Image source: Getty Images.

Cathie Wood’s ARK Innovation ETF (NYSEMKT:ARKK) rose to prominence during the pandemic bull market of 2020 to 2021. At the time, disruptive growth stocks were on fire and this exchange-traded fund (ETF) benefitted in a big way, delivering huge returns for investors. Can I buy the product for my Stocks and Shares ISA or SIPP today? Let’s take a look.

The UK version of ARK

There is a version of this ETF that’s available to UK investors today. Launched on the London Stock Exchange (LSE) in April last year, it’s called the ARK Innovation UCITS ETF (LSE: ARCK) and it’s available on my investment platform, Hargreaves Lansdown, and a few other platforms.

Like the original US-listed product, the ETF seeks to invest in companies involved in ‘disruptive innovation’ (defined as companies introducing technologically-enabled new products or services that potentially change the way the world works). Areas of focus include artificial intelligence (AI), robotics, energy storage, multiomic sequencing, and public blockchains.

For the UK-listed ETF, expenses are 0.75% a year (relatively high for an ETF). Investors may also need to pay trading fees and platform charges.

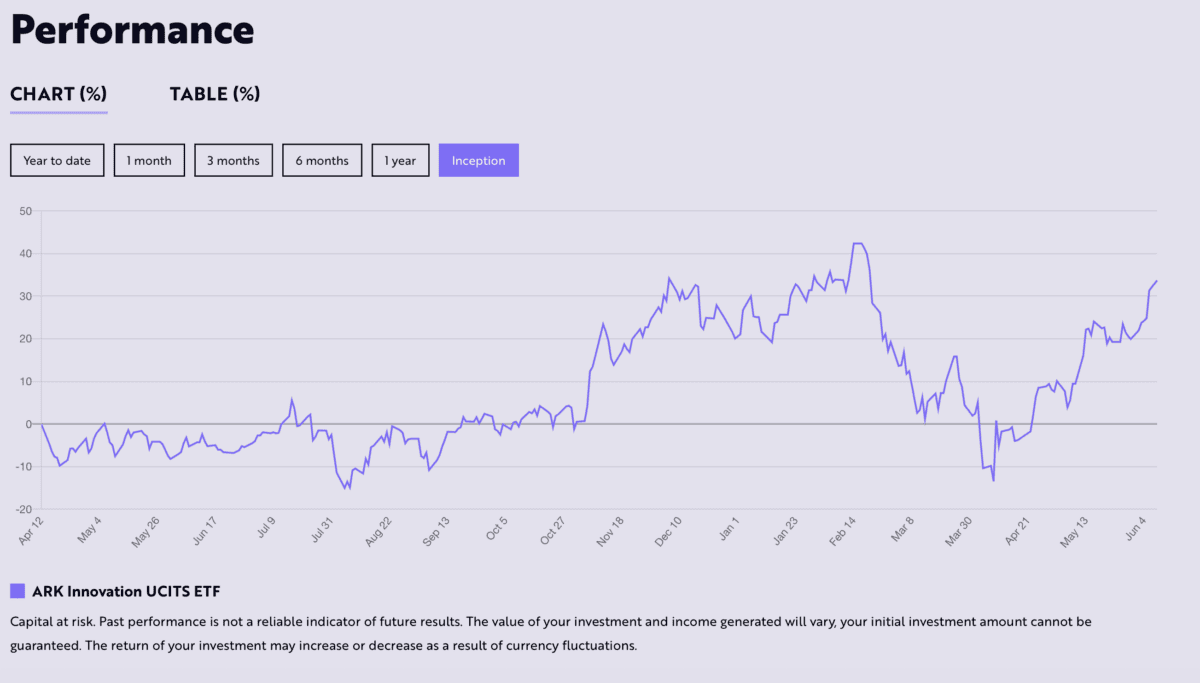

In terms of performance, it has been strong since launch. In the 14 months or so that the ETF has been listed on the LSE, its value has increased about 30%.

Should I invest?

So, the ETF is available to UK investors like myself. The question is – should I invest?

I do like the concept of an innovation ETF. Today, the world is experiencing an incredible technology revolution and I want to be capitalising on it.

With this ETF, I potentially can. I like the fact that it provides exposure to themes such as AI, robotics, and fintech – these are all industries with huge growth potential.

Looking at the holdings, however, the ETF looks quite risky to me. Currently, Tesla is about 9% of the portfolio. I’m not so keen on that stock (I think it’s way overvalued at current prices). Other top holdings include Roblox, Roku, and Palantir – three stocks I see as high risk and quite speculative.

One other thing that concerns me a little is long-term performance. Over the last five years, the US-listed version of the ARK Innovation ETF has fallen about 9%. That compares to a gain of over 20% for the UK-listed Scottish Mortgage Investment Trust, which has a similar focus (and a lower ongoing fee).

I’ll point out that I already have a decent-sized position in Scottish Mortgage in my portfolio. So, buying the ARK Innovation ETF as well would mean doubling up on my exposure to higher-risk disruptive growth stocks.

My thoughts on ARK

Given the current holdings and underwhelming five-year performance, I’m going to keep the ARK Innovation ETF on my watchlist for now. I may add it to my portfolio at some stage in the future but in the near term, I’m going to stick with Scottish Mortgage as my play on disruptive growth stocks.