Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tom Lee, Fundstrat’s head of research, says Bitcoin could climb to $250,000 by the end of 2025. According to an interview on CNBC’s Squawk Box today, Lee pointed out that Bitcoin recently dipped from its all-time high of $111,970 down to about $104,000. He still thinks that the market is holding up around that level.

Related Reading

Lee’s Short-Term Outlook

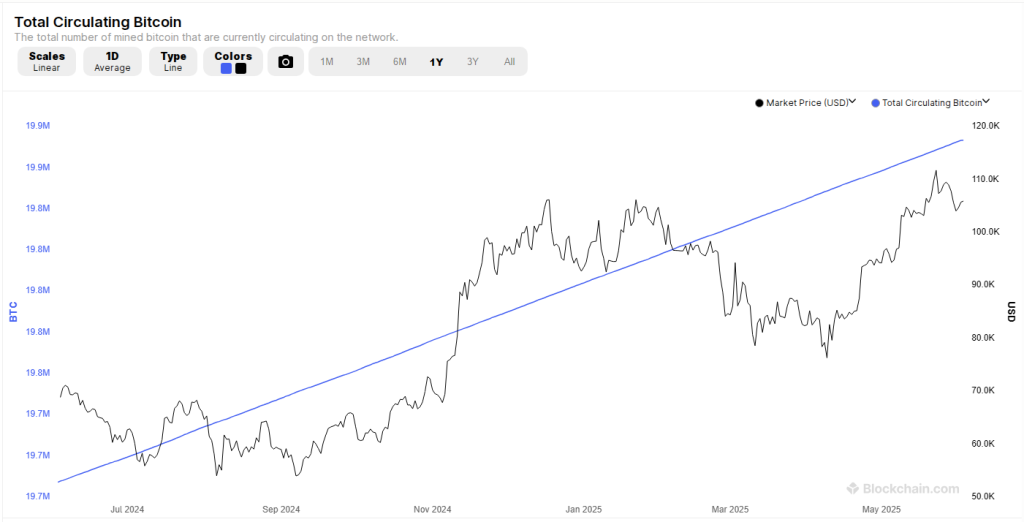

Lee told Squawk Box’s host Joe Kernen that 95% of all Bitcoin—about 19.80 million coins—has already been mined out of a maximum of 21 million. That leaves roughly 1.13 million coins waiting to be produced. He sees that as a tight supply setup.

He also noted that while nearly all Bitcoin exists, 95% of the global population does not own any. Based on reports, that gap between supply and potential buyers could push prices higher in the months ahead.

To reach $250,000 from around $104,000 now, Bitcoin would need to jump about 140%. Lee still believes it can hit $150,000 by December and could even stretch toward $200,000 to $250,000 if demand heats up.

Supply And Demand Gap

Lee highlighted the fact that most people in the world have not bought any Bitcoin. He said this creates an imbalance. On one side you have a nearly fixed supply. On the other, there may be millions of new buyers in the next 10 years. He explained that if even a fraction of those people decide to buy Bitcoin, the price could move a lot higher.

Right now, only about 5% of all coins remain to be mined. That means new supply is slowing down fast. At the same time, more wallets, apps, and easy ways to buy could bring in fresh money. Lee thinks this mismatch is a big part of why Bitcoin could keep climbing.

Long-Term Valuation Targets

When asked about Bitcoin’s terminal value—meaning its price when all coins are mined by 2140—Lee said he expects it to match gold’s roughly $23 trillion market cap. That works out to at least $1.15 million per Bitcoin if there are 20 million coins in circulation.

He chose 20 million instead of 21 million because assumed losses (lost keys, forgotten wallets) mean not every coin will ever be spent. Lee went further, saying he sees room for Bitcoin to hit $2 million or $3 million per coin. That would put his average “bull case” at $2.5 million, which is roughly a 2,300% rise from today’s levels.

Related Reading

Other Analyst Projections

VanEck’s head of digital asset research, Matthew Sigel, also has a long-range prediction. Based on what Sigel told investors, VanEck sees Bitcoin hitting $3 million by 2050. That forecast lines up with Lee’s idea of Bitcoin matching or even beating gold over time. Both calls assume steady growth in demand, plus wider use by big institutions like hedge funds or pension plans.

Featured image from Gemini, chart from TradingView