Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

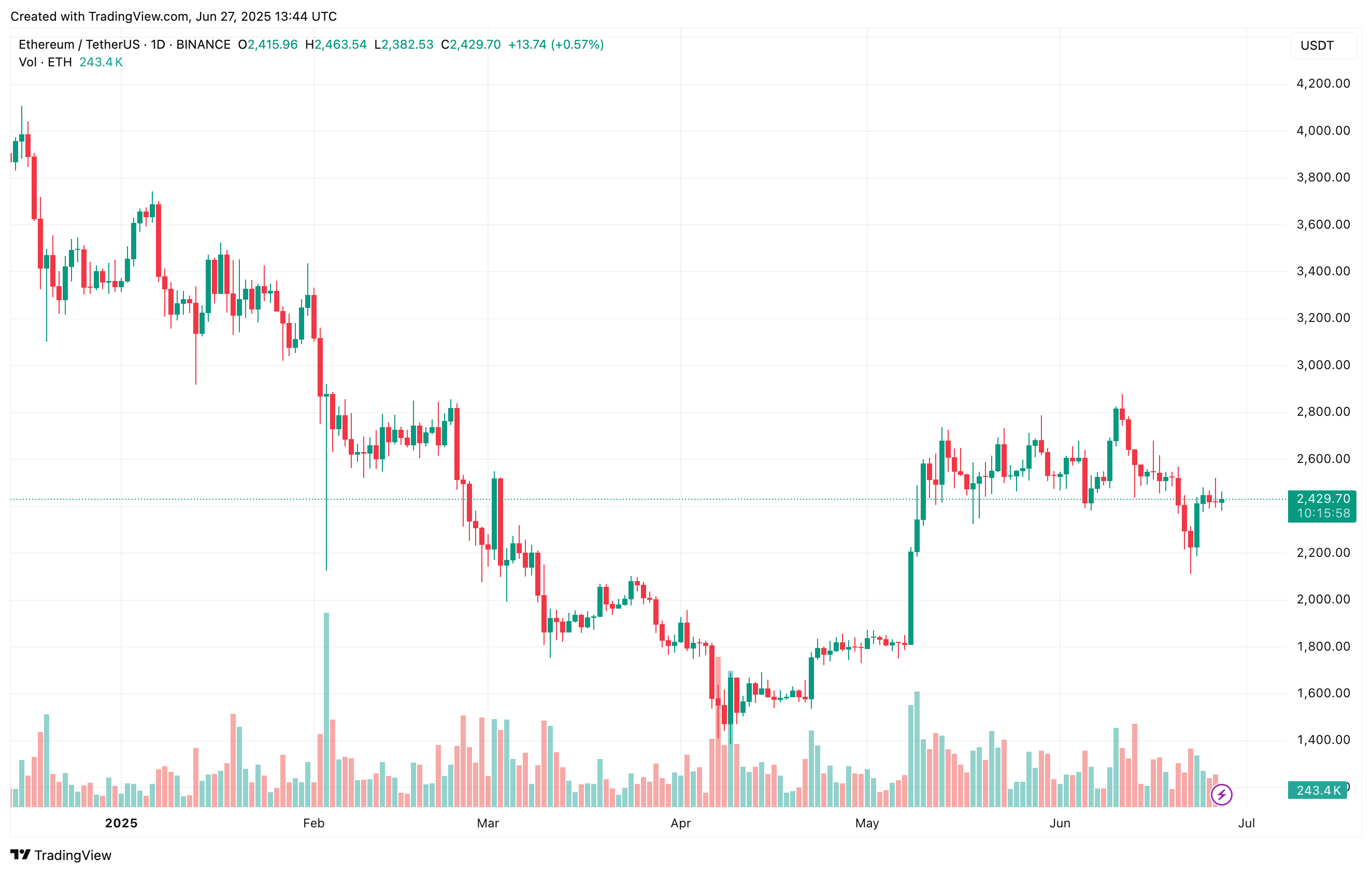

Ethereum (ETH) has recorded strong gains over the past two weeks, rising from $2,111 on June 12 to $2,515 on June 25, reigniting hopes for a sustained bullish rally that could push the digital asset beyond the crucial $3,000 level.

Ethereum Rally Marked By Shift In Dynamics

According to a recent CryptoQuant Quicktake post by contributor Amr Taha, Ethereum’s latest rally has been accompanied by a notable shift in market dynamics – including a flip to positive funding rates, a potential short squeeze, and a rise in ETH inflows to Binance crypto exchange.

Related Reading

Recent data from Binance reveals a significant shift in ETH funding rates from negative to positive. Positive funding rates typically indicate that traders are opening or holding leveraged long positions, reflecting expectations of further upside.

However, rising funding rates may also raise the risk of a short-term price pullback if long positions become overextended. Data from CoinGlass shows that 68.15% of liquidations over the past 24 hours were long positions – highlighting this risk.

Taha also emphasized the role of a short squeeze in Ethereum’s recent price surge and the increase in funding rates. As ETH’s price climbed, it retested the previous short-squeeze zone around $2,500. He explained:

In that earlier event, short positions were forcibly closed by initiating aggressive market buy orders to cover their exposure, triggering a cascading effect known as a short squeeze. This dynamic occurs when traders who had bet against ETH (shorts) are forced to close their positions by aggressively buying back the asset to limit losses.

Meanwhile, ETH inflows to Binance have also spiked. On-chain exchange data suggests that 177,000 ETH was deposited into Binance over a three-day period – an unusually high volume.

Such a surge typically signals increased selling pressure or large-scale repositioning by major holders. Large transfers of ETH to exchanges often precede either potential sell-offs or liquidity provisioning.

In conclusion, Taha noted that while a short-term correction may be likely, ETH’s breakout above $2,500 underscores the aggressive speculative activity driving its recent price action. Traders are advised to closely monitor funding rates and exchange flows for signs of an impending retracement.

ETH Bulls Take The Charge

Recent technical analysis suggests ETH may be gearing up for a breakout above the $2,800 resistance level. The asset also recently formed a golden cross on the daily chart, fuelling speculation that a new all-time high (ATH) could be within reach.

Related Reading

That said, ETH is not entirely in the clear. Technical analyst Crypto Wave recently predicted that the cryptocurrency may revisit lower levels in the $1,700 to $1,950 range. At press time, ETH trades at $2,429, down 0.4% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com