Image source: Getty Images

A Stocks and Shares ISA is one of the best tools available to UK investors. And while the data from HMRC comes with a bit of a lag, the number of ISA millionaires seems to keep going up.

There’s a £20,000 contribution limit per year. But even for someone starting from scratch at 30, I think it’s more than possible to build a portfolio worth £1m by retirement.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Returns

Investing £20,000 per year involves putting aside £1,666 each month from a salary. That won’t be realistic for everyone, but the chance to earn tax-free returns is one worth taking seriously.

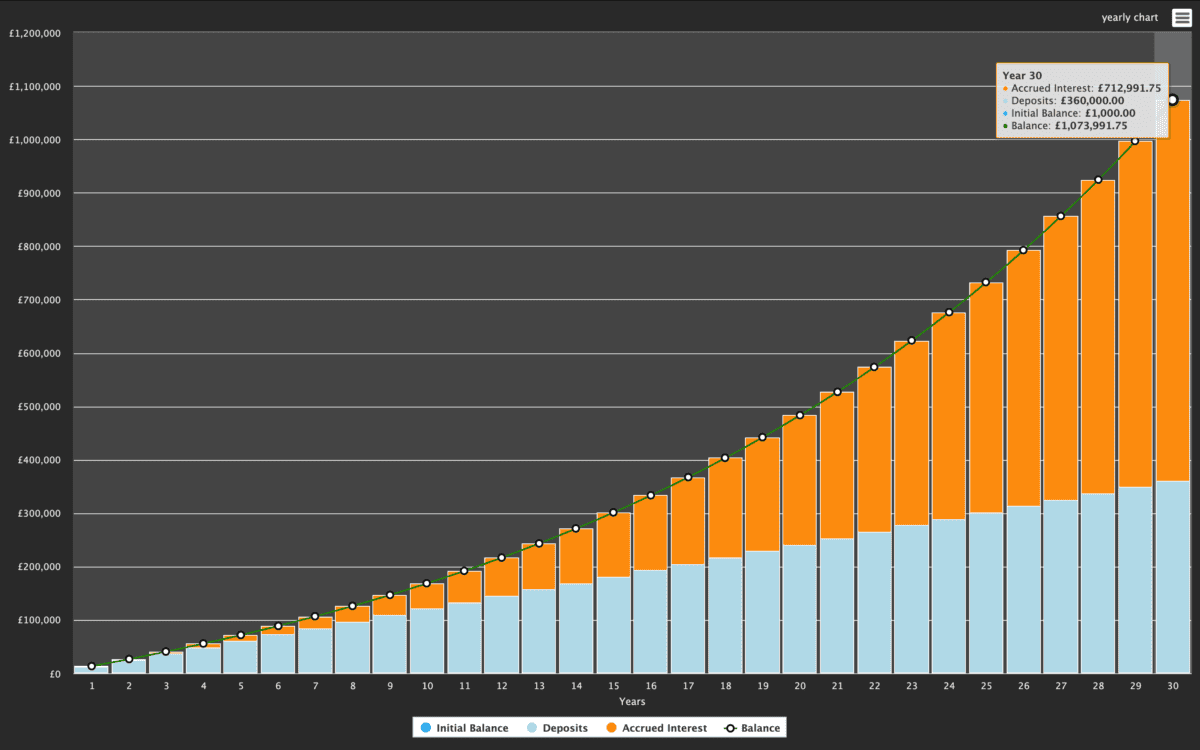

Even with £1,000 per month, reaching a million within 30 years involves earning an average annual rate of 6.5% (with any dividends reinvested). And I think that could be highly achievable.

Source: The Calculator Site

The average return from the FTSE 100 over the last 20 years is 6.8% per year – above the required rate. And for the first decade, investors starting at 30 have another big advantage.

Until the age of 39, a Lifetime ISA gives investors a 25% boost on up to £4,000 of deposits. That means a potential £1,000 per year, which is already an 8% return on a £12,000 annual investment.

Even with this, earning more than 6.5% per year isn’t guaranteed – investments can go down as well as up. But it’s a big part of why I think that return is very realistic over the long term.

After 10 years of earning 8% per year, the required rate for the remaining 20 years falls to just 6%. And the long-term record of the stock market makes me optimistic on this front.

Where to invest?

The risk of losing money in the stock market is very real. But one of the best ways for investors to try and minimise this possibility is by focusing on high-quality companies.

I think FTSE 100 company Informa (LSE:INF) is a good example. The stock is down since the start of the year and one reason is a potential challenge to the firm’s academic publishing arm.

The US is threatening to cut federal funding to academia by 44% from 2026. There’s a risk that could reduce demand for publishing services and it’s an important one to consider.

Publishing, however, isn’t Informa’s biggest division. Most of the firm’s sales come from its B2B Live Events division – and this part of the business is actually growing strongly.

The latest trading update reported year-over-year sales growth of 8.3%. And these are hugely profitable events for the company with relatively low working capital requirements.

Investors might not be familiar with Informa. But strong growth, attractive economics, and a powerful competitive position mean I think it’s worth considering for the long term.

Sounds easy…

There’s no easy way to turn £1,000 per month into £1m. But by following some relatively simple rules, investors can give themselves the best chance over the long term.

One of these is maximising returns by using a Stocks and Shares ISA (and a Lifetime ISA). These might not seem like big things, but the results can add up over time.