What will be Iran’s response to the US bombing? President Donald Trump just attacked and bombed Iran’s Fordow, Natanz, and Isfahan nuclear sites and then called for peace. He just declared war; there is no going back.

In response, crypto markets were as chaotic and capricious as the U.S. president, with Bitcoin crashing to $100,945 within minutes, slashing $40 billion from the total market before leveling off at $102,350.

Meanwhile, Iran labeled the strikes a violation of the Non-Proliferation Treaty. It returned fire—literally—launching missiles deep into Israeli territory as the region tilted further toward all-out war. What else can we expect from this conflict and the greater impact on international equities, crypto, and the global markets?

Iran-Israel Missile Exchanges Amplify Tensions

After Saturday’s U.S.-Israel-led attack, Iran reportedly launched two waves of missiles, totaling 27 strikes, hitting areas from the Golan Heights to the upper Galilee and Tel Aviv.

Israeli authorities confirmed damage at ten different sites, including severe impacts in metropolitan regions like Haifa and Tel Aviv. Emergency medical crews reported 16 injuries as they continue to comb through affected areas.

For the first time, Iran’s missile strategy involved attacks in close succession, intensifying the ongoing exchange of strikes.

Donald Trump to Barak Ravid few hours ago: “We achieved a great success tonight. Israel is now much safer.”

Israel now: pic.twitter.com/d3GSZ3dLmM

— Daily Iran Military (@IRIran_Military) June 22, 2025

President Trump wasted no time claiming victory.

“We have completed our very successful attack on the three nuclear sites,” he posted, praising American forces as unmatched in the world.

Iran, meanwhile, pushed back hard. Its Atomic Energy Organization denounced the airstrikes as an “evil conspiracy” and blasted international watchdogs like the IAEA for staying silent

Bitcoin and Crypto Market Reacts to Geopolitical Chaos

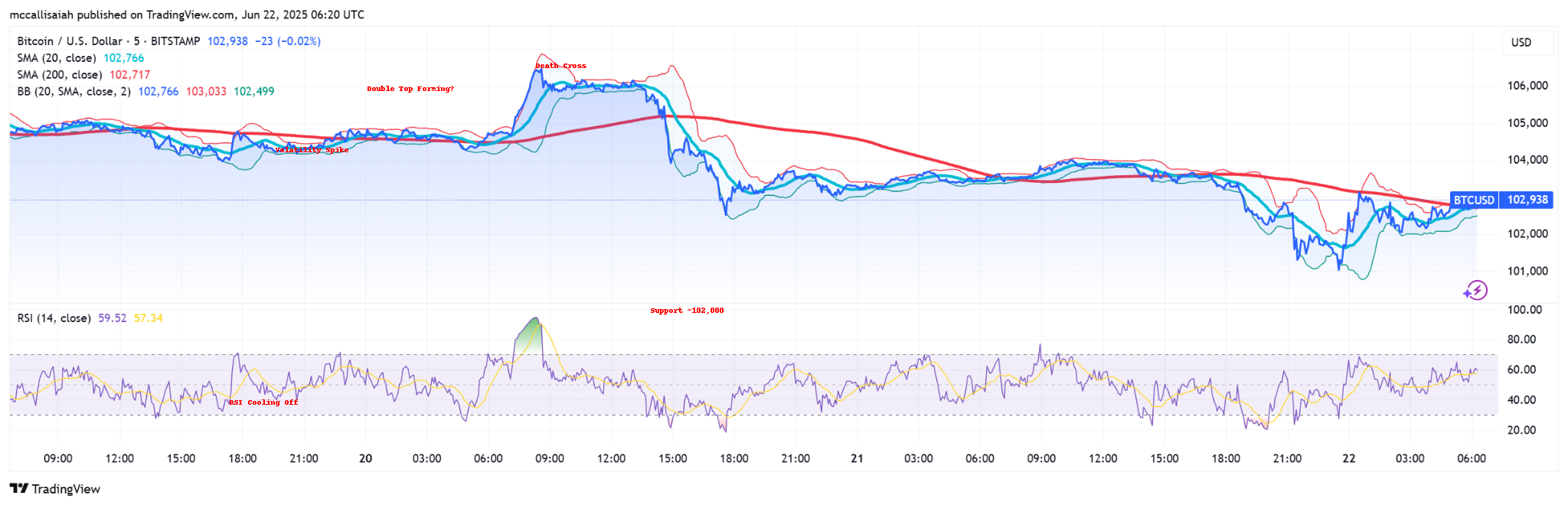

Bitcoin didn’t take the news well. Within minutes of Trump confirming the strikes, BTC cratered to $100,945. It later rebounded slightly to $102,350, but not before erasing $40 billion from the crypto market.

Momentum signals now suggest the market isn’t out of the woods yet:

I love watching people freak out over a -5% “Bitcoin crash”.

Bitcoin isn’t volatile.

You just don’t understand what stability looks like after a 100+ year fiat hallucination.

— Adam Livingston (@AdamBLiv) June 22, 2025

BTC’s footing looks shaky at $102K, a level it’s tested more than once this week. A fresh death cross with the SMA diving below the 200 adds to the bearish outlook. Bollinger Bands, which briefly expanded during the selloff, have narrowed again. Historically, that’s the calm before the next storm.

Historically, when Bitcoin has stayed relatively silent for weeks, it’s the precursor to parabolic gains.

Meanwhile, Iran has doubled down, vowing to press ahead with its nuclear plans and warning off outside interference.

What’s Next for WW3?

Tensions are rising fast, and the fallout may not stop at Iran’s borders. Retaliatory strikes on U.S. bases or allied territories remain a serious threat. The IAEA hasn’t weighed in yet, but geopolitical analysts are already game-planning what happens if Russia or China make further moves on Ukraine or Taiwan in the chaos.

With uncertainty rising, investors are hedging hard. Don’t be surprised if Bitcoin continues to rebound.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- In response to the Iran-U.S.-Israeli war, crypto markets were as chaotic and capricious as the U.S. president

- Historically, when Bitcoin has stayed relatively silent for weeks, it’s the precursor to parabolic gains.

The post Iran Response to US Bombing: Bitcoin Recovers As WW3 Looms appeared first on 99Bitcoins.