Image source: Getty Images

The best time to buy shares is when other investors are looking elsewhere. And it’s fair to say that uncertainty around US trade policy has caused a shift in the stock market.

Since the start of the year, the FTSE 100 is up 6% while the S&P 500 is roughly where it was at the start of January. So does that mean it’s time for investors to look at buying US shares?

The S&P 500 doesn’t look cheap

The MSCI US Index has underperformed the MSCI World Index since the start of the year. But the S&P 500 as a whole posted earnings growth of around 18% in the fourth quarter of 2024.

That’s very impressive and higher earnings do make valuations more attractive. However, in the grand scheme of things, the difference is fairly marginal.

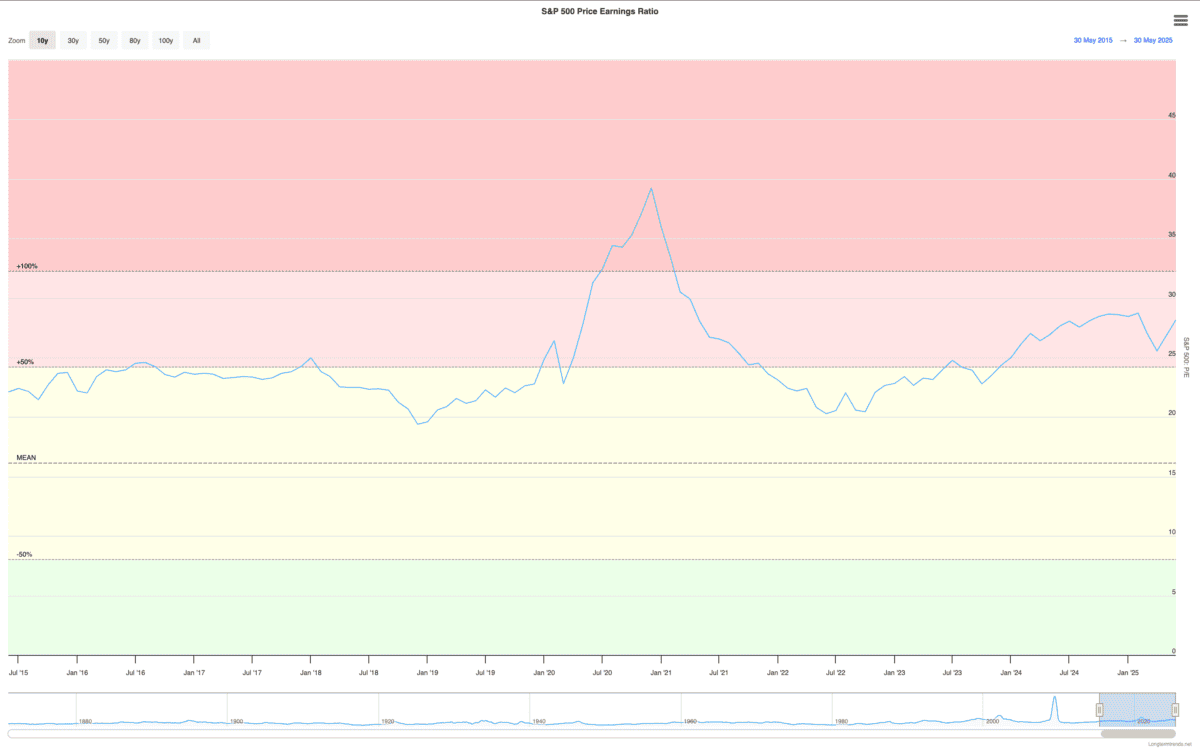

The current price-to-earnings (P/E) ratio of the S&P 500 is towards the higher end of where it has been over the last 10 years. And history tells us that returns from these levels are typically underwhelming.

Of course, the future doesn’t always resemble the past. But I think there are opportunities in individual stocks that look much more attractive.

Not all stocks are same

The S&P 500 is in positive territory since the start of the year, but not every stock has performed the same. So far, one of the worst-performing sectors in 2025 has been energy.

Overall, energy shares are down around 3.5% and some individual stocks have fared much worse. But this is the kind of shift that I think can generate opportunities for investors.

A sector falling out of favour with the stock market can give investors a chance to buy the best shares at unusually good prices. Right now, I think ConocoPhillips (NYSE:COP) might be a good example.

The stock is down almost 14% since the start of the year, but the company’s long-term advantages remain intact. And it has ambitious plans for shareholder returns.

A potential energy opportunity

In 2024, ConocoPhillips generated just over $8.25bn in free cash and it has ambitious plans to grow this by $6bn between now and 2029. If it can do this, the current share price looks very cheap.

The firm’s stated target involves the company generating almost 15% of its current market value in free cash each year from 2029. But a lot depends on what happens to oil prices in the next few years.

This is the biggest risk with ConocoPhillips shares. Its future ambitions are based on an average oil price of $70 per barrel and it’s worth noting the price of WTI crude is currently 10% below this.

Investors therefore shouldn’t count their chickens prematurely. But with a significant amount of untapped inventory available at less than $40 per barrel, there could still be good returns on the way.

Greedy when others are fearful

US stocks as a whole don’t look like an obvious buying opportunity to me at the moment. But it’s a different story with the out-of-fashion energy sector and ConocoPhillips is a good example.

The firm is currently set to return almost 100% of its market value to shareholders over the next 10 years. And with ambitious growth plans ahead, I think it’s worth considering at today’s prices.