Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

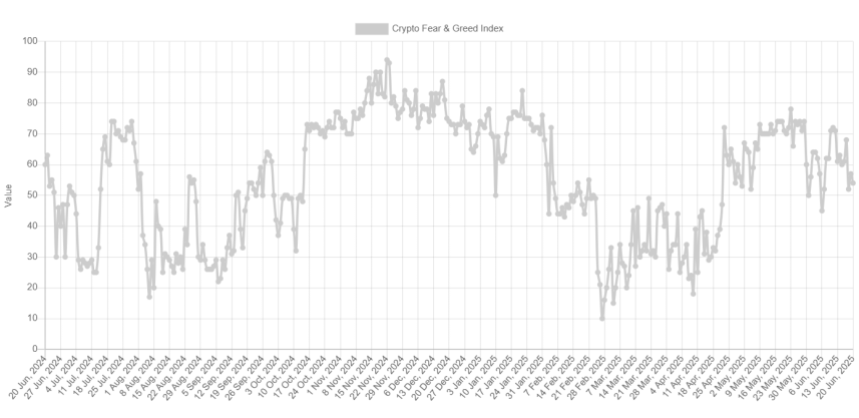

Data shows the Bitcoin Fear & Greed Index has returned back to the neutral territory, a sign that investors are losing optimism.

Bitcoin Fear & Greed Index Has Reset Back To Neutral

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment present among the traders in the Bitcoin and wider cryptocurrency markets.

Related Reading

The index makes use of the data of these five factors in order to determine the trader mentality: trading volume, market cap dominance, volatility, social media sentiment, and Google Trends.

The indicator represents the calculated sentiment as a score lying between zero and hundred. Values above the 54 mark correspond to the dominance of greed in the market, while those below 46 to presence of fear among the investors. All values lying between these cutoffs correlate to a net neutral sentiment.

Now, here is how the mood in the Bitcoin market is like right now according to the Fear & Greed Index:

As is visible above, the Bitcoin Fear & Greed Index has a value of 54 at the moment, which suggests the investors hold a neutral sentiment, although one that’s right on the edge of turning into greed.

The recent neutral mentality in the sector has come following a phase of greed among the traders, as the below chart shows.

As displayed in the graph, the Bitcoin Fear & Greed Index spiked to a high of 72 earlier in the month as the asset’s price gave investors hope that its consolidation phase might be coming to an end.

As the recovery rally has fizzled out and the coin has returned to its range, however, optimism among the investors has predictably faded. If history is to go by, though, this development may not actually be so bad for the cryptocurrency.

Generally, digital asset markets tend to move in a way that goes contrary to the expectations of the majority. The probability of such an opposite move taking place goes up the more extreme the crowd opinion becomes.

Besides the three core sentiments, there are two special regions known as the extreme fear (under 25) and extreme greed (above 75). These zones are where the likelihood of a contrary move has been the strongest in the past, with tops and bottoms often taking form.

Although the market sentiment has recently only seen a reset to the neutral territory, the fact that the investors are no longer greedy could still be a positive for Bitcoin and other cryptocurrencies. There have been many instances in the past where a dip into the neutral zone was enough for the bull run to regain momentum.

Related Reading

It only remains to be seen, though, how the prices of BTC and others would develop in the coming days.

BTC Price

At the time of writing, Bitcoin is floating around the $102,800 mark, down more than 2% in the last seven days.

Featured image from Dall-E, Alternative.me, chart from TradingView.com