Image source: Getty Images

When deciding which FTSE 100 shares I plan to buy, I think it’s a good idea to consider what major hedge funds are doing.

These professional investment firms often take large and sometimes aggressive positions in stocks, including betting against stocks they expect to fall in price (known as short selling).

They may pack tonnes of experience, but just like any humble retail investor, these mighty funds don’t always make the right calls. And in the case of one of these Footsie companies, I think they may be mistaken. But which do I think are worth considering today?

Kingfisher

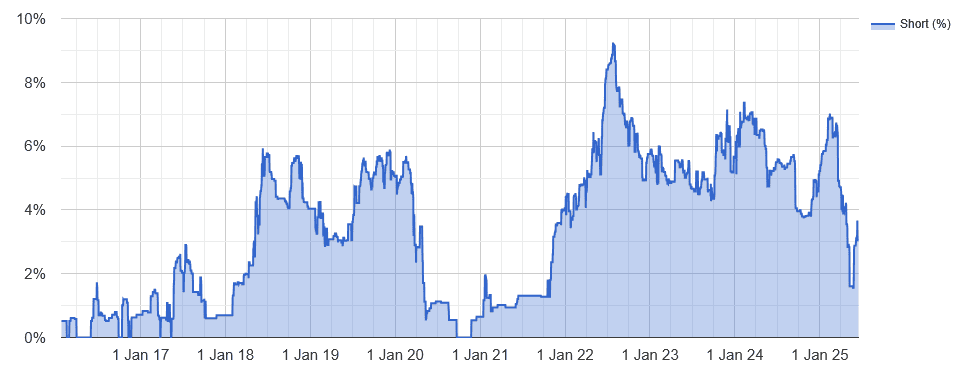

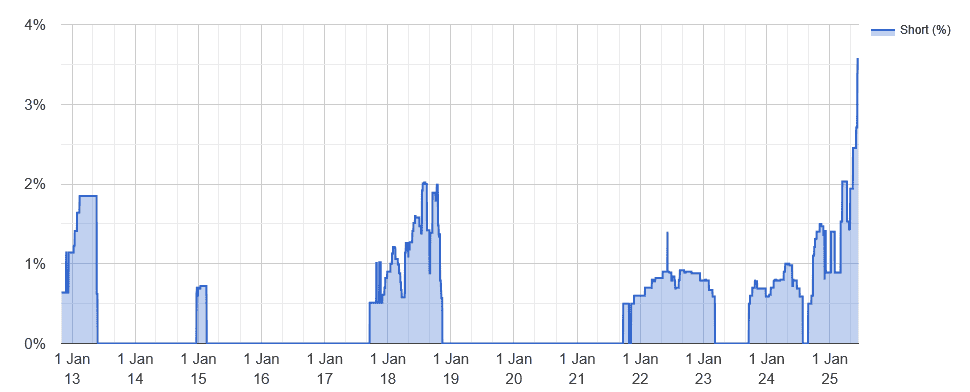

According to shorttracker.co.uk, Kingfisher‘s (LSE:KGF) the third-most shorted stock on the FTSE today. Some 3.1% of its shares are shorted, placing it only behind Sainsbury’s and WPP (LSE:WPP).

In total, three different hedge funds have taken a bearish position out on the retailer.

It’s no surprise to me that these institutional investors are so gloomy. Kingfisher’s been in the mire for years, pressured by weak consumer spending, increasing competition, and stress in the UK housing market. Rising labour costs and supply chain issues haven’t helped matters either.

Could the B&Q owner be about to turn the corner though? Better-than-expected first quarter financials give cause for some optimism –sales rose 2.2% in the three months to April, bucking predictions of a painful drop.

But while its UK operation has perked up, its French and Polish markets remain bogged down (sales dropped 3.2% and 1.1% in the first quarter). There’s also scepticism over whether Kingfisher can keep the pace up at home as the cost-of-living crisis endures.

Given the huge risks it poses, I think this is a share investors may want to consider avoiding.

WPP

As mentioned, WPP’s also one of the FTSE 100’s most shorted stocks right now. With short interest at 3.4%, and five funds having taken out a related position, these institutions are actually more bearish on the marketing giant than Kingfisher.

Yet if I was given a choice, this is the blue-chip I think investors should look at for their portfolios. The truth is that at current prices, I think it’s worth serious consideration by those seeking a recovery stock.

WPP’s had a pretty miserable time of late, as ongoing economic uncertainty has seen businesses trim their advertising budgets. In the three months to March, like-for-like revenues at the firm dropped 2.7% year on year.

I wouldn’t be shocked if conditions remain tough in the near term. Escalating trade disputes between the US and its major trading partners remain a significant threat. But looking further out, the business has enormous growth potential as it doubles down on digital advertising and leverages the power of artificial intelligence (AI). It’s spending hundreds of millions of pounds in this area — on platforms, tools and staff — to drive growth here.

Today, WPP shares trade on a forward price-to-earnings (P/E) ratio of 6.8 times. This is comfortably below the 10-year average of 10.7, and could provide the platform for a price rebound when market conditions improve. With global interest rates falling, this may come sooner than the market possible expects.