Image source: Getty Images

Hostelworld (LSE: HSW) is a small-cap UK stock that suffered during the pandemic five years ago. As global travel came to a standstill, the hostel-booking platform’s revenue fell off a cliff, driving the firm into the red.

However, with those dark Covid days thankfully in the rear-view mirror, the share price has been steadily regaining lost ground. It’s gone from 77p back then to 136p, representing a gain of roughly 79%.

Yet City brokers see further potential gains ahead, and have a consensus price target of 192p. That’s 40% higher than the current level, though there’s no guarantee it will reach that price within the next 12 months.

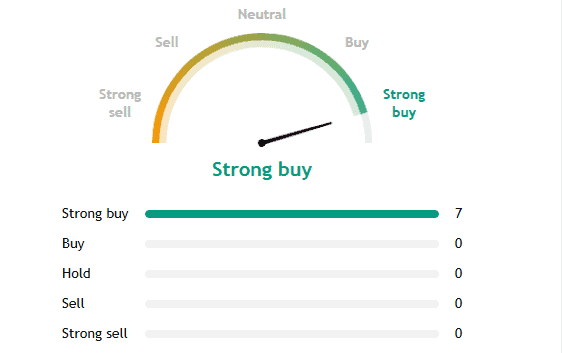

Interestingly though, all seven analysts covering this small-cap stock are very bullish, rating it as a Strong Buy.

What do they see in Hostelworld? Let’s check out some details.

Niche market

For those unfamiliar, Hostelworld is basically the Airbnb of hostels. It acts as a marketplace, taking commission when travellers book accommodation via its website or app.

The company has hostel partners in over 180 countries, and younger travellers make up the majority of bookings. In 2019, Hostelworld generated €80.7m in revenue and a net profit of €8.4m. Then it endured three years of losses before returning to profitability in 2023 as global travel rebounded after the pandemic.

In 2025, it’s expected to report €97.5m in revenue and a net profit of €13.9m. So it’s managed to weather the Covid storm, and is growing once again.

Growth plan

Building on this momentum, management recently set out a growth plan. The target is for low double-digit revenue growth in 2026 and 2027, with an adjusted EBITDA margin above 20%, and adjusted free cash flow conversion of about 70%.

The company has a strong balance sheet, with no debt, and an €8m net cash position at the end of 2024. The dividend has been reinstated, with a progressive policy of 20%-40% of adjusted post-tax profit, starting in the second half of this year.

It has also just commenced a £5m share buyback programme.

Social network

One area the firm is seeing success in is its social network. This allows members to message, connect, and meet up with like-minded travellers.

Launched in Q2 of 2022, the network had 2.6m members by Q1 2025. These social members are booking 2.2 times more than non-members over the first 91 days after signing up. So there is evidence of strong network effects emerging here.

Hostelworld will also start including more budget hotels and other accommodation options on its platform. While that might spur growth, it also takes it further into competition with Airbnb, Booking.com, and others.

Also, global travel demand could always be impacted by another pandemic or some sort of global conflict. So these are risks to bear in mind.

Decent valuation

That said, I like the social network angle, as it’s likely to keep users loyal to the platform. I see a lot of monetisation potential.

More repeat bookings should also reduce marketing spend, which has already fallen from 58% as a percentage of revenue in 2022 to 46%.

Finally, the stock is trading at just 11 times next year’s forecast earnings. Weighing things up, I think Hostelworld is worth considering for investors looking for a cheap small-cap stock.