RESOLV is steady, up 84% from all-time lows. The launch of the USR stablecoin is timely, following the Senate’s passing of the GENIUS Act. If the bill becomes law, DeFi projects could surge.

Resolv is capturing crypto media attention as of June 12, and for good reasons.

While its native token, RESOLV, is up 84% from June 10 lows, the project launched its core product, an algorithmic stablecoin, at an opportune time.

This timely launch could propel RESOLV prices even higher in the coming sessions, given positive regulations and rising demand for stablecoins.

The question remains: Is the current RESOLV dip an opportunity for smart investors to buy the token at a discount? Is RESOLV poised for a mega rally in the coming days and weeks?

DISCOVER: 20+ Next Crypto to Explode in 2025

RESOLV Holds Firm After Strong Start

Although the coin dipped slightly, like most altcoins, including some of the best cryptos to buy like Cardano and Solana, the uptrend set in motion by the June 10 bar remains intact.

RESOLV prices are still within the bull bar of June 10, and notably, the current dip is with light volume.

Technically, this is bullish, and traders could find entry points on dips above the June 11 lows at around $0.28. On the upper end, a close above $0.42 with rising trading volume could propel RESOLV to new all-time highs.

The lift-off stems from Resolv’s value proposition and its innovative offerings to the crypto and financial community.

Behind the token is a project launching a yield-bearing, risk-neutral, USD-tracking stablecoin designed for DeFi.

It features an automated, public, and on-chain dispute resolution mechanism, along with a liquidity-enhancing protocol.

Will the Rally Continue?

The listing on Binance Alpha boosted demand and prices once the token began trading on June 10.

