Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is currently hovering in a tightly compressed price range after failing multiple times to break above $110,000 earlier this month. The past few days have been characterized by the leading cryptocurrency trading around $105,000, with neither bulls nor bears taking control. Despite the overall consolidation, a subtle yet significant signal is starting to flash beneath the surface, particularly on the 4-hour chart, that might send Bitcoin to a new all-time high soon.

Return Of Rare Divergence Pattern On Bitcoin’s 4H Chart

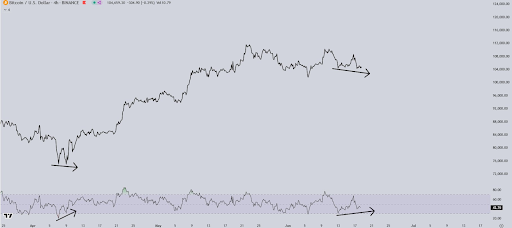

Crypto analyst Luca (@CrypticTrades_) took to social media platform X to share a chart that highlights an important technical development on Bitcoin’s 4-hour timeframe: the return of a bullish divergence. This signal, which previously appeared in early April, preceded the massive rally that catapulted Bitcoin to its May 22 all-time high of $111,800. The same divergence is forming once again and another Bitcoin price breakout may be very close.

Related Reading

As shown in the 4-hour candlestick timeframe chart below, the divergence is clearly illustrated between price action and the Relative Strength Index (RSI). Price has been forming lower lows, while the RSI has been printing higher lows. This mismatch serves as an early indicator that selling momentum is fading, and a reversal to the upside could follow. The previous instance of this pattern directly preceded a sharp move from a $74,000 low in early April to above $111,000 in just a few weeks.

What Does This Divergence Mean For Bitcoin’s Price?

Bullish divergences on mid-timeframe charts like the 4-hour have a reputation for being the first reversal signals when supported by rising volume. In Bitcoin’s current case, the appearance of this pattern again could mean that the recent retracement from $111,800 has run its course. With RSI now trending upward even as price presses slightly lower, Bitcoin may be witnessing another hidden accumulation phase before its next leg higher.

Related Reading

If the pattern holds true to its previous performance in April, the leading cryptocurrency could be setting up for another push toward new all-time high levels. Bitcoin is currently not far off from a new all-time high, as it is only about 5.5% away from its price peak. Based on this, another strong breakout could easily aim beyond the previous $111,800 high.

Although Bitcoin’s price is relatively stagnant for now, the presence of this bullish divergence is a reminder of how quickly things can change. The previous bullish divergence ended up with a 50% price surge. A similar performance from the current price level would translate to another target above $160,000.

At the time of writing, Bitcoin is trading at $105,700, up by 1.4% in the past 24 hours, already showing signs of the bullish divergence signal coming into action.

Featured image from Getty Images, chart from Tradingview.com