Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

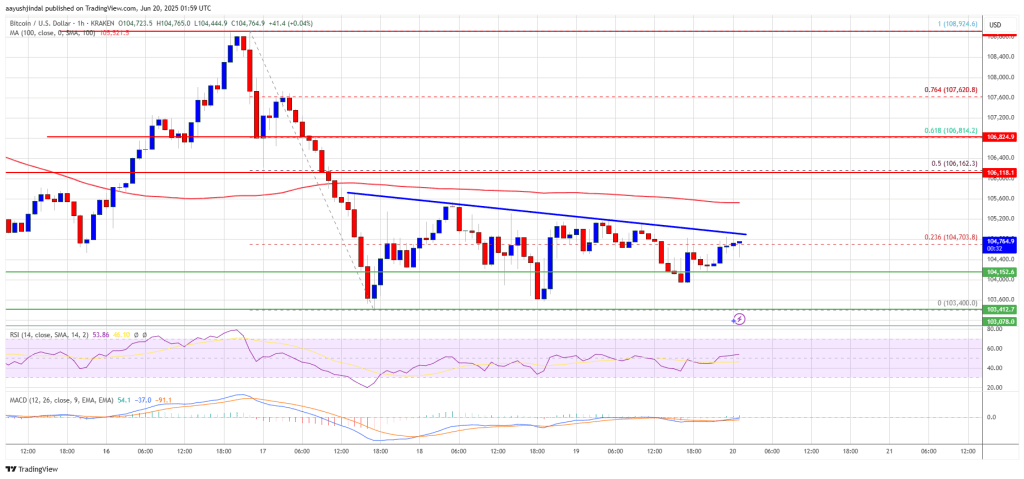

Bitcoin price started a fresh decline below the $106,000 zone. BTC is now consolidating and might soon aim for a fresh increase above the $105,500 zone.

- Bitcoin started a fresh decline below the $106,000 zone.

- The price is trading below $105,500 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $104,850 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh increase if it stays above the $103,500 zone.

Bitcoin Price Faces Resistance

Bitcoin price started a fresh decline below the $107,500 zone. BTC gained pace and dipped below the $106,200 and $106,000 levels.

There was a clear move below the $105,000 support level. Finally, the price tested the $103,500 zone. A low was formed at $103,400 and the price started a consolidation phase. It climbed above the 23.6% Fib retracement level of the downward move from the $108,925 swing high to the $103,400 low.

However, the bears were active below the $105,000 zone. Bitcoin is now trading below $105,000 and the 100 hourly Simple moving average. There is also a key bearish trend line forming with resistance at $104,850 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $105,000 level. The first key resistance is near the $105,500 level. The next key resistance could be $106,150. It is near the 50% Fib retracement level of the downward move from the $108,925 swing high to the $103,400 low.

A close above the $106,150 resistance might send the price further higher. In the stated case, the price could rise and test the $108,000 resistance level. Any more gains might send the price toward the $108,800 level.

Another Drop In BTC?

If Bitcoin fails to rise above the $105,000 resistance zone, it could start another decline. Immediate support is near the $104,150 level. The first major support is near the $103,500 level.

The next support is now near the $102,500 zone. Any more losses might send the price toward the $101,200 support in the near term. The main support sits at $100,000, below which BTC might gain bearish momentum.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $104,150, followed by $103,500.

Major Resistance Levels – $105,000 and $106,200.