Image source: Getty Images

One growth stock stuck out like a sore thumb when I opened my Stocks and Shares ISA watchlist yesterday (23 June). That was Hims & Hers Health (NYSE: HIMS), which was down almost 35%, registering it’s worst-ever day.

This is a share I’ve been watching for a while, but haven’t bought yet. Even after yesterday’s crash, it’s still up 86% over 12 months.

Could this crash be an opportune time for me to nip in and open a position?

Personalised medicine platform

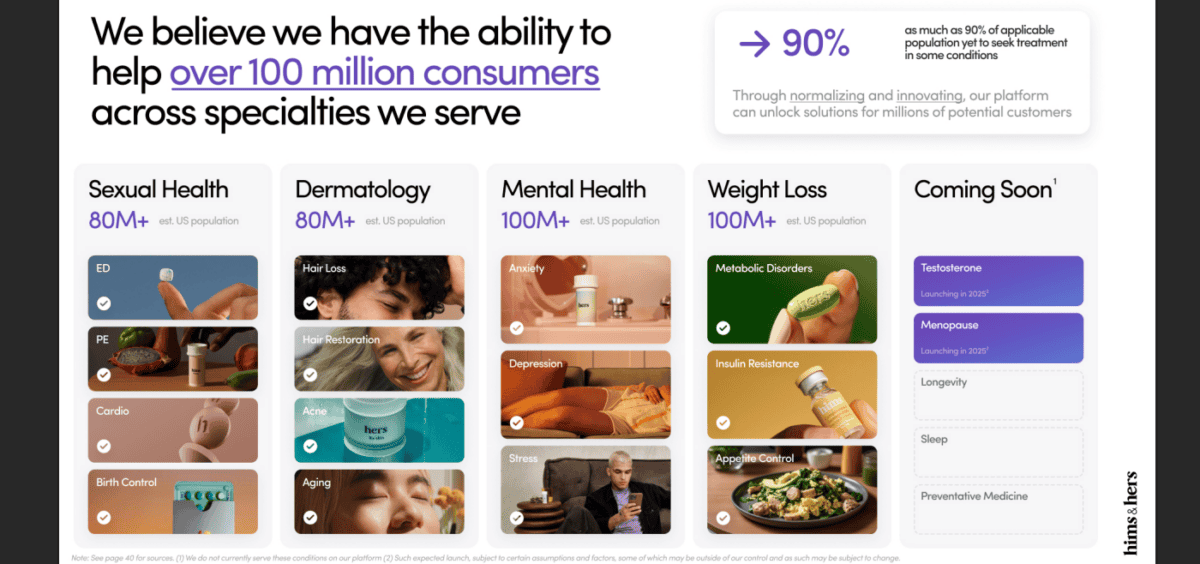

Hims & Hers is a vertically integrated pharmacy and telehealth platform focused on personalised wellness. It offers prescription and over-the-counter treatments for hair loss, mental health, skincare, sexual health, and more.

In 2024, the firm’s revenue soared 69% year on year to $1.5bn. However, this isn’t a jam-tomorrow growth story, because both net income and free cash flow more than quadrupled in Q1 of this year. Subscribers grew 38% to 2.4m.

Driving some of this eye-catching growth has been compounded GLP-1 weight-loss drugs, which the firm began selling on its platform in 2024. In May, it announced a partnership with pharmaceutical giant Novo Nordisk to sell its blockbuster Wegovy treatment.

War of words

Since that announcement, Hims & Hers stock has been rocketing. Until yesterday that is, when Novo terminated the collaboration.

In a statement, the firm pulled no punches, accusing Hims of “illegal mass compounding and deceptive marketing“. It used the words “knock-off drugs” a number of times in relation to “personalised” doses of semaglutide that Hims continues to sell. Semaglutide is the active ingredient in Wegovy.

More seriously, Novo alleges that potentially unsafe active ingredients are being sourced from foreign suppliers in China, thereby putting patients at risk.

Essentially then, there are three allegations here:

- The continued selling of copycat versions of Wegovy, which Novo says violates regulations.

- Deceptive marketing of these as ‘personalised’ treatments.

- Semaglutide sourced from unapproved Chinese suppliers.

In response, Hims’ CEO Andrew Dudum wrote on X: “We refuse to be strong-armed by any pharmaceutical company’s anticompetitive demands that infringe on the independent decision making of providers and limit patient choice.”

Dudum said Novo’s management is “misleading the public“, and that the platform will continue offering access to different weight-loss treatments, including semaglutide.

My move

What to make of all this? Well, there could obviously be regulatory compliance risk here. Lawsuits appear inevitable, and there’s likely at least some brand damage.

Meanwhile, Novo will keep selling Wegovy with two of Hims’ rivals, namely Ro and LifeMD. So the firm could lose share in the booming weight-loss space, which isn’t ideal.

However, there’s more to the platform than just Wegovy. It was already growing strongly before GLP-1s, and its opportunity to aggregate demand in some very large health categories appears undimmed to me. It’s also expanding into Europe via a recent acquisition.

Hims’ disruptive direct-to-consumer platform aims to be cheaper and more personalised than the traditional healthcare model. Therefore, I think shareholders should expect further industry resistance, like Uber got from taxi firms.

I’d like management to reassure investors about the supply chain accusations. Ideally, this will happen when the firm reports Q2 earnings in August, if not before.

But if the stock keeps falling in the coming days, I will open a starter position.