Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

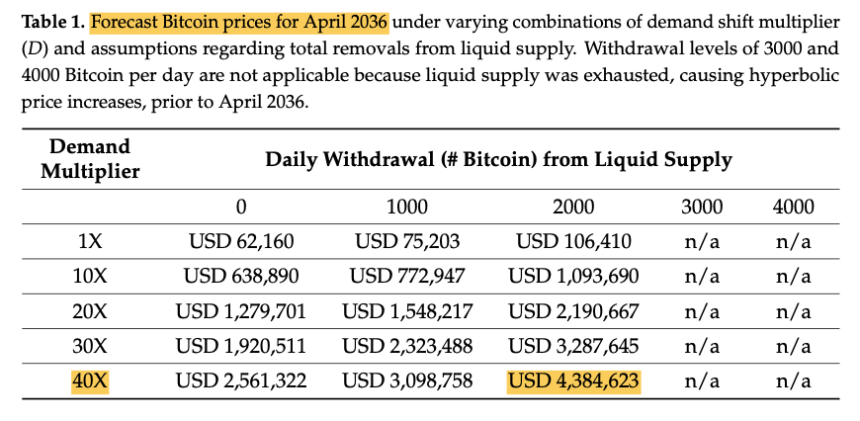

In a striking forecast, two academic researchers, Murray Rudd and Dennis Porter, have predicted that Bitcoin (BTC) could soar to an astonishing $4.3 million by 2036 if institutional buying trends continue.

This prediction was highlighted by market expert Giovanni Incasa, who emphasized the significance of applying rigorous supply-demand theories to Bitcoin’s unique economic structure.

Supply Shock Warning

Rudd and Porter have employed pure mathematical modeling to analyze Bitcoin’s market dynamics, warning that the impending supply shock could lead to price fluctuations ten times more severe than anything seen to date.

Their findings suggest that the effects of this supply shock will result in permanent wealth redistribution, fundamentally altering the landscape of digital assets.

Related Reading

According to their conservative estimates, the Bitcoin price could reach $2.2 million per coin by 2036, a projection rooted in what they describe as “economic physics.”

The researchers note that the current liquid supply of Bitcoin stands at only 11.2 million coins, with an estimated 4 million Bitcoin lost forever due to lost keys and Satoshi Nakamoto’s unspent stash.

Their analysis reveals that only half of BTC’s total supply is actively liquid, meaning that even modest institutional purchases could lead to significant supply shortages.

Evidence of this trend can be seen in the daily buying habits of US exchange-traded funds (ETFs), which have averaged 285 Bitcoin per day since their launch, and the actions of Bitcoin treasury companies that are removing thousands of coins from circulation through debt financing.

Senator Cynthia Lummis has also proposed a strategic reserve of one million Bitcoin, which would involve an acquisition of approximately 550 coins per day over five years.

The researchers calculate that if 2,000 Bitcoin are removed from circulation daily, the price could reach $106,000—a figure that is already close to today’s trading price of $104,800, suggesting that their mathematical framework is holding true.

The crux of the researchers’ findings is that traditional supply curves are not applicable to BTC. Its perfectly inelastic supply creates significant bottlenecks as demand rises, leading to dramatic price increases. They emphasize that institutions that delay their investments risk becoming permanently priced out of the market.

Three Scenarios For Bitcoin

Rudd and Porter outline three potential scenarios for Bitcoin’s future. In a conservative scenario, with a 20-fold increase in demand and continued institutional adoption leading to 2,000 daily Bitcoin withdrawals, prices could reach $2.2 million by 2036.

Their bullish scenario posits a 30-fold demand growth, where Bitcoin could hit $5 million by early 2031. The most extreme, hyperbolic scenario anticipates a 40-fold demand increase, with daily withdrawals escalating to 4,000 Bitcoin, potentially driving prices to $4.3 million by 2036 and valuing Bitcoin at six times the current market cap of gold.

Related Reading

The implications of Rudd and Porter’s research extend beyond mere speculation. It highlights a transformative period for BTC and the broader financial landscape, where strategic positioning and early adoption could mean the difference between thriving and merely surviving in the digital economy.

Featured image from DALL-E, chart from TradingView.com