels, chart from TradingView