Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has weathered a wave of volatility in recent days, triggered by the escalating conflict between Israel and Iran. As geopolitical tensions rise and global markets grapple with uncertainty, risk assets like BTC have faced increased pressure. Yet despite this turbulent backdrop, Bitcoin has managed to maintain its footing above key support levels, demonstrating notable resilience.

Related Reading

Currently trading just under its all-time high, Bitcoin is in a consolidation phase that many analysts view as the calm before a potential breakout. Top analyst Rekt Capital shared insights indicating that the final major Weekly resistance, which has previously capped price rallies, may now be weakening as a point of rejection. If confirmed, this shift could signal a critical turning point in the market structure and open the door to price discovery.

Investors are watching closely as BTC holds strong while macro headwinds—including rising US Treasury yields and fears of energy disruptions—continue to swirl. With the broader market bracing for further developments in the Middle East, Bitcoin’s ability to maintain higher lows and approach resistance with momentum suggests that the bulls may soon reclaim full control. The coming days could prove pivotal for the next phase of BTC’s market cycle.

Bitcoin Awaits Clarity As Middle East Tensions Shape Market Sentiment

The conflict between Israel and Iran continues to dominate headlines and exert influence over global markets. As tensions escalate, investors remain cautious, closely monitoring geopolitical developments and their macroeconomic ripple effects. In this uncertain environment, Bitcoin has entered a consolidation phase, with neither bulls nor bears fully in control.

The lack of a clear direction stems from diverging investor expectations. Optimistic market participants anticipate that a diplomatic resolution may be reached in the coming days or weeks. A peace deal could reduce market anxiety, drive oil prices lower, and reignite momentum across risk assets—Bitcoin included. On the other hand, more cautious investors fear that the situation could worsen. Prolonged conflict may spark volatility in the energy sector, push inflation higher, and strain economic stability, particularly in regions dependent on oil imports.

This week may prove decisive for Bitcoin’s next major move. Price action remains tightly bound, but all eyes are on the long-standing Weekly resistance. According to Rekt Capital, the final major Weekly resistance—once a strong rejection point—now appears to be weakening. This shift in structure suggests that Bitcoin may be preparing for a breakout into price discovery territory, should macro conditions stabilize.

Related Reading

BTC Price Holds Above Key Support Amid Consolidation

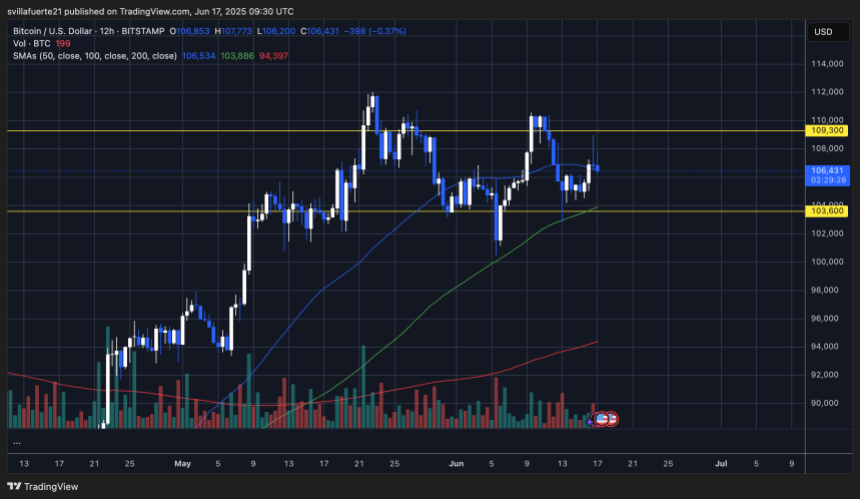

The 12-hour chart for Bitcoin shows that BTC continues to trade within a tight range, holding above the critical $103,600 support while struggling to break cleanly through the $109,300 resistance. This zone has repeatedly acted as a ceiling for price action since early May, with sellers stepping in around $109K and buyers defending dips near $104K.

The recent bounce from just above the $103,600 level reflects ongoing buyer interest at that range, reinforced by the 100-day SMA (green), which is providing dynamic support. Meanwhile, the 50-day SMA (blue) is curling slightly upward, showing early signs of positive momentum, although the price has yet to clearly reclaim and hold above it.

Volume remains moderate, indicating a lack of strong conviction on either side. For bulls to regain full control, BTC must push through the $109,300 resistance with sustained volume and hold that breakout level. A failure to do so may result in another rejection and a potential retest of the lower boundary near $103,600.

Featured image from Dall-E, chart from TradingView