Image source: Rolls-Royce Holdings plc

Over the last five years, the Rolls-Royce (LSE:RR) share price has gone from 98p to £9.38. In other words, it’s up 859% and has left the rest of the FTSE 100 in the dust.

Some of this is obviously the result of Covid-19 challenges subsiding, but the stock is now over 100% above where it was before 2019. So have investors missed their opportunity?

Growth drivers

In general, there are two reasons why share prices go up. One is the business starts making more money and the other is investors become more optimistic about its future prospects.

Over the last few years, Rolls-Royce has benefitted from both. Disruption during the pandemic has made earnings unusually volatile, but a look at the firm’s sales gives a good illustration.

The company’s total revenues have increased by around 65% since 2020. But this alone isn’t enough to account for a jump of over 850% in the stock.

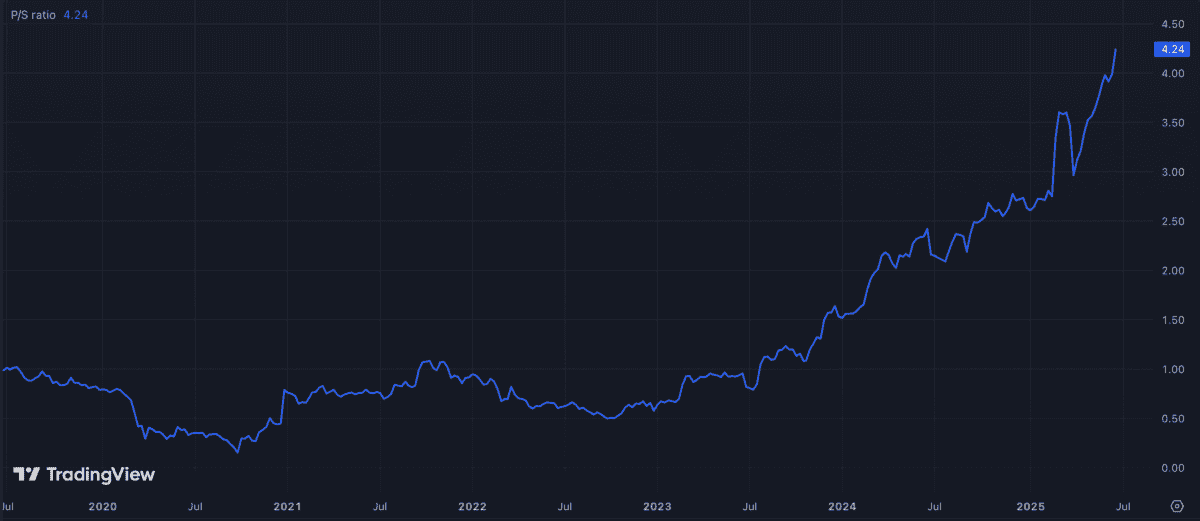

The big change is in the price-to-sales (P/S) multiple the stock trades at. This has gone from just below 1 in 2020 to 4.22 – an increase of 322%.

Rolls-Royce P/S ratio 2020-25

In other words, there’s no doubt Rolls-Royce has produced some outstanding results over the last five years. But the biggest reason for the rising share price has been multiple expansion.

Fundamentally, that means expectations for the company are higher than they were. And this means investors need to think carefully about whether or not it can meet these.

Expectations

Analyst expectations for the firm are for revenues to reach around £23.5bn by 2028. Based on the company’s current market value, that implies a future price-to-sales multiple of just under 3.5, which is unusually high.

High multiples aren’t usually a good sign, but there’s more to see here. Rolls-Royce has relatively high fixed costs, meaning higher sales typically result in wider margins and earnings that grow at a faster rate.

This can cut both ways – when things go wrong (such as during a pandemic) a relatively small hit to sales can have an outsized effect on profits. But high fixed costs can be a powerful force when things go well.

Analysts are indeed expecting earnings per share to grow more quickly, reaching 36p in 2028. At today’s prices, that’s a price-to earnings (P/E) multiple of 26.

There are a lot of potential opportunities ahead of Rolls-Royce. These include expanding into narrow-body aircraft, small modular nuclear reactors, and a shift to sustainable aviation fuels.

Any or all of these could boost revenues and profits over the next few years. But the current share price seems to factor in a lot of optimism and small disruptions can have large effects.

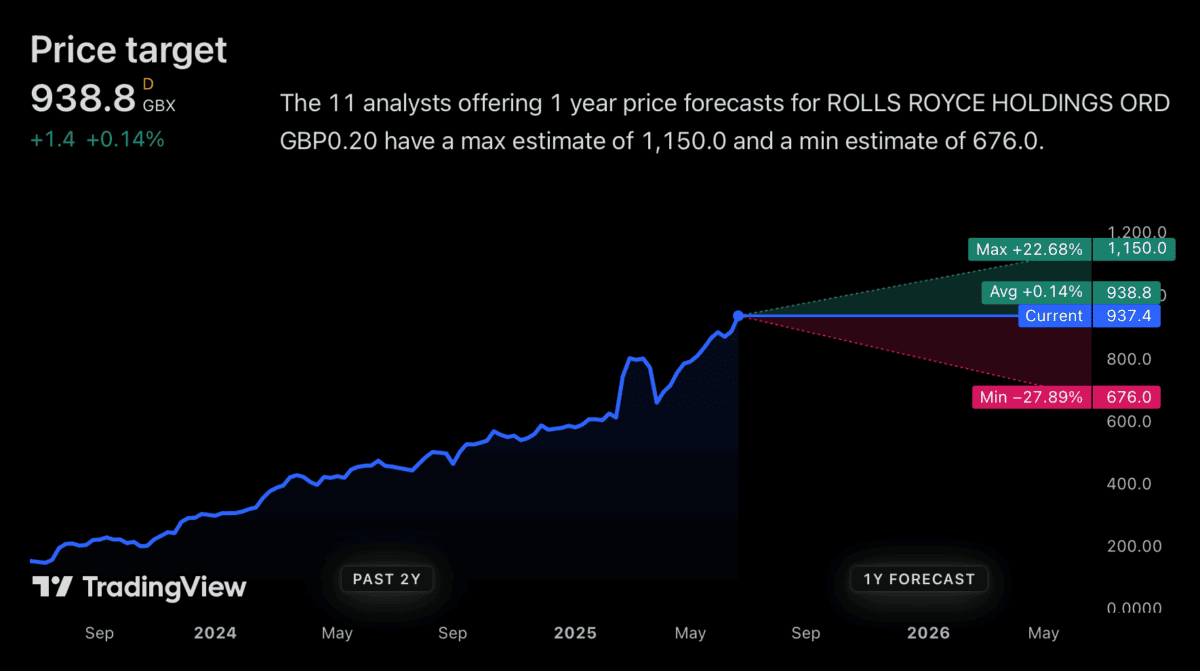

Price targets

Despite the positive growth assumptions, analysts don’t have huge expectations for the Rolls-Royce share price. The average price target is almost exactly the stock’s current level.

My sense is the analysts have this one right. The current price reflects some high expectations and while the company could exceed these, I don’t think it’s especially likely.

I’m therefore not expecting the Rolls-Royce share price to do as well as it has done over the last few years. I’ve got my eye on other FTSE 100 opportunities at the moment.