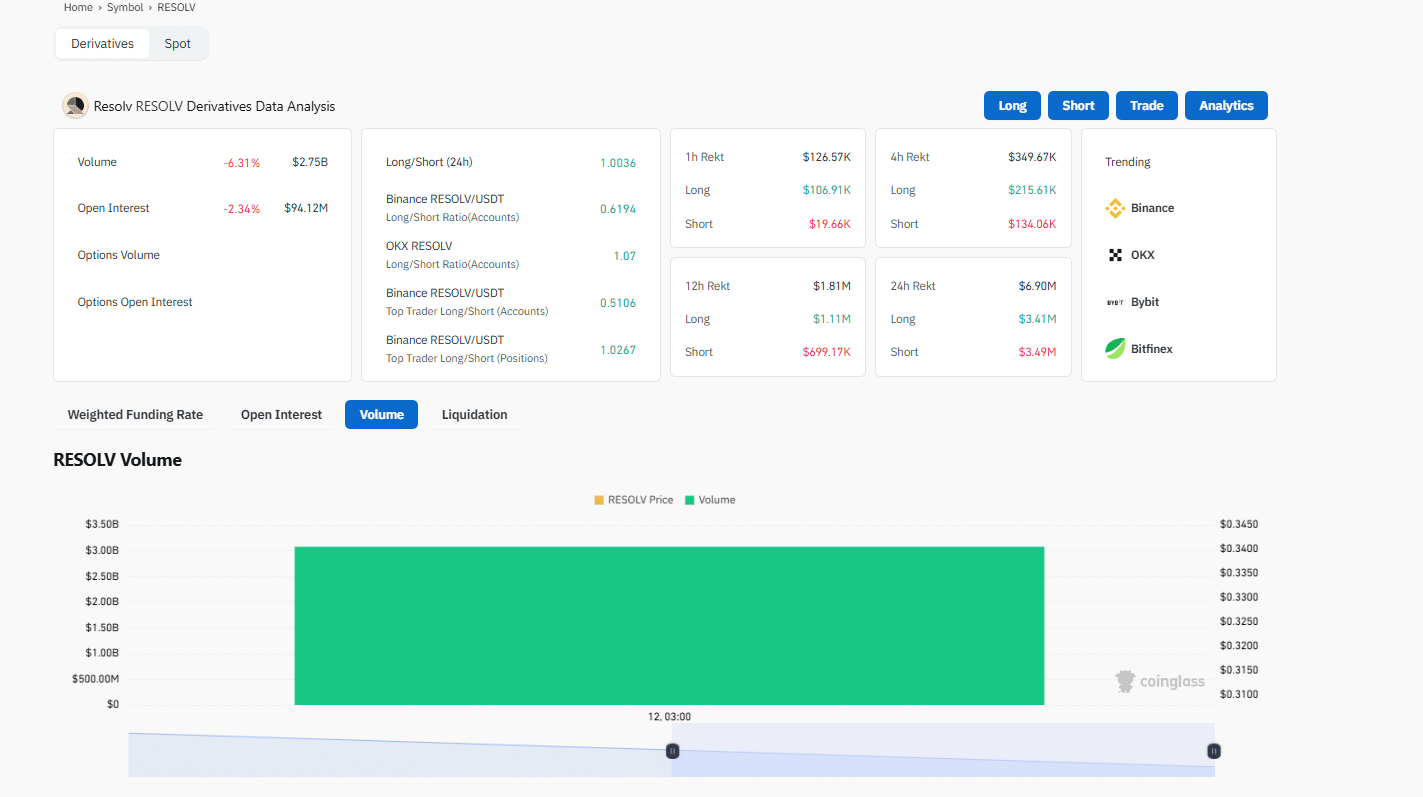

As of June 12, derivatives trading volume exceeded $3 billion.

(Source)

Meanwhile, open interest stood at $94 million, down 3%. Most of RESOLV’s open interest is on Binance, but demand is high on other exchanges, including Bitget and Hyperliquid.

Momentum is also building up.

As of June 11, over 1 million RESOLV tokens had been distributed to stakers, with another 1 million set aside for distribution in the next two weeks. Currently, stakers receive a 69% APR yield.

Staking highlights after first 14 days of staking:

• 1,000,000 $RESOLV are already distributed to stRESOLV holders

• Another 1,000,000 $RESOLV is allocated for the next 14 days

• Higher staking multiplier after claiming and restaking rewards

• Current APR is ~69% pic.twitter.com/I4UOllrqLs

— Resolv Foundation (@ResolvCore) June 11, 2025

However, the biggest driver for RESOLV and DeFi is the passage of the GENIUS Act in the U.S. Senate.

After a 68-30 vote, the Senate advanced the GENIUS Act following over four weeks of debate. Majority Leader John Thune urged Congress to support the bill.

Endorsing the bill aligns with President Donald Trump’s vision of making the United States a hub for crypto activity, boosting even some of the best meme coin ICOs.

If Congress approves the GENIUS Act and it becomes law, it could mainstream crypto, benefiting DeFi projects like Resolv.

Although the Act provides a federal regulatory framework for stablecoins in the U.S., it classifies yield-generating stablecoins like USR as securities subject to SEC regulation.

The GENIUS ACT basically corrals stablecoins into the banking world – **no interest payouts, only licensed banks & buddies can issue them, and your favorite decentralized stablecoin might be outlawed**. TL;DR: It’s a *stablecoin crackdown* that protects incumbents and could… pic.twitter.com/3p2cWyR8Mh

— Richard Heart (@RichardHeartWin) May 16, 2025

Consequently, for USR to be accessible in the U.S., Resolv must obtain licensing from the strict regulator, which limits flexibility in DeFi integrations and increases costs.

DISCOVER: 9 Best Crypto Presales to Invest in June 2025 – Top Token Presales

RESOLV Crypto Rally Getting Started? Senate Passes GENIUS Act

- RESOLV price trending higher, up 84% from June 10 lows

- USR stablecoin is yield-bearing

- Resolv’s launch timely

- United States Senate passes GENIUS Act

2025

The post Is Resolv Rally Just Getting Started? US Senate Approves GENIUS Act appeared first on 99Bitcoins